How Margin Debt Works

Money that is borrowed to buy stocks is sometimes an indicator of future market performance. Here is how it works and why the matter is relevant now.

Money that is borrowed to buy stocks is sometimes an indicator of future market performance. Here is how it works and why the matter is relevant now.

Margin debt is a sometimes-overlooked but key part of the stock market that is particularly pertinent right now.

It is the money that investors borrow from stockbrokers to buy securities when they can’t or don’t want to fund the entire purchase with cash. Say an investor wants to purchase 100 shares at $50 each for a total of $5,000 but has only $2,500 to invest. That individual could buy the rest of the shares on margin. The same process can be used to buy exchange-traded funds.

Investors frequently use margin to get more bang for their investing buck. “The pro of margin is that it increases your purchasing power,” says Jeff Deiss, director of wealth planning at ACM in Ridgewood, N.J.

The downside is that brokers typically charge interest on borrowed money. And if the individual starts losing money on the investment, the stockbroker might ask for additional cash as security or collateral. That decision and how much cash will be required will depend on a variety of factors, including the remaining value of the investment, how much money the investor owes the broker and the requirements of the broker.

“Buying on margin comes with a lot of risk, and if you are going to use margin, it is probably a good idea to have some cash on the side,” says Mr. Deiss. Investors who don’t have the required additional cash may be forced to close out their positions at a loss.

A large amount of buying on margin also can be detrimental to the stock market as a whole.

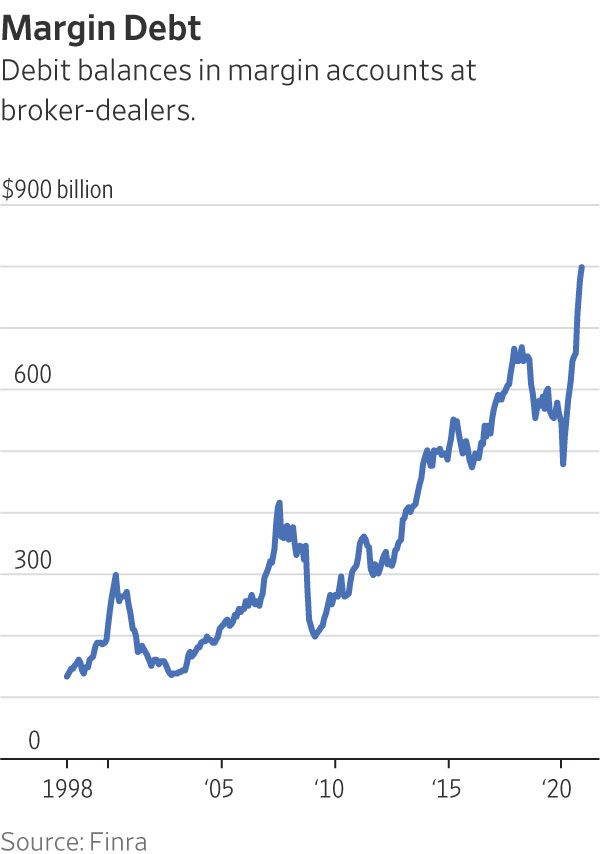

At the end of January, customer margin debt at U.S. brokers regulated by the Financial Industry Regulatory Authority, or Finra, jumped to $799 billion from $562 billion a year earlier, according to data provided by Finra.

Some analysts say that jump in margin debt came from individual investors, who turned to online trading amid pandemic-related lockdowns. A combination of new easy-to-use trading technology, ultralow borrowing costs and stimulus checks from the federal government helped fuel the phenomenon.

“For younger folks, it’s kind of the drug of choice,” Mr. Deiss says.

The problem is, when there is a lot of margin debt concentrated in a few stocks, those stocks tend to see wild price swings, says Fabiana Fedeli, global head of fundamental equities at Rotterdam-based asset-management company Robeco. Anecdotal evidence indicates that the recent increase in margin debt coincided with higher participation levels by individual investors, she says.

Indeed, certain stocks that became popular with individual investors also saw price volatility earlier this year. “The minute that the margin couldn’t be met, some of the positions had to be sold immediately,” Ms. Fedeli says. “It gives volatility to the market,” she says.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”