America’s Billionaires Love Japanese Stocks. Why Don’t the Japanese?

Japan’s government wants cash-hoarding households to invest more

Japan’s government wants cash-hoarding households to invest more

TOKYO—Japan’s government is on a mission to make buying stocks hot again.

Many of America’s biggest investors are bullish on Japan. Warren Buffett shared that he increased his investments in Japanese companies during an April visit to the country. Ken Griffin is preparing to reopen an office in Tokyo for his hedge fund, Citadel, and investment banks Goldman Sachs and Morgan Stanley have issued optimistic outlooks for Japan’s stock market.

Japan’s problem is this: There are few signs its estimated 125 million residents share in the excitement.

Burned by dismal returns since the bursting of Japan’s asset bubble in the late 1980s and early 1990s, generations of families here have stashed most of their money in low-yielding savings accounts rather than trying to increase their wealth through the stock market.

Japanese households put an average of just 11% of their savings into stocks and 54% in cash and bank deposits, according to Bank of Japan data released last month. That trails well behind the U.S., where households have about 39% of their money tied up in the market and only 13% in cash and bank deposits, according to Federal Reserve data.

Haruyo Arai, a 62-year-old office worker, began investing in the stock market just last month.

“I was brought up by parents who would say, ‘Don’t dabble in stocks,’ ” she said.

Japanese Prime Minister Fumio Kishida has pledged to double households’ asset incomes, in part by encouraging people to invest in risky assets like stocks. The government is raising caps for Japan’s tax-exempt investment system for small investors, the Nippon Individual Savings Account, with changes set to take effect in January. The Tokyo Stock Exchange has been urging companies to boost their valuations and increase shareholder returns.

Arai cited the upcoming expansion to NISA, along with a desire to save more money for the future, as some of the reasons she decided to begin taking investing more seriously. She has been taking weekend classes at Tokyo-based Financial Academy to learn more about stocks and waking up early every morning to watch a TV news program focused on the economy.

Some believe investors like Arai will prove to be the exception, not the rule. Stocks here haven’t hit a record in decades. There isn’t much buzz among ordinary people about investing in Japanese markets.

“I’ve got the impression that Japanese people don’t really think positively about the desire to make money,” said Takashi Kawaguchi, a 48-year-old office worker who, like Arai, has been learning about investing at Financial Academy.

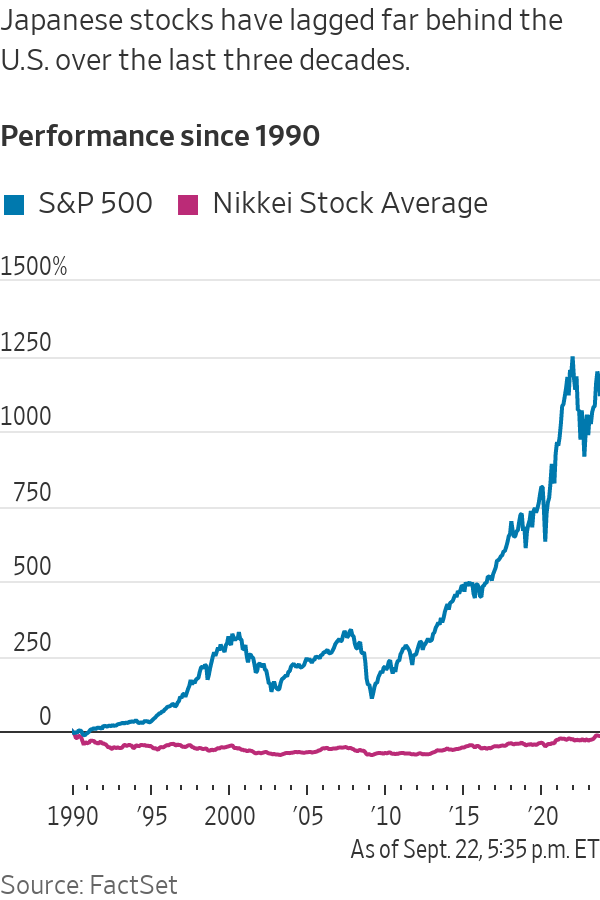

While the 2023 rally has helped lift Japanese stock indexes to 33-year highs, long-term returns pale in comparison to what an investor would have gotten by investing in U.S. stocks. The Nikkei closed at 32,402 on Friday, still 17% below its record hit in 1989. The S&P 500 has grown more than twelvefold over that time. That has made many investors here turn to foreign markets instead of focusing their bets within Japan.

“The Nikkei might hit 40,000, god knows when,” said Heihachiro “Hutch” Okamoto, foreign equity consultant at retail brokerage Monex. “But most of our investors prefer U.S. stocks.”

To Okamoto’s point, the most popular names traded on Monex daily aren’t Japanese stock indexes like the Topix or Nikkei, brand-name companies like Sony or even the “sogo shosha”—the trading houses that Buffett has invested in. Instead, they are all American names: companies like Nvidia, Tesla, Apple and Amazon.com, as well as funds tracking the S&P 500 and the Nasdaq-100.

And that is just among those interested in investing in the first place. While in past years, everyday investors in Japan made a name for themselves with their forays into the foreign exchange market, the overall trading culture here has been one of hesitation.

“Most people here think investing is very risky,” said Hidekazu Ishida, a special adviser at FinCity.Tokyo, which works with the government and the financial industry to try to boost investment in Tokyo. Being into finance comes off as “kakkowarui,” he added, referencing a word for uncool.

Even some heads of companies are lukewarm about the idea of encouraging more individual investors to buy Japanese stocks.

“I’m neutral about that,” said Takeshi Niinami, chief executive officer of whisky and beverage giant Suntory, when asked if he thought it would be a good idea for more Japanese people to invest in the market. Stock investing is risky, he said. And many Japanese people remain wary of participating in the market, because of the severity of prior downturns.

“I think perhaps increasing interest rates is better for people,” he said.

—Chieko Tsuneoka and Alastair Gale contributed to this article

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”