The Robots Are Coming—to Collaborate With You

Doosan Robotics’ blockbuster IPO—the biggest in Korea this year—shows that the robot stock craze has well and truly arrived

Doosan Robotics’ blockbuster IPO—the biggest in Korea this year—shows that the robot stock craze has well and truly arrived

Our future looks increasingly robotic—whether we like it or not. But the investment craze in robotics stocks may already be getting ahead of itself.

The latest example: South Korea’s Doosan Robotics, whose shares nearly doubled in value on their first day of trading Thursday. The company, which is part of the conglomerate Doosan Group, raised around $300 million from an initial public offering, making it Korea’s biggest IPO this year so far.

Doosan makes collaborative robots, or cobots, designed to work together with humans on factory floors. Such robotic helpers are most suitable for smaller companies that may not be ready to automate their whole production line but use cobots to automate processes better done by machines. Apart from its heavy-duty industrial robots, Doosan also makes variants that can serve coffee—and beer.

Doosan isn’t the only robotics company looking frothy of late. Shares of its smaller peer Rainbow Robotics, which is backed by Samsung Electronics, have more than quadrupled this year. Samsung raised its stake in Rainbow to 15% in March.

To be fair, there are plenty of good reasons to be optimistic about industrial robots. Poor demographics and poisonous immigration politics in most advanced economies will mean weak labor-force growth in the future. Robots rarely go on strike. And in the U.S., the enormous surge in manufacturing investment—courtesy of the Inflation Reduction Act and other industrial policy bills—means demand for manufacturing workers could remain strong for quite a while. Reshoring to advanced economies is another tailwind for robotics.

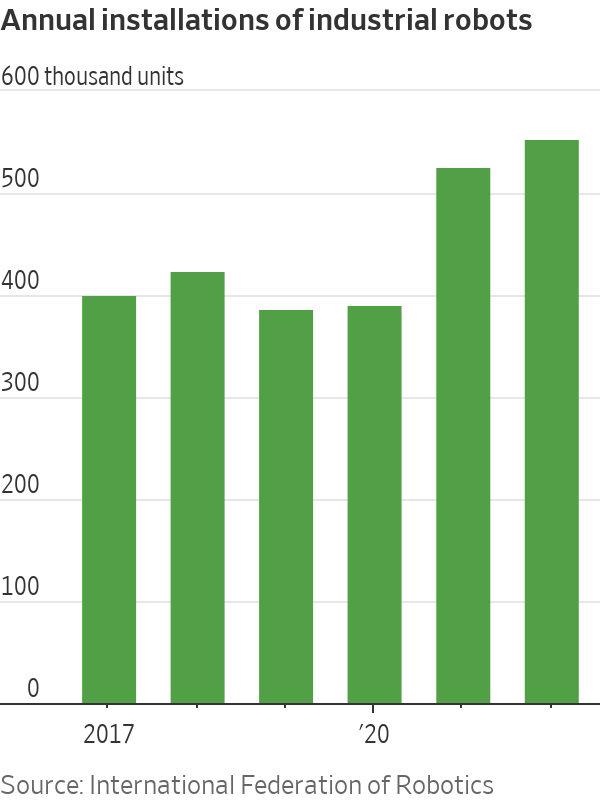

In 2022, almost 60% of Doosan’s sales came from North America and Europe. Though cobots are still a small part of the overall robot market—accounting for 7.5% of industrial robots installed in 2021, according to the International Federation of Robotics—shipments have been growing faster than the market as a whole. Installations for all industrial robots grew 5% year on year to a record high in 2022.

The company is the seventh-largest maker of cobots globally, according to its prospectus. But since the top two companies, Denmark’s Universal Robots and Japan’s Fanuc, dominate the sector with nearly half of the market, Doosan’s market share amounted to only 3.6%.

Doosan has been growing fast: Its sales more than doubled to around 45 billion won, the equivalent of $33 million, in 2022 from 2020. But it isn’t cheap. With a market capitalisation of around $2.5 billion, Doosan now trades at 74 times last year’s revenue. Fanuc trades at just 4.7 times revenue. Doosan is also unprofitable, though its chief executive expects it to move into the black next year.

The robot craze, like the artificial-intelligence craze, is grounded in real technological trends—and demographic ones too. But like human workers, not all robot firms are created equal. Jumping aboard the robot stock bandwagon at any price might not serve investors over the long run.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”