Rising Interest Rates Mean Deficits Finally Matter

Investors ignored deficits when inflation was low. Now they are paying attention and getting worried.

Investors ignored deficits when inflation was low. Now they are paying attention and getting worried.

The U.S. has long been the lender of last resort to the world. During the emerging-market panics of the 1990s, the global financial crisis of 2007-09 and the pandemic shutdown of 2020, it was the Treasury’s unmatched capacity to borrow that came to the rescue.

Now, the Treasury itself is a source of risk. No, the U.S. isn’t about to default or fail to sell enough bonds at its next auction. But the scale and upward trajectory of U.S. borrowing and absence of any political corrective now threaten markets and the economy in ways they haven’t for at least a generation.

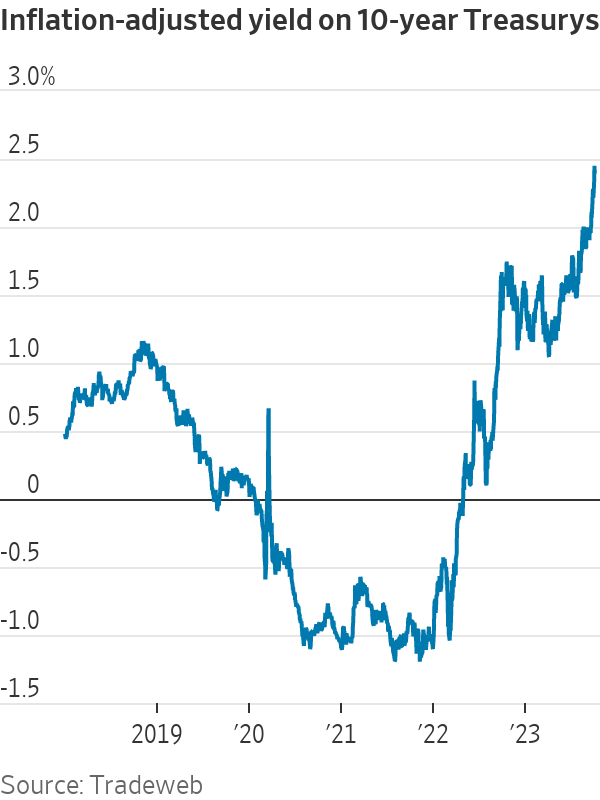

That’s the takeaway from the sudden sharp rise in Treasury yields in recent weeks. The usual suspects can’t explain it: The inflation picture has gotten marginally better, and the Federal Reserve has signalled it’s nearly done raising rates.

Instead, most of the increase is due to the part of yields, called the term premium, which has nothing to do with inflation or short-term rates. Numerous factors affect the term premium, and rising government deficits are a prime suspect.

Deficits have been wide for years. Why would they matter now? A better question might be: What took so long?

That larger deficits push up long-term rates had long been economic orthodoxy. But for the past 20 years, interest-rate models that incorporated fiscal policy didn’t work, noted Riccardo Trezzi, a former Fed economist who now runs his own research firm, Underlying Inflation.

That’s understandable. Central banks—worried about too-low inflation and stagnant growth—had kept interest rates around zero while buying up government bonds (“quantitative easing”). Private demand for credit was weak. This trumped any concern about deficits.

“We had a blissful 25 years of not having to worry about this problem,” said Mark Wiedman, senior managing director at BlackRock.

Today, though, central banks are worried about inflation being too high and have stopped buying and in some cases are shedding their bondholdings (“quantitative tightening”). Suddenly, fiscal policy matters again.

To paraphrase Hemingway, deficits can affect interest rates gradually or suddenly. Investors, asked to buy more bonds, gradually make room in their portfolios by buying less of something else, such as equities. Eventually, the risk-adjusted returns of these assets equalise, which means higher bond yields and lower price/earnings ratios on stocks. That has been happening for the past month.

Sometimes, though, markets can move suddenly, such as when Mexico threatened to default in 1994 and Greece did default a decade later. Even in countries that, unlike Mexico or Greece, borrow in currencies they control, interest rates can become hostage to deficits, such as in Canada in the early 1990s or Italy in the 1980s and early 1990s.

The U.S. isn’t Canada or Italy; it controls the world’s reserve currency, and its inflation and interest rates are mostly driven by domestic, not foreign, factors. On the other hand, the U.S. has also exploited those advantages to accumulate debt and run deficits that are much larger than those of peer economies.

There’s not much sign that this has yet imposed a penalty. Investors still project that the Fed will get inflation down to its 2% goal. At 2.4%, real (inflation-adjusted) Treasury yields are comparable to those in the mid-2000s and lower than in the 1990s, when the U.S. government’s debts and deficits were much lower.

Still, sometimes bad news accumulates below investors’ radar until something brings their collective attention to bear. Could a point come when “all the headlines will be about the fiscal unsustainability of the U.S.?” asked Wiedman. “I don’t hear this today from global investors. But do I think it could happen? Absolutely, that paradigm shift is possible. It’s not that no one shows up to buy Treasurys. It’s that they ask for a much higher yield.”

It’s notable that the recent rise in bond yields came as Fitch Ratings downgraded its U.S. credit rating, Treasury upped the size of its bond auctions, analysts began revising upward this year’s federal deficit, and Congress nearly shut down parts of the government over a failure to pass spending bills.

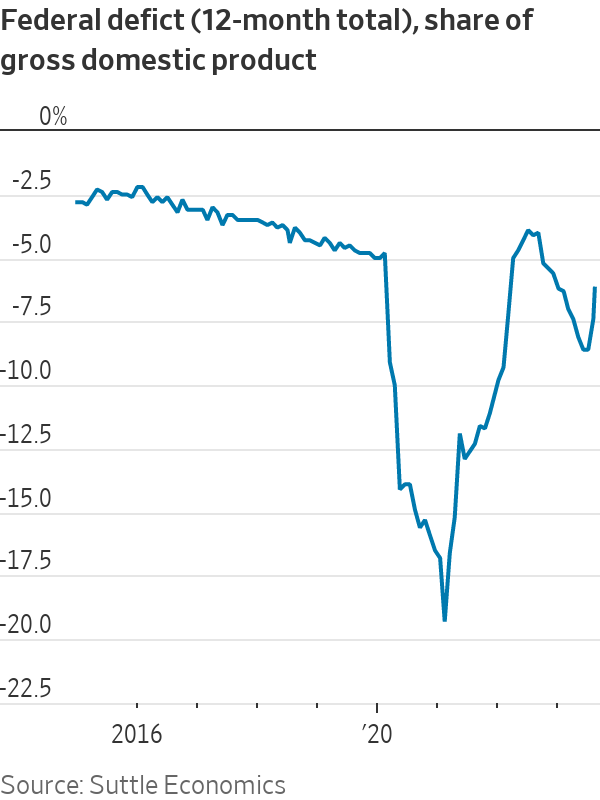

The federal deficit was over 7% of gross domestic product in fiscal 2023, after adjusting for accounting distortions related to student debt, Barclays analysts noted last week. That’s larger than any deficit since 1930 outside of wars and recessions. And this is occurring at a time of low unemployment and strong economic growth, suggesting that in normal times, “deficits may be much higher,” Barclays added.

Abroad, fiscal policy has clearly begun to matter. Last fall, a proposed U.K. tax cut triggered a surge in British bond yields; the government scrapped the proposal, then resigned. Italian yields have risen since the government last week delayed reducing its deficit to below European guidelines. Trezzi said that for the past decade the European Central Bank had bought more than 100% of net Italian government bond issuance, but that’s coming to an end.

Foreign investors, worried about inflation and deficits, have been selling Italian bonds, while Italian households have been buying, Trezzi said. “With a weakening economy, it is unclear for how long…households can offset the selloff of foreigners.”

Investors looking for U.S. political will to rein in deficits would take note that both former President Donald Trump and President Biden, their parties’ front-runners for the 2024 presidential nomination, have signed deficit-busting legislation and that both of their parties have pledged not tocut the two largest spending programs, Medicare and Social Security, or raise taxes on most households.

They would also notice that the Republican speaker of the House of Representatives was just ousted by rebels in his own party because he had passed a bipartisan spending bill to prevent the government from shutting down. True, the rebels wanted less spending. But shutdowns, Barclays noted, represent “erosion of governance.” This isn’t how a country trying to reassure the bond market acts.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”