Welcome to Singapore. Known for its political stability, multicultural and multiethnic demographic, Singapore grew from a tiny fishing town into a bustling financial hub that is a magnet for talents regional and international. A growing pool of expatriates flocking into the lion city only means one thing: real estate is heating up and getting more competitive. For those that have just recently received job offers to Singapore, fret not. Here’s a rundown of the best areas for expats to reside in Singapore.

Kanebridge spoke with a rising real estate agent in Singapore, Denyse Chong for her insights on these trends in Singapore.

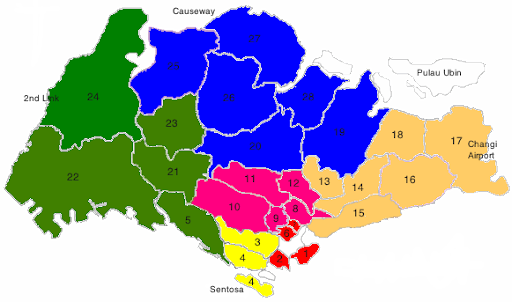

District 9: Orchard, Cairnhill, River Valley

Not only are the properties in these areas near to the Central Business District (Raffles Place, City Hall etc), it also boasts Singapore’s famous Orchard Road Shopping Belt! Cafes, restaurants, eateries, and groceries are easily accessible when you need them, and work is only a short 20-minute commute away! Within District 9, River Valley would be my personal favourite. The Riverfront Lifestyle promises a very chill, relaxing environment that you’ll be excited to come home to after a day of work.

District 10: Bukit Timah, Holland

Expats with children will most likely bookmark this district as this is the place you’d want to be when considering education options for your adolescents. It is surrounded by elite junior institutions such as Anglo Chinese School, Raffles Girls, Nanyang Primary, to name a few. It is also home to the Singapore Botanical Gardens where you can bond with your family over picnics. It is slightly farther out than Orchard, but even then, reaching the CBD will take you no longer than 30-mins.

District 3: Queenstown, Tiong Bahru

Tiong Bahru is known for its “quaint little vibes” with walk-up apartments, shophouses and local coffee shops. You’re also inbetween either CBD, or the Telok Blangah offices. For some weekend fun, you can easily pop by Sentosa’s beach clubs for drinks.

What is the community vibe like in those areas you have recommended?

Depending on where and which part of those areas, it can be pretty fast-paced, especially during rush hours. More so for the dwellings along the Orchard stretch. Foot and vehicular traffic can get quite heavy at the end of the day.

Rivey Valley is a nice quiet neighbourhood. You would meet fellow expats at the cafés in the area having brunch on weekends after walking their dogs, or fellow neighbours going for a run or cycle along the Singapore River.

Queenstown and Tiong Bahru presents more of a local vibe with more public housing located in the area, compared to D09 and D10. If you’re looking to immerse yourself into local culture, this area can be very interesting too!

What is the ideal age of a property to purchase in those regions?

Depending on your budget. If it’s within your financial means, purchasing a BUC (building under construction) property/brand-new property directly from the developer will be better as there are lower risks incurred from progressive payment. You are also at lower risks amidst a hike in interest rates as your loan would be disbursed progressively and not in entirety. Alternatively, you can also consider projects that have just obtained completion, so the wait is less, and you can move in immediately.

If you’re in need of larger living spaces, I would recommend going for slightly older developments (10 years of age and above) as you would get more liveable space for the same amount of beds and bath layout. However, this is location subjective. Finding an older development may also command a higher premium than a developer’s new release due to prevailing PSF prices.

Should I rent or buy outright? Are there any significant barriers to entry for purchasing a dwelling in Singapore?

If you’re here for a short but good time, renting would be a better way as you get to explore a variety of properties during your stay here.

Barriers of entry for purchasing a property include the upfront cash on hand required amounting to 25% of property price, as well as the additional buyer stamp duties foreigners would be required to pay, above the property price, at 30%, payable in cash. This represents a huge quantum.

Freehold or Leasehold?

It should be pre-requisited on what your goals are. If you’re purchasing and intending to pass the property down to your children, I would say freehold. But if you’re intending to invest, leasehold is equally competitive. The returns on investment may even stand to be better than a freehold property too.

Is it more popular to stay within the city? (Or is staying within the city fringe an upcoming trend, if so, why?)

While I believe it used to be popular to stay within the city due to close proximities to the office, nowadays, staying within the city fringe is getting increasingly popular as well. Furthermore, City Fringe property prices are much lower than that within the Core Central Region (CCR). Our Public Transportation is reliable and cost-efficient. This allows for more expats to rent at city fringe places for bigger spaces at the same budget. (An equivalent 2-bedroom rental in the city would translate to renting a 3-bedroom in the city fringe). It is a consideration for Expats to want to “detach” from work by returning to their home slightly further away from the hustle and bustle of the city.

You may wish to contact Denyse for further assistance if you’re looking to relocate to Singapore for work.

Denyse Chong

(65) 97116664

R063810F

From the shacks of yesterday to the sculptural sanctuaries of today, Australia’s coastal architecture has matured into a global benchmark for design.

From gorilla encounters in Uganda to a reimagined Okavango retreat, Abercrombie & Kent elevates its African journeys with two spectacular lodge transformations.

Ray White senior data analyst Atom Go Tian says Sydney’s elite postcodes are pulling further ahead, with Bellevue Hill dominating the nation’s most expensive streets in 2025.

Sydney has cemented its status as the nation’s luxury capital, with Kambala Road in Bellevue Hill being Australia’s most expensive street this year, posting a median house price of $39.35 million.

And, according to Ray White senior data analyst Atom Go Tian, last year’s leader, Wolseley Road, was excluded from this year’s rankings due to limited sales.

“Wolseley Road recorded only three sales this year and was therefore excluded from the rankings, though its $51.5 million median would have otherwise retained the top position,” he says.

Bellevue Hill continues its dominance, accounting for six of the nation’s top 10 streets. Tian says the suburb’s appeal lies in its rare blend of location and lifestyle advantages.

“The suburb’s enduring appeal lies in its rare combination of proximity to both the CBD and multiple beaches, harbour views, and large estate-sized blocks on tree-lined streets.”

Vaucluse remains a powerhouse in its own right. “Vaucluse extends this harbourside premium with even more direct beach access and panoramic water views,” he says.

The gulf between Sydney and the rest of the country remains striking.

According to Tian, “Sydney’s most expensive streets are more than five times more expensive than the leading streets in Perth and Brisbane, and more than 10 times the premium streets in Canberra and Adelaide.”

He attributes this to Sydney’s economic role and geographic constraints, describing it as “Australia’s financial capital and its most internationally connected city.”

Beyond Sydney, each capital city has developed its own luxury hierarchy. Tian highlights Melbourne’s stronghold in Toorak, noting that “Melbourne’s luxury market remains centred around Toorak, led by Clendon Road, St Georges Road and Linlithgow Road.”

Brisbane’s prestige pockets are more dispersed: “Brisbane’s luxury real estate shows a more diverse pattern,” he says, led by Laidlaw Parade at $6.5 million. Perth’s top-end market remains anchored in the Peppermint Grove–Dalkeith corridor, with Forrest Street at $7.5 million.

He also points to the stark contrast at the lower end of the spectrum. “Darwin presents a mirror image, hosting all 10 of the country’s cheapest streets,” Tian says. Austin Street in Southport sits at just $117,500.

The national spread reaches its extreme in New South Wales. “Sydney emerges as the most polarised market, spanning an extraordinary range from Railway Parade in Katoomba at $385,000 to Kambala Road’s $39.35 million,” Tian says.

Methodology: Tian’s analysis examines residential house sales between November 2022 and November 2025, with only streets recording at least five sales included. Several streets with higher medians, including Black Street, Queens Avenue and Clairvaux Road in Vaucluse, were excluded because they did not meet the sales threshold.