Global Art Market Soars By 29%

Reaching $65 billion in sales.

Reaching $65 billion in sales.

The global art market rebounded strongly in 2021 despite the challenges of the pandemic, according to a global art market report released Tuesday.

Aggregate sales, including sales by dealers and auction houses, jumped 29% from 2020 to an estimated US$65.1 billion last year, surpassing pre-pandemic levels in 2019, according to the annual report jointly published by Art Basel and UBS and authored by Clare McAndrew, founder of Dublin-based Arts Economics.

“The art market has demonstrated incredible resilience in 2021, with a strong uplift in aggregate sales, despite still operating under some very challenging conditions,” McAndrew said in the report. “Dealers and auction houses successfully adjusted to a new two-tier system of online and offline sales and events, and the rising wealth of the high-net-worth collectors helped to support demand at the higher end of the market.”

The median expenditure by high-net-worth individuals (HNWIs), those who have a net worth of more than US$1 million, excluding real estate and private business assets, reached US$274,000 in 2021, more than double the level in 2020, according to the report.

Further, 74% of HNWIs surveyed bought art-based non-fungible tokens, or NFTs in 2021, with a median price of US$9,000 each, the report said.

The findings are based on a survey of 2,339 wealthy individuals across 10 major markets, and represent one element of the wide-ranging report on the state of the global art market.

Sales by dealers amounted to approximately US$34.7 billion in 2021, increasing 18% year-on-year. Public sales by auction houses, excluding private sales, reached an estimated US$26.3 billion in 2021, an increase of 47% from a year ago, according to the report.

Geographically, the U.S. still dominates, accounting for US$28 billion, or 43% of the total global sales of art and antiques in 2021. Greater China was the second largest with a market share of 20%, or US$13.4 billion in sales.

Reprinted by permission of Penta. Copyright 2021 Dow Jones & Company. Inc. All Rights Reserved Worldwide. Original date of publication: March 29, 2022.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

Move over, Marvel. The next blockbuster entertainment franchise might come from Japan.

Anime is shaping up as the country’s next big export industry, beyond cars and electronics. This once-niche entertainment form is entering the worldwide mainstream , and its growth could light up investors’ portfolios.

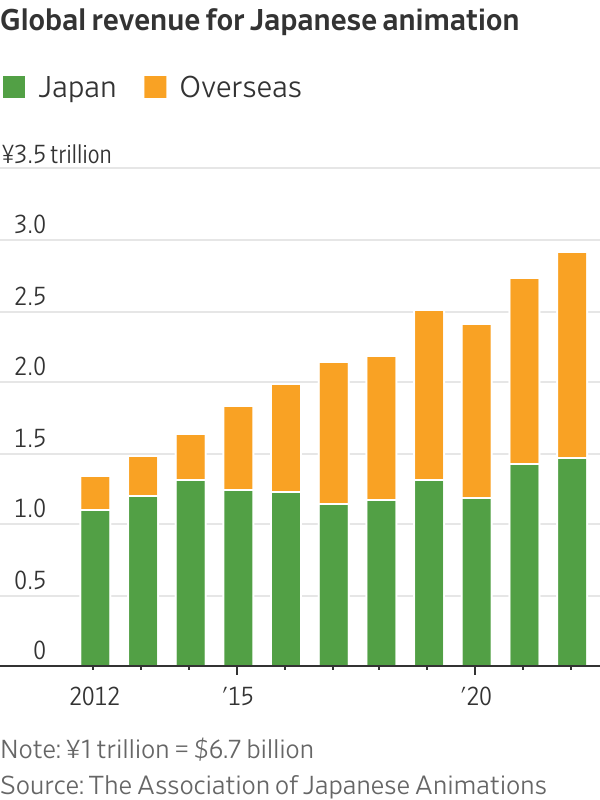

The global market for Japanese animation, known as anime, and its related products has more than doubled between 2012 and 2022 to 2.9 trillion yen, equivalent to $20 billion, according to the Association of Japanese Animations. The overseas market has been driving that growth. Markets outside of Japan made up around half of the total in 2022, compared with around 18% a decade earlier.

Streaming companies such as Netflix are certainly taking notice. Its live-action series “One Piece,” based on a Japanese comic, was its most-watched show in the second half of 2023. In fact, anime content on Netflix in the period logged 14% viewing growth from the first half of 2023, compared with a 4% drop overall, according to Jefferies. These streaming platforms will continue to introduce more anime-related content to their global audiences.

Japan’s anime and manga, the Japanese word for comics, have created many well-known characters and franchises over the years, such as Pokémon. And it looks to be getting even more mainstream. The anime market in North America has grown from $1.6 billion in 2018 to $4 billion this year, according to Jefferies. And Asia, which has long been more receptive to anime, will likely continue to grow strongly, especially in China. Anime has also been popular on Chinese streaming platforms such as Bilibili .

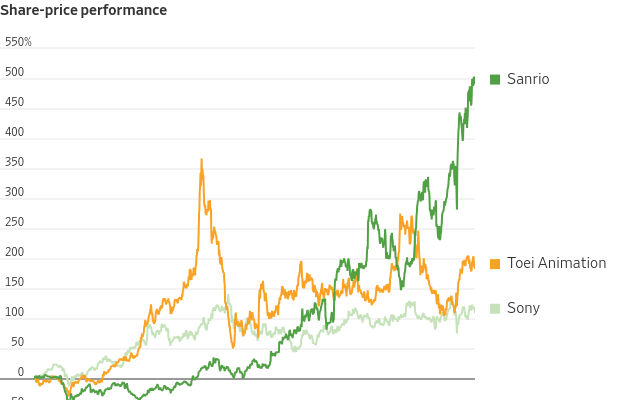

Apart from streaming, selling merchandise can be even more lucrative. Sanrio , which owns characters like Hello Kitty , has reported record profits, with its share price rising nearly sixfold over the past five years.

Sony would be another major beneficiary of this trend . The company owns animation streaming service Crunchyroll, which had 15 million subscribers as of June. That compared with around 3 million subscribers when Sony announced the acquisition of the streaming service from AT&T for nearly $1.2 billion in 2020. This contrasts with Sony’s approach in online streaming for other content: It acts more like an “arms dealer,” selling movies and shows to platforms such as Netflix and Amazon.com . That means the company could benefit more directly from the anime boom. And anime also has strong synergies with its movie and game businesses .

Anime maker Toei Animation, which owns popular franchises such as “One Piece” and “Dragon Ball,” is another listed company that would benefit. It makes anime itself, but more important for the overseas markets, it also earns licensing revenue from the copyrights to popular franchises that it owns. Sales outside of Japan accounted for more than half of its total revenue in the latest fiscal year ended in March. Season two for Netflix’s “One Piece” is already in production. Toei stock has nearly tripled since the end of 2019.

Anime has blockbuster potential, not just for audiences but for investors as well.