Surging Nvidia Stock Keeps Drawing In More Believers

The chip company that is cashing in on the market’s artificial-intelligence obsession seems to many investors like an unstoppable force

The chip company that is cashing in on the market’s artificial-intelligence obsession seems to many investors like an unstoppable force

Nvidia ’s historic run is minting profits for investors big and small . Many are betting the boom is just beginning.

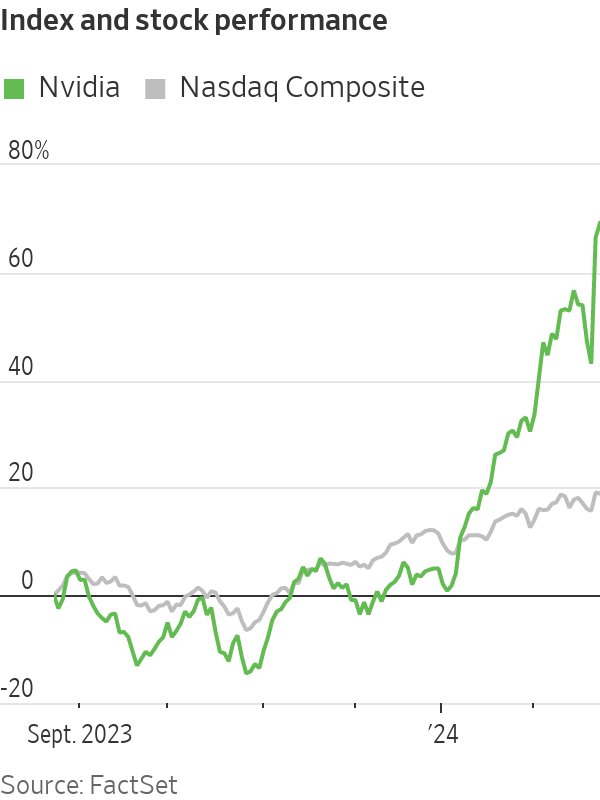

They are piling into trades that the chipmaker’s shares, which have more than tripled over the past year , are headed still higher. Some have turned to the options market to look for ways to turbocharge their bets on artificial intelligence after a blockbuster earnings report sent the stock up 17% over the past two days.

The exuberance reflects hope that the company is the vanguard of wide adoption of artificial intelligence—and an intense fear of missing out among investors who have sat on the sidelines while the company’s valuation has eclipsed $2 trillion .

With the help of Nvidia, stocks have stormed into 2024 . The S&P 500, which has chalked up fresh records in recent weeks, is up 6.7%. That is the index’s second-best performance for this time period over the past 10 years. The gains were only surpassed by an 11% increase in 2019.

Nvidia has contributed to about a quarter of those gains, according to S&P Dow Jones Indices.

The Nasdaq, too, is up 6.6% this year and neared a record Friday. The tech-heavy index has been boosted by Nvidia, which this week tacked on $277 billion in additional market value, along with six other tech titans collectively known as the Magnificent Seven.

The Dow Jones Industrial Average is up 3.8% this year and has hit repeated records in recent weeks.

“You look at these numbers and what this company’s done—it’s almost without precedent,” said Mike Ogborne, founder of San Francisco-based hedge fund Ogborne Capital Management, who counts Nvidia among his top five biggest holdings . “It is nothing short of amazing.”

Ogborne compared AI with the launch of the internet more than two decades ago, which kick-started a technology craze that lasted years.

“It’s exciting,” Ogborne said. “It’s great for America.”

Tamar June in Reno, Nev., is one investor along for Nvidia’s furious stock-market ascent. Since the 1990s, the 61-year-old software-company chief executive has been buying shares of tech firms, including Apple , Microsoft , Cisco, Intel and Oracle . June had been familiar with Nvidia for some time but in recent years kept reading about the chip company in the news. She liked that it was profitable and growing.

June decided to purchase some shares in 2022 at about $260, then watched the stock erase more than half of its value later that year. She held on, knowing that Nvidia’s graphics processing units were in high demand for cloud computing. Then, an AI frenzy hit the stock market in 2023, sending Nvidia’s stock soaring.

Now, Nvidia shares are closing in on $800, and June is looking for opportunities to buy more. She isn’t fazed by worries that the AI boom is bound to come crashing down. June experienced the bursting of the dot-com bubble and the 2008 financial crisis—and watched stocks bounce back to new highs.

“I think it’s still in the beginning stages,” June said of AI developments. “There’s still a lot of headroom for technology because our whole future depends on it.”

A herd of investors chased Nvidia while it raced toward its $2 trillion valuation.

At Robinhood Markets , Nvidia was the most purchased stock by customers on a net basis and received the heaviest notional trading volumes over the past month, according to Stephanie Guild, head of investment strategy at the digital brokerage.

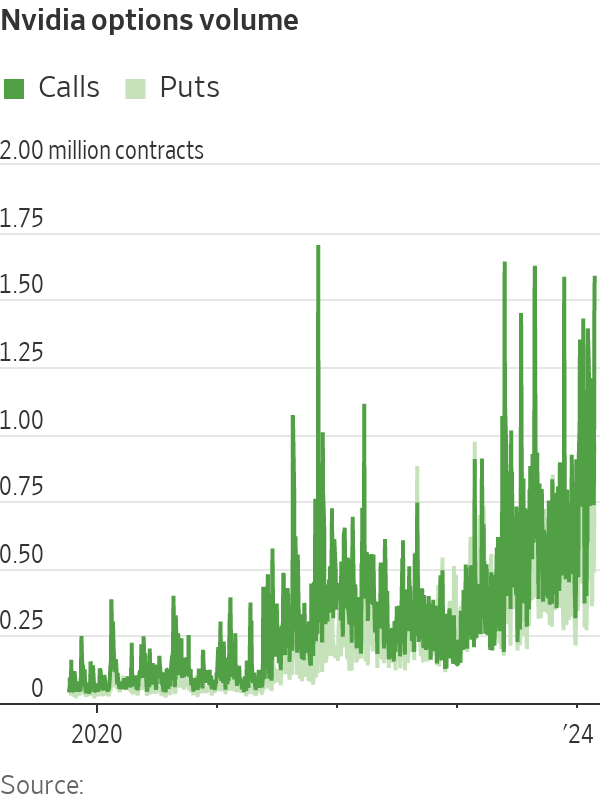

The rise drove many traders to pile into the company’s options, a risky corner of the market notorious for boom-and-bust trades.

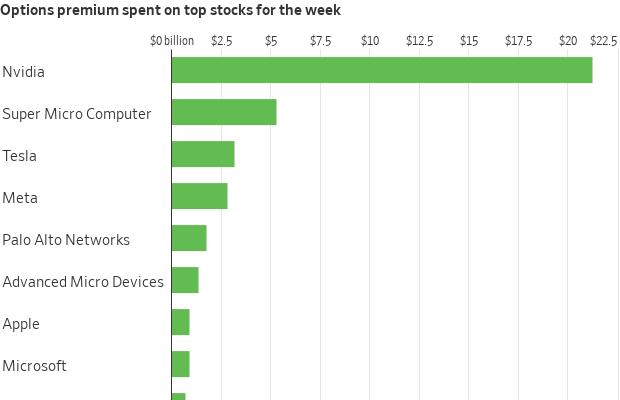

Nvidia has also morphed into one of the most popular trades in this market, with traders placing more than $20 billion in stock-options bets tied to the company over the past week, according to Cboe Global Markets data. That was more than what they spent on Tesla , Meta Platforms , Microsoft, Apple, Amazon and Alphabet combined.

Call options, contracts that confer the right to buy shares at a specific price, were particularly popular. And many of the trades appeared to suggest that investors were fearful of missing out on bigger gains to come. Some of the most active trades Friday were calls pegged to the shares jumping to $800 or $850, up from their closing price of $788.17. Betting against the shares has been a losing game , leading many investors to throw in the towel on bearish wagers.

The values of many of these options bets exploded while Nvidia soared, rewarding those who piled in. The big gains also enticed others to join in the trades while the stock’s rally continued.

“There’s a snowball effect,” said Henry Schwartz, a vice president at exchange-operator Cboe Global Markets, of the options activity surrounding Nvidia.

Ahead of the tech behemoth’s earnings report Wednesday, options pegged to the shares jumping to $1,300 —around double where they were trading at the time—were some of the most popular trades.

And for some investors, the 16% one-day jump in Nvidia’s share price Thursday wasn’t enough. They sought even bigger returns and piled into several niche exchange-traded funds that offer magnified exposure to Nvidia stock.

The GraniteShares 2x Long NVDA Daily ETF has taken in almost half a billion dollars from investors on a net basis since launching late in 2022. The fund’s shares have more than doubled in 2024 and have surged nearly 650% since inception.

There have been few signs of profit-taking so far. Investors added a net $263 million to the fund in the past month. The fund’s cousin, which turbocharges bearish bets against Nvidia, has been much less popular.

The euphoria surrounding Nvidia has spread to other stocks, too. Shares of Super Micro Computer , a much smaller company worth less than $50 billion, popped more than 30% Thursday after Nvidia’s earnings report. Traders spent more than $5 billion on options tied to the company, more than what they spent on Tesla this week. Tesla is worth about 13 times as much as the company.

Nvidia’s continued, rapid ascent has stunned even early bulls on semiconductors and generative AI.

Atreides Management founder Gavin Baker, who started covering Nvidia as an analyst at Fidelity in 2000, reminded investors in his Boston hedge fund in an early 2021 letter of Marc Andreessen ’s adage that software was eating the world. “Today, AI is replacing software,” he wrote.

Atreides started buying Nvidia shares in the fourth quarter of 2022, according to regulatory filings.

The wager proved profitable. But as Nvidia shares kept soaring, Baker started selling. Atreides was out of Nvidia by the end of the second quarter of 2023. “This has been a painful mistake,” Baker wrote in a June 2023 letter to his clients, when Nvidia was trading north of $420 a share.

Atreides’s stake in competitor Advanced Micro Devices has helped alleviate the pain from missing out on larger gains. The firm made nearly a quarter billion last year alone on AMD, which it continues to hold along with several other related bets.

Michael Hannosh, a 20-year-old college student in Chicago, said he first purchased shares of Nvidia in August 2022, when the stock traded below $180. Nvidia was one of his first-ever stock purchases. He had built a custom computer for videogaming and used a lot of Nvidia parts.

Hannosh said he kept the shares until last March, then sold them for a roughly 30% profit. He later bought a few more shares at about $230 and sold them over the course of the next several days at a profit.

The shares have tripled since.

“It’s blown my f—ing mind to bits. It’s insane,” said Hannosh. “I really wish I held it, obviously.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”