‘Thrifting’ Extends to Holiday Shopping Too

Roughly 17% of gifts this holiday season will be a resold item, according to Salesforce data

Roughly 17% of gifts this holiday season will be a resold item, according to Salesforce data

A new kind of present is gaining acceptance this holiday season. More consumers are picking secondhand items to gift each other, finding it to be an environmentally and budget-friendly option.

Thrift stores that sell used clothes and goods are springing up online and on street corners. Goodwill Industries International, the nonprofit behind the familiar chain of thrift stores, is ramping up its online efforts. Fashion brands are developing their own resale offering to keep up with clothing-reseller sites such as Depop and Poshmark. Roughly 17% of gifts this holiday season will be a resold item, according to software firm Salesforce.

“Consumers are choosing resale first because of the incredible value, the unique merchandise, and the incredible sustainability benefit,” said Matt Kaness, chief executive of GoodwillFinds, the nonprofit’s online e-commerce platform run in partnership with Salesforce.

Secondhand clothes, once seen as frumpy and embarrassing, are now keenly sought out by the fashion conscious. A popular vintage aesthetic dovetails with consumer calls for goods that do less harm to the world. About 85% of American shoppers have bought or sold preowned items over the past year, nearly a third for the first time, according to online marketplace OfferUp’s Recommerce report. In apparel alone, some 10% of the global market will be secondhand by next year.

GoodwillFinds is the only major nonprofit player in resale.

GoodwillFinds’ online platform allows a smarter operation than the traditional bricks-and-mortar store, said Kaness, formerly an executive with retailers including Walmart and Urban Outfitters. The platform uses artificial intelligence and large data sets to more accurately price and categorise items, creating a much more efficient system, Kaness said.

“In a store, it’s a human looking at the item. They have paper sticker tickets for the price and they have to process such a volume that it is somewhat random,” he said. In contrast, the company’s online system uses computer vision to take a picture, identify the item, create a listing and price it.

Moving online is the logical choice for secondhand sellers, said 25-year-old Brooke Bowlin, who runs lifestyle blog Nuance Required. “Secondhand stores just can’t sell enough,” said Bowlin, who started her own thrift store in Siloam Springs, Ark. “By moving online and expanding the audience, there is an opportunity to re-home more clothes,” she said.

Major fashion brands are also increasingly recognising that secondhand is as much a necessity as it is an opportunity. The fashion industry is responsible for up to 8% of global emissions, relying on resource-intensive raw materials and fast-moving trends that have contributed large amounts of waste. Around 11.3 million tons of textile waste go to landfills in the U.S. every year, according to environmental organisation Earth.Org.

Outdoor-clothing retailer Patagonia established its Worn Wear platform in 2017, one of the first resale channels by a major brand.

As much as adapting to trends, Patagonia Worn Wear aims to change consumer behavior, said Asha Agrawal, managing director of the Patagonia venture fund that runs the platform.

“A lot of our messaging is around—‘you don’t need to buy something new,’” she said.

Worn Wear buys back used brand gear from consumers by paying higher prices than peer-to-peer apps or other marketplaces, Agrawal said. This strategy contributes to the bulk of the platform’s costs but also boosted its inventory fourfold this year alone, she said, adding Worn Wear has been profitable for the last two years.

Worn Wear is now integrated into the Patagonia brand. “You can now do your main shopping with Patagonia with our resale business in the U.S.,” she said. “That’s a huge evolution for us.”

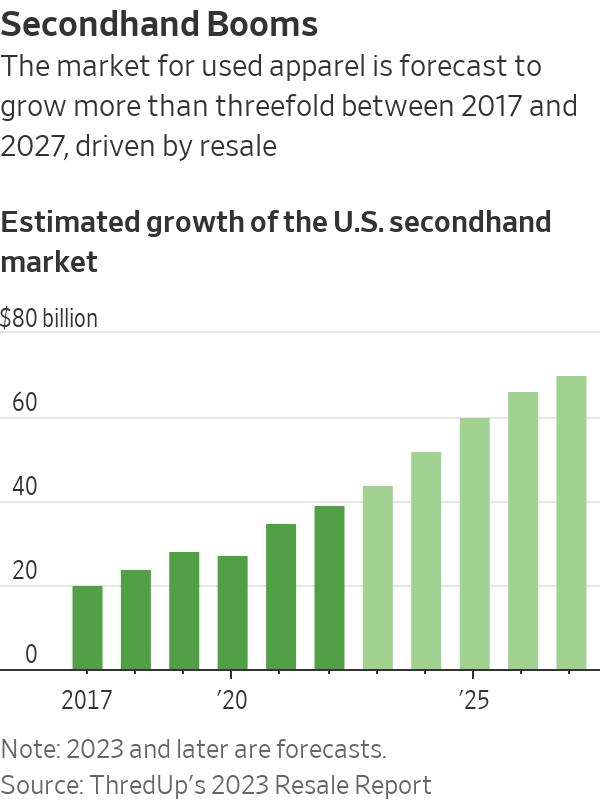

Resale by brands and third parties is expected to outpace traditional thrift sales and donations in the U.S., rising to 60% of a $70 billion total by 2027 from 15% of the $20 billion secondhand market in 2017, according to online thrift store ThredUp’s recent resale report.

Other fashion players have their versions. Sweden’s Hennes & Mauritz launched H&M Pre-Loved in the U.S. this year, in partnership with ThredUp. Inditex-owned Zara has launched a preowned platform that offers repair services, customer-to-customer sales and donations of used garments in the U.K. and France, with plans for a U.S. rollout by 2025.

Resale remains an imperative for fashion brands as a way to control distribution and retain the trust of shoppers increasingly alert to the fate of their old clothes. However, scaling up resale generates a raft of operational challenges such as authentication, returns and ensuring that secondhand doesn’t look like an afterthought, said Anita Balchandani, fashion lead at consultant firm McKinsey & Co.

Unlike nonprofits, such as Goodwill, that get their inventory from donations and don’t have to be accountable to shareholders, retailers are struggling to make business sense of resales, Balchandani said.

“No one has proven the path to scaling this up profitably,” she said. “You almost have to create a whole new end-to-end supply chain…. The retailer who cracks that journey is going to make a real difference in this space.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”