I Cancelled My Unused Subscriptions. The Money I Saved Paid for a Tesla.

A close look turned up a car’s worth of savings I didn’t know existed

A close look turned up a car’s worth of savings I didn’t know existed

My new Tesla was burning a $511 hole in my monthly budget. So I set myself a challenge: Could I cover the cost just by getting rid of cable, Netflix and other subscriptions I didn’t need?

The financially responsible among us might cancel streaming services between seasons of their favorite shows . I tend to add new ones and forget about the old ones, doing my share to support America’s ballooning subscription economy. People pay about $273 a month for subscriptions, which is almost $200 more than they think they do, according to a 2021 survey . (Since then, services like Disney+ and Discovery+ have raised their prices further.)

But I needed to make room for the first car payment in my 41 years. I had taken the family car-shopping when our 2001 Toyota Camry, which we inherited from my wife’s grandmother, started to go. I’m not a car guy and had never once wished I’d owned a Tesla. I booked a demo drive for the Model Y because I thought our kids would get a kick out of it.

The fact that we liked the car was almost as surprising as the fact that it was cheaper than the electric Volvo, Volkswagen and Hyundai options we saw. It felt like a spaceship compared with the Camry, which has 205,000 miles, a broken tape deck and an interior stained with blue and yellow crayon.

Our new monthly payment covered a 12,000-miles-a-year lease with no down payment. Tesla estimated I would save about $100 a month from replacing gas with electric, though I would need to drive (and charge) the car to know for sure. Tesla’s app tracks my estimated savings. For now, that left us with $411 to cut from our other monthly expenses.

My wife was on board. My kids shrugged. I got out my notebook and started making a list.

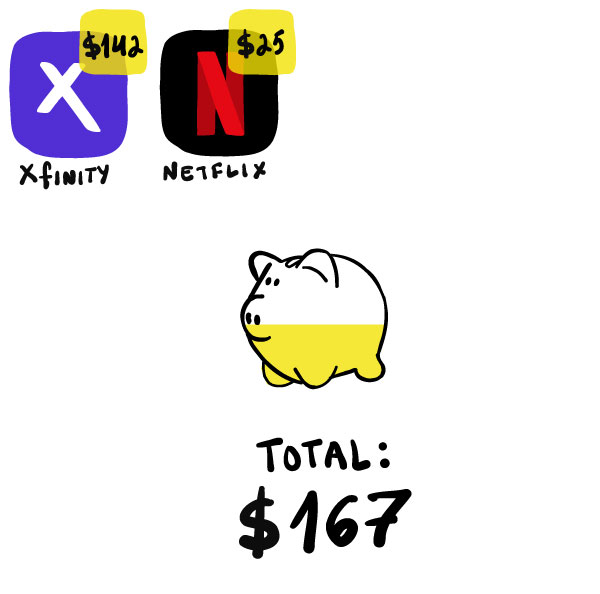

My first stop was my Xfinity bill.

Somehow, it had swelled to $249 a month—basically half the price of the car. In addition to cable and internet, I’d been paying Xfinity for things like a landline because cell service can be spotty in my basement office. So long, landline. After cutting everything but internet, my bill fell to $107. I haven’t dropped a call yet.

Next were the streaming services that I’d been paying for but not watching much. Over the past few years, the only person in the house “watching” Netflix was me. And I wasn’t actually watching it. I was listening to episodes of “Seinfeld” in an earbud when I went to bed. The jokes and the rhythm of their back-and-forths were a pleasant send-off as I fell asleep.

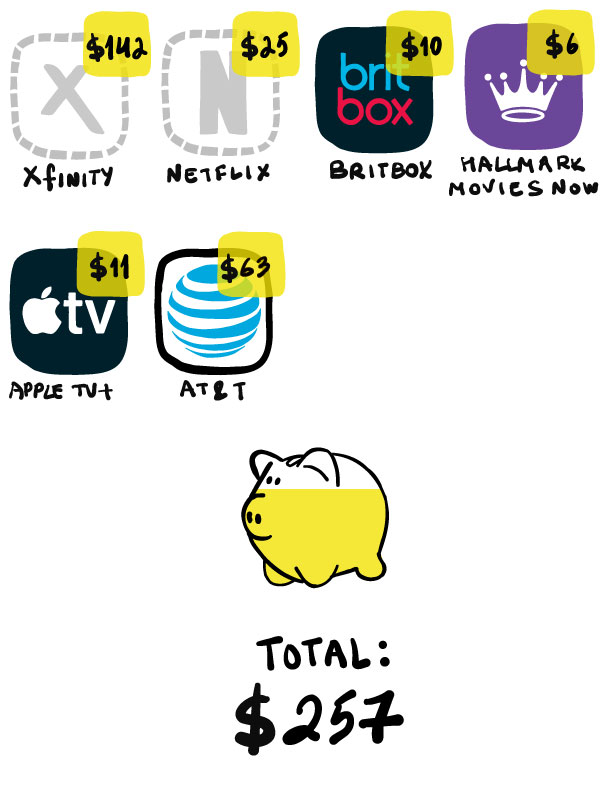

I had joined the growing number of Americans ditching streaming services. I also broke up with BritBox, a streaming service that I’d counted on to watch Agatha Christie’s “Poirot,” as well as Apple TV+. I said goodbye to Hallmark Movies Now, which I’m not ashamed to admit I enjoyed every now and then.

Next up was AT&T .

Paying for cellphone service is like paying the water bill: something I did without protest and never really thought twice about. But I’d started to get curious about the ads I’d been seeing for low-cost services like Boost Mobile and Cricket Wireless. When we agreed to let our 13-year-old son have a phone, part of the deal was that he had to pay for and maintain the account himself. He got a plan with Mint Mobile. It has worked so well for him that we decided to give it a try.

We had been paying AT&T about $128 a month for two lines. Now, we’re paying Mint about $65. If there is a downside to making this move, I have yet to notice it.

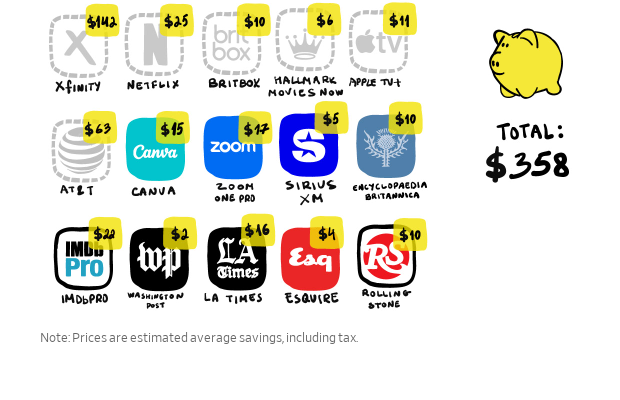

Then my wife and I sat at our dining table going through the last couple months of transactions in our checking account. Seeing how much money we were wasting was painful. We were both paying for subscriptions to Canva, a graphic-design service.

We’ve also been paying for Zoom One Pro, which I probably haven’t used in more than a year. I attempted canceling SiriusXM, but they kept me around by dropping the cost by about $5 a month, which is nice because I have become obsessed with a channel dedicated to country artist and sometimes actor Dwight Yoakam.

Upon further consideration I axed subscriptions to IMDbPro and Encyclopaedia Britannica, which I’m sure I’ve used professionally, but…not for a while. Finally, I cut or got reduced rates on four of my digital subscriptions to news publications. I had been making monthly payments to them more often than I was reading them.

In the end, I was able to cut out about $358 in unnecessary bills and subscriptions. Added to the $100 in estimated gas savings, the cost dropped to $53 for a car we desperately needed.

And since the lease came with six months of free access at Tesla Superchargers, the Tesla app tells me I saved $164 by not pumping gas in January, exceeding the $100 I had estimated. In January at least, my car was free-ish.

“So I love and I hate what you did,” David Bach told me. The author of personal finance books like “Smart Couples Finish Rich” has long preached the merits of cutting out small, fixed expenses. But he’d rather have seen me invest the savings.

“If you’re already a millionaire, go enjoy the Tesla,” he said.

It isn’t like we’ve had to revert to our DVD collection to entertain ourselves. We still have Disney+, Hulu, Max, the language-learning service Duolingo and, of course , Spotify. We get three print newspapers delivered and many more digital news subscriptions.

I’m reacquainting myself with some shows on the services I kept, like Billy Bob Thornton’s “Goliath” on Prime Video—featuring an exceptional performance from Dwight Yoakam.

It is possible we’ll start subscribing all over again. Americans resubscribe to about 23% of the larger streaming services they cut within three months. That share rises to over 40% after a year, according to Antenna, a subscription-analytics provider.

I get it. I subscribed to Paramount+ for Super Bowl Sunday (yes, I canceled it the following Tuesday). And I’m tempted to return to Netflix every time I get ready for bed. I still haven’t found a lullaby to replace “Seinfeld,” but at least I am the master of my (financial) domain.

I need something upbeat but not preachy, familiar, but with enough episodes that I don’t get too sick of them. I tried “Bob’s Burgers,” but Louise Belcher’s screams and the high-pitched strumming of the ukulele between scenes kept me awake.

Oh well. Reliable transportation is worth the $511 monthly payment. Come to think of it, that feels a lot like a subscription.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”