American Finance Has Left Europe In the Dust. The Tables Aren’t Turning.

Restoring the competitiveness of European banks and asset managers can’t be achieved by tweaking regulations

Restoring the competitiveness of European banks and asset managers can’t be achieved by tweaking regulations

After a decade and a half of seeing the U.S. economy pull ahead thanks to its outsize technology sector, European politicians are desperate to fight back in emerging industries such as green energy. One challenge they face is that America also keeps pulling ahead in the business of financing the investments required.

On Thursday, Luxembourg for Finance—a public-private partnership that seeks to promote the financial industry in the low-tax city state—published a report detailing the different ways in which European banks and asset managers might regain an edge relative to U.S. and Asian peers.

This is part of an effort by officials across the European Union to give firms a break. “Old economy” industries such as car manufacturing face rising competition from China and higher energy costs since Russia invaded Ukraine. The U.S. Inflation Reduction Act also has drawn investment across the Atlantic. Last year, the European Commission tasked former Italian prime ministers Mario Draghi and Enrico Letta with drafting a report on European competitiveness.

Luxembourg for Finance Chief Executive Nicolas Mackel echoes a common refrain: “Europe can take the lead in financial services when we eliminate fragmentation.” His report points out that the return on equity of European banks has bounced back in recent years. But it also showcases the gulf that has opened up relative to U.S. financial firms.

European lenders’ return on equity is now around 8%, compared with 12% across the Atlantic and 10% in Asia, in part as a result of stricter regulations following the 2008 banking crisis. Most European banks trade below book value on the stock market, having returned a negative 14% to investors since the April 2009 trough. Large American banks trade above book value and have gained 113%.

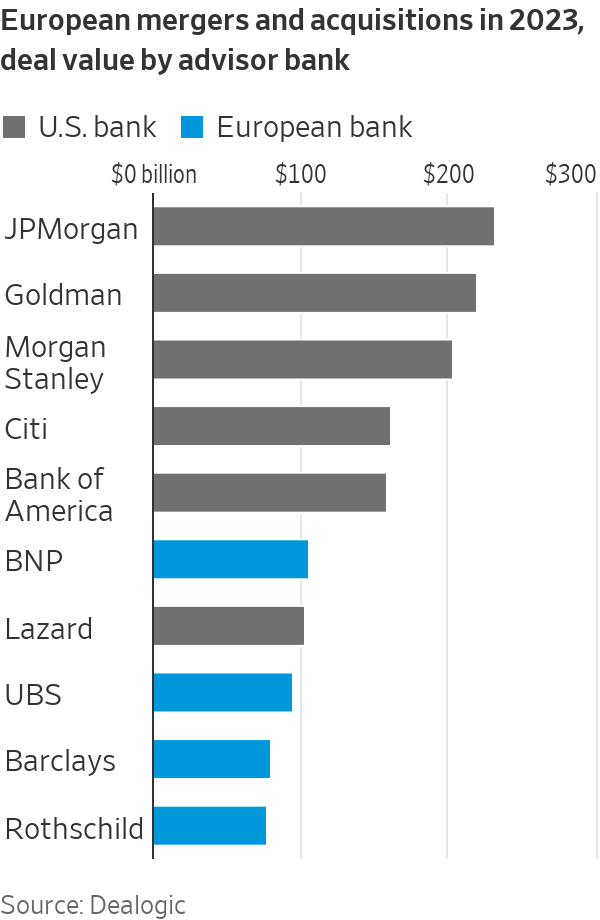

In services particularly exposed to international competition, American banks dominate in Europe too: In 2023, they took the top five positions for mergers and acquisitions deals, Dealogic data shows, with France’s BNP Paribas coming in sixth, and the top six spots for issuing equity.

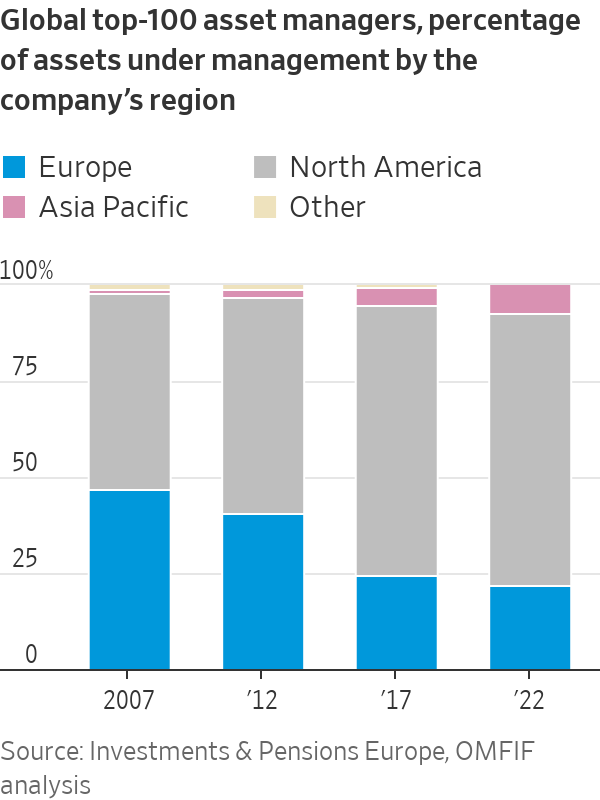

And this isn’t just about banks. In 2007, top European and U.S. asset managers roughly split the global market between them. By 2022, European fund managers had just 22% of total assets under supervision, with only France’s Amundi playing in the big leagues. This reflects their failure to jump on the train of low-fee passive investment as effectively as U.S. giants such as Vanguard and BlackRock. Ironically, the latter’s dominance in exchange-traded funds resulted from its acquisition of iShares from Britain’s Barclays in 2009.

European officials are taking some useful steps. They admitted in 2022 that a directive aimed at harmonising securities markets, known as Mifid 2, has done more harm than good, and have agreed to amend it. New EU-wide savings products give pensioners greater choice, and might help address the lack of sophistication that characterises European individual investors relative to Americans used to managing 401(k)s. Stringent constraints on what asset managers can offer are being relaxed, and the rules governing sustainable finance—where Europe has an edge—are being clarified.

Meanwhile, the fallout from last year’s Silicon Valley Bank debacle will bring U.S. regulation closer to Europe’s.

Such rule changes might narrow the gap, as investors have recognised: The stock-market discount at which European lenders trade compared with American ones has shrunk over the past three years. But it is hard to see the tables fundamentally turning. In the digital era, economies of scale are even more powerful. The European Union comprises many countries with different languages, whose firms and investors have local financial relationships and strong home biases. The obstacles to eliminating fragmentation are huge.

If Europe can’t compete with America’s private financial muscle, it is doubly problematic that its efforts to mobilise industrial investment through the public sector have been meek compared with the U.S. Inflation Reduction Act. Promoting more sustainability-minded funds isn’t an adequate fix.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”