Money Angst? You Might Consider a Financial Therapist

Unconscious beliefs and emotions can mess up how people handle their finances. The hard part is finding experts qualified to handle both money and the mind.

Unconscious beliefs and emotions can mess up how people handle their finances. The hard part is finding experts qualified to handle both money and the mind.

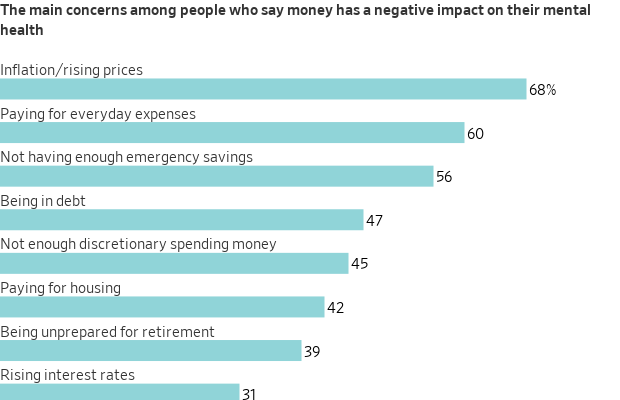

Do you worry a lot about higher food and gas bills? Fight with your spouse over spending splurges? Fear you’ll outlive your savings?

Some people seek to ease such money anxieties by hiring a financial therapist.

The goal of financial therapists ultimately is to help people make good financial decisions, typically by raising their clients’ awareness of how their emotions and unconscious beliefs have affected their sometimes messy experiences with money.

Needs for such help often arise following a job loss, bankruptcy or marital partner’s financial infidelity—when one spouse hides or misrepresents financial information from the other. Even something seemingly positive, such as getting a big inheritance or winning a lottery, can cause financial anxiety.

“Folks are craving help with financial well-being,’’ says Ashley Agnew , president of the Financial Therapy Association, a professional group launched in 2009.

Financial therapists tend to come from mental-health and financial-planning disciplines, and there are signs that their ranks are rising: The Financial Therapy Association has 430 members, up from 225 in 2015. Still, according to the group, fewer than 100 financial therapists have completed its certification process, introduced in 2019. You can be an association member without being certified by it.

The reason for the increased interest is clear: Many Americans are worried about their personal finances. In a survey of about 3,000 U.S. adults conducted last October by Fidelity Investments, more than one-third of respondents said they were in “worse financial shape” than in the previous year. Some 55% of those respondents blamed inflation and cost-of-living increases.

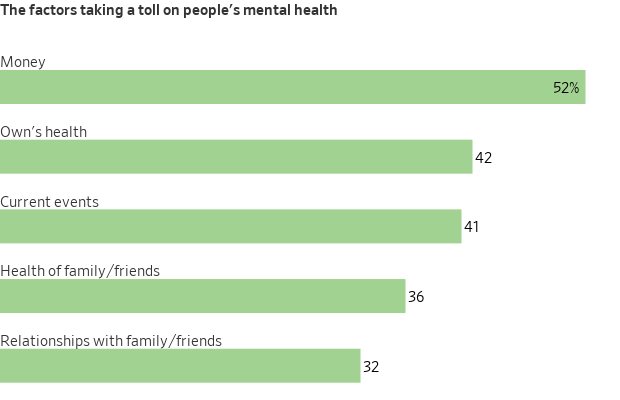

Similarly, 52% of 2,365 Americans polled for Bankrate.com said money negatively affected their mental health in 2023. That is 10 percentage points higher than in 2022. Financially anxious and stressed individuals are less likely to plan for retirement, prior research has concluded.

New York advisory firm Francis Financial hired financial therapist Allen Sakon last November to aid individual clients. Many are divorced or widowed women with complicated money problems.

Certain clients “don’t believe they have enough resources, even though objectively they do,” says Sakon, who is a certified financial therapist, financial planner and accountant. Meanwhile, others with limited means mistakenly believe “they can live as extravagantly as they want,’’ she says.

Sakon currently counsels a recently divorced woman who is struggling with her dramatically lower income and the imminent sale of the family’s suburban New York home. “Her world has been turned upside down” by a financially messy divorce, Sakon says.

Though the woman has stressful new money responsibilities, she long avoided financial decisions, according to Sakon. “A money-avoidant grown-up is typically someone who was excluded from money discussions as a child,” she says.

Sakon says she hopes to eventually help this client feel capable of making financial decisions based on her resources and the financial plan that Sakon created for her.

Nate Astle , a certified financial therapist in Kansas City, Mo., met nine times from May 2023 to February 2024 with Andrea and Gianluca Presti , a 30-something Texas couple who were having persistent spats over money. Andrea Presti , an email marketer, says she believed that “if we didn’t go to financial therapy, I was going to question our entire relationship and whether we could continue.”

The wife cites an argument over the possible purchase of an expensive new car to replace their decade-old vehicle as an example of the couple’s financial conflicts. They disagreed over whether to give up a car that still worked well.

The husband, Gianluca Presti, a music producer, says financial therapy taught him and his wife to communicate better through active listening. He says he stopped being the couple’s money gatekeeper, became more open-minded about spending—and agreed to pay up to $45,000 cash for a new car. “We have to be a team if we want to solve financial issues,” he now realises.

Astle helped the Prestis revamp their household budget as well. It now reflects each spouse’s interests by including expenditures, investments and savings.

Astle, who is also a marriage and family therapist, says he has seen his financial-therapy clients more than double to 43 since 2022.

Still, there are possible pitfalls when hiring a financial therapist. One major drawback: Anyone can claim they are qualified to practice financial therapy.

No government agency regulates the young profession. Candidates for certification by the Financial Therapy Association must take online courses designed by the association covering financial and therapeutic techniques, counsel clients for 250 hours and pass a 100-question test. But you can call yourself a financial therapist and not be certified by the association.

Meanwhile, the cost of financial therapy varies widely—from $125 to $350 an hour, Agnew estimates. Insurance rarely covers the tab.

In addition, there is no broad evidence that financial therapy works well. No large-scale studies demonstrating the field’s effectiveness have been conducted.

Another potential downside is that financial therapists with mental-health backgrounds typically lack extensive financial-planning experience—and vice versa. It is wise to interview at least three financial therapists, experts suggest. Then, pick someone who admits the limits of their expertise.

“I am very upfront about my boundaries,” says practitioner Aja Evans , a licensed mental-health counsellor who isn’t certified in financial therapy. Evans adds that she failed the certification test but plans to take it again during 2024—and before she becomes Financial Therapy Association president in January.

She says she feels well-qualified to help clients recognise how their upbringing affects their money beliefs today. “But I am in no shape or form going to be advising you about your investments, money moves or creating a financial plan,” Evans says. For clients who want that assistance, she says, she refers them to certified financial planners and accountants she knows well.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”