US: Inflation eased again in January but came in above Wall Street’s expectations, clouding the Federal Reserve’s path to rate cuts and potentially giving the central bank breathing space to wait until the middle of the year.

The Labor Department reported Tuesday that consumer prices rose 3.1% in January from a year earlier, versus a December gain of 3.4%. That marked the lowest reading since June.

Still, the consumer-price index was higher than the predicted 2.9%, a disappointment for investors who hope the Fed will cut rates sooner rather than later. Rate cuts tend to help stock prices by boosting economic activity and reducing competition from bonds for investor dollars.

The release gave a nasty jolt to markets. Stocks fell sharply and bond yields rose. The Dow Jones Industrial Average slid more than 500 points, or about 1.4%, its worst one-day decline since March. For all three major U.S. stock indexes, it was their worst performance on a CPI release day since September 2022 , according to Dow Jones Market Data.

The yield on the 10-year Treasury note rose to 4.315%, bringing it to its highest level since the end of November.

Interest-rate futures, which before Tuesday’s report implied the central bank would probably begin cutting rates by its May meeting, now suggest a June start date is more likely.

Where the Fed could go from here

Investors’ belief that Fed cuts were imminent has helped fuel the rally in stocks. The Dow on Monday had hit its 12th record close of 2024.

But Tuesday’s inflation report underscores why Fed officials have been dismissive of such expectations. Some Fed officials have suggested that the pace of improvement over the past six months might overstate underlying progress in containing price pressures.

Officials have said they aren’t ready to entertain rate cuts at their next meeting, March 19-20, because they want to see more evidence that inflation is returning to their 2% target.

Fed Chair Jerome Powell has said officials want to see more evidence that inflation is returning to its 2% goal, which is measured against a separate gauge to be released later this month by the Commerce Department.

“It’s not that the data aren’t good enough. It’s that there’s really six months of data,” Powell said in an interview on “60 Minutes” earlier this month. “It doesn’t need to be better than what we’ve seen, or even as good. It just needs to be good.”

Core prices, which exclude food and energy items in an effort to better track inflation’s underlying trend, were up 3.9% in January. That was equal to December’s gain, which was the lowest since mid-2021.

From a month earlier, overall prices were up a seasonally adjusted 0.3%, and core prices were up 0.4%—larger gains than economists expected.

Two measures of inflation

The Fed’s preferred measure of inflation has been running cooler than the Labor Department’s, and analysts said that could continue in January. The figures released Tuesday calculate medical care and airfares differently, and those categories were especially strong in January. The Labor Department’s measure also puts a much higher weight on shelter costs, which for both owners and renters are derived from rents. Shelter costs accounted for 0.23 percentage point of the monthly gain in overall prices in January. Shelter costs were up 0.6% month over month.

Some Fed officials have said they are looking for evidence that a slowdown in price pressures is broadening beyond goods such as used cars, which have seen prices decline over the past year. Tuesday’s figure showed the opposite: Price declines accelerated for goods while price increases accelerated for services.

And prices are still far above where they were before the pandemic—especially for items that most Americans buy often, like groceries.

The sting of those past price increases might be part of why so many Americans remain down on the economy . An analysis conducted by Goldman Sachs economists suggests that frustration with high price levels might have contributed to low confidence readings that persisted in the early 1980s even after inflation had slipped sharply.

“It does seem like it takes a while for confidence to recover, in part because people are focused on levels rather than changes,” said Goldman chief economist Jan Hatzius .

The Labor Department’s measure of overall consumer prices was up 19.6% this January from four years earlier, just before the pandemic hit. In contrast, prices were up 8.9% in the four years ended January 2020.

Economists generally expect inflation to cool this year, though they caution the process could be bumpy. Cooling prices for newly signed leases, for example, should eventually translate into lower shelter costs.

“I can tell inflation has gotten better,” said Mike Poore, of Henderson, Ky. “That’s definitely a good thing. It’s a shame it’s not happening quicker.”

The high cost of groceries

A Bank of America Institute analysis of customer data found households tended to make far more transactions a month for food and drinks at restaurants and bars, for groceries and for gasoline than they do for other items. Labor Department figures show that prices in all three of those frequent-transaction categories are higher, relative to before the pandemic, than prices overall.

Research from University of California, Berkeley economist Ulrike Malmendier and three co-authors found that prices for items that people buy more often play an outsize role in framing their inflation expectations. “In terms of what gets ingrained in people’s brains, it’s stuff that they purchase frequently,” she said.

Other research Malmendier has conducted examines the scarring effects of inflation episodes , which can have persistent, and potentially costly, effects on people’s financial decisions. She is heartened by the fact that inflation has retreated relatively quickly from the 9.1% it hit in June 2022 —a contrast to the experience of the late 1970s and early 1980s, when inflation remained elevated for years.

“I’m a little less worried about long-lasting effects than I was in 2022,” she said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

Subsidised minivans, no income taxes: Countries have rolled out a range of benefits to encourage bigger families, with no luck

Imagine if having children came with more than $150,000 in cheap loans, a subsidised minivan and a lifetime exemption from income taxes.

Would people have more kids? The answer, it seems, is no.

These are among the benefits—along with cheap child care, extra vacation and free fertility treatments—that have been doled out to parents in different parts of Europe, a region at the forefront of the worldwide baby shortage. Europe’s overall population shrank during the pandemic and is on track to contract by about 40 million by 2050, according to United Nations statistics.

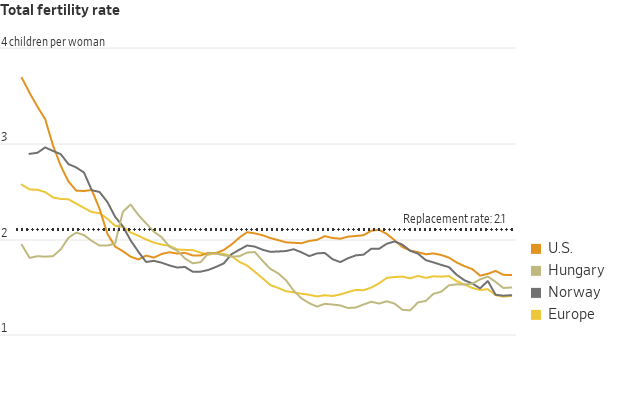

Birthrates have been falling across the developed world since the 1960s. But the decline hit Europe harder and faster than demographers expected—a foreshadowing of the sudden drop in the U.S. fertility rate in recent years.

Reversing the decline in birthrates has become a national priority among governments worldwide, including in China and Russia , where Vladimir Putin declared 2024 “the year of the family.” In the U.S., both Kamala Harris and Donald Trump have pledged to rethink the U.S.’s family policies . Harris wants to offer a $6,000 baby bonus. Trump has floated free in vitro fertilisation and tax deductions for parents.

Europe and other demographically challenged economies in Asia such as South Korea and Singapore have been pushing back against the demographic tide with lavish parental benefits for a generation. Yet falling fertility has persisted among nearly all age groups, incomes and education levels. Those who have many children often say they would have them even without the benefits. Those who don’t say the benefits don’t make enough of a difference.

Two European countries devote more resources to families than almost any other nation: Hungary and Norway. Despite their programs, they have fertility rates of 1.5 and 1.4 children for every woman, respectively—far below the replacement rate of 2.1, the level needed to keep the population steady. The U.S. fertility rate is 1.6.

Demographers suggest the reluctance to have kids is a fundamental cultural shift rather than a purely financial one.

“I used to say to myself, I’m too young. I have to finish my bachelor’s degree. I have to find a partner. Then suddenly I woke up and I was 28 years old, married, with a car and a house and a flexible job and there were no more excuses,” said Norwegian Nancy Lystad Herz. “Even though there are now no practical barriers, I realised that I don’t want children.”

The Hungarian model

Both Hungary and Norway spend more than 3% of GDP on their different approaches to promoting families—more than the amount they spend on their militaries, according to the Organization for Economic Cooperation and Development.

Hungary says in recent years its spending on policies for families has exceeded 5% of GDP. The U.S. spends around 1% of GDP on family support through child tax credits and programs aimed at low-income Americans.

Hungary’s subsidised housing loan program has helped almost 250,000 families buy or upgrade their homes, the government says. Orsolya Kocsis, a 28-year-old working in human resources, knows having kids would help her and her husband buy a larger house in Budapest, but it isn’t enough to change her mind about not wanting children.

“If we were to say we’ll have two kids, we could basically buy a new house tomorrow,” she said. “But morally, I would not feel right having brought a life into this world to buy a house.”

Promoting baby-making, known as pro natalism, is a key plank of Prime Minister Viktor Orbán ’s broader populist agenda . Hungary’s biennial Budapest Demographic Summit has become a meeting ground for prominent conservative politicians and thinkers. Former Fox News anchor Tucker Carlson and JD Vance, Trump’s vice president pick, have lauded Orbán’s family policies.

Orbán portrays having children inside what he has called a “traditional” family model as a national duty, as well as an alternative to immigration for growing the population. The benefits for child-rearing in Hungary are mostly reserved for married, heterosexual, middle-class couples. Couples who divorce lose subsidised interest rates and in some cases have to pay back the support.

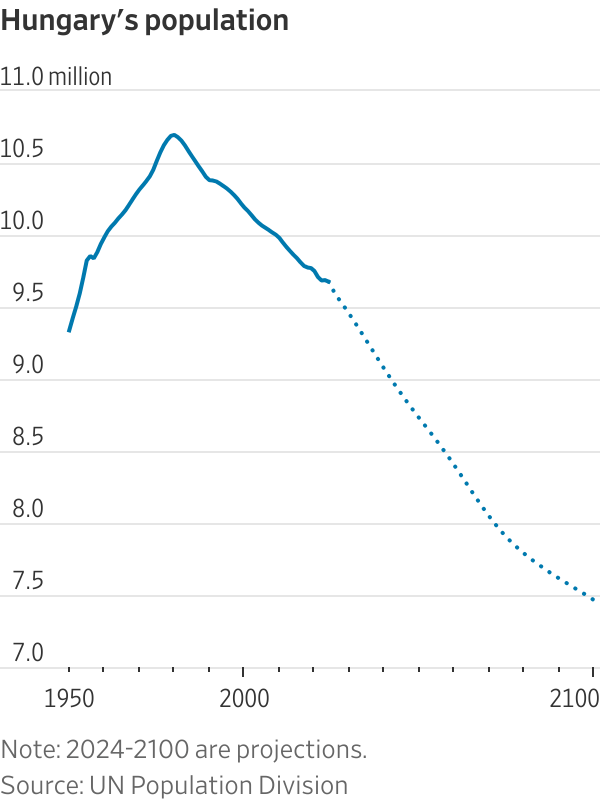

Hungary’s population, now less than 10 million, has been shrinking since the 1980s. The country is about the size of Indiana.

“Because there are so few of us, there’s always this fear that we are disappearing,” said Zsuzsanna Szelényi, program director at the CEU Democracy Institute and author of a book on Orbán.

Hungary’s fertility rate collapsed after the fall of the Soviet Union and by 2010 was down to 1.25 children for every woman. Orbán, a father of five, and his Fidesz party swept back into power that year after being ousted in the early 2000s. He expanded the family support system over the next decade.

Hungary’s fertility rate rose to 1.6 children for every woman in 2021. Ivett Szalma, an associate professor at Corvinus University of Budapest, said that like in many other countries, women in Hungary who had delayed having children after the global financial crisis were finally catching up.

Then progress stalled. Hungary’s fertility rate has fallen for the past two years. Around 51,500 babies have been born there this year through August, a 10% drop compared with the same period last year. Many Hungarian women cite underfunded public health and education systems and difficulties balancing work and family as part of their hesitation to have more children.

Anna Nagy, a 35-year-old former lawyer, had her son in January 2021. She received a loan of about $27,300 that she didn’t have to start paying back until he turned 3. Nagy had left her job before getting pregnant but still received government-funded maternity payments, equal to 70% of her former salary, for the first two years and a smaller amount for a third year.

She used to think she wanted two or three kids, but now only wants one. She is frustrated at the implication that demographic challenges are her responsibility to solve. Economists point to increased immigration and a higher retirement age as other offsets to the financial strains on government budgets from a declining population.

“It’s not our duty as Hungarian women to keep the nation alive,” she said.

Big families

Hungary is especially generous to families who have several children, or who give birth at younger ages. Last year, the government announced it would restrict the loan program used by Nagy to women under 30. Families who pledge to have three or more children can get more than $150,000 in subsidised loans. Other benefits include a lifetime exemption from personal taxes for mothers with four or more kids, and up to seven extra annual vacation days for both parents.

Under another program that’s now expired, nearly 30,000 families used a subsidy to buy a minivan, the government said.

Critics of Hungary’s family policies say the money is wasted on people who would have had large families anyway. The government has also been criticised for excluding groups such as the minority Roma population and poorer Hungarians. Bank accounts, credit histories and a steady employment history are required for many of the incentives.

Orbán’s press office didn’t respond to requests for comment. Tünde Fűrész, head of a government-backed demographic research institute, disagreed that the policies are exclusionary and said the loans were used more heavily in economically depressed areas.

Government programs weren’t a determining factor for Eszter Gerencsér, 37, who said she and her husband always wanted a big family. They have four children, ages 3 to 10.

They received about $62,800 in low-interest loans through government programs and $35,500 in grants. They used the money to buy and renovate a house outside of Budapest. After she had her fourth child, the government forgave $11,000 of the debt. Her family receives a monthly payment of about $40 a month for each child.

Most Hungarian women stay home with their children until they turn 2, after which maternity payments are reduced. Publicly run nurseries are free for large families like hers. Gerencsér worked on and off between her pregnancies and returned full-time to work, in a civil-service job, earlier this year.

She still thinks Hungarian society is stacked against mothers and said she struggled to find a job because employers worried she would have to take lots of time off.

The country’s international reputation as family-friendly is “what you call good marketing,” she said.

Nordic largesse

Norway has been incentivising births for decades with generous parental leave and subsidised child care. New parents in Norway can share nearly a year of fully paid leave, or around 14 months at 80% pay. More than three months are reserved for fathers to encourage more equal caregiving. Mothers are entitled to take at least an hour at work to breast-feed or pump.

The government’s goal has never been explicitly to encourage people to have more children, but instead to make it easier for women to balance careers and children, said Trude Lappegard, a professor who researches demography at the University of Oslo. Norway doesn’t restrict benefits for unmarried parents or same-sex couples.

Its fertility rate of 1.4 children per woman has steadily fallen from nearly 2 in 2009. Unlike Hungary, Norway’s population is still growing for now, due mostly to immigration.

“It is difficult to say why the population is having fewer children,” Kjersti Toppe, the Norwegian Minister of Children and Families, said in an email. She said the government has increased monthly payments for parents and has formed a committee to investigate the baby bust and ways to reverse it.

More women in Norway are childless or have only one kid. The percentage of 45-year-old women with three or more children fell to 27.5% last year from 33% in 2010. Women are also waiting longer to have children—the average age at which women had their first child reached 30.3 last year. The global surge in housing costs and a longer timeline for getting established in careers likely plays a role, researchers say. Older first-time mothers can face obstacles: Women 35 and older are at higher risk of infertility and pregnancy complications.

Gina Ekholt, 39, said the government’s policies have helped offset much of the costs of having a child and allowed her to maintain her career as a senior adviser at the nonprofit Save the Children Norway. She had her daughter at age 34 after a round of state-subsidised IVF that cost about $1,600. She wanted to have more children but can’t because of fertility issues.

She receives a monthly stipend of about $160 a month, almost fully offsetting a $190 monthly nursery fee.

“On the economy side, it hasn’t made a bump. What’s been difficult for me is trying to have another kid,” she said. “The notion that we should have more kids, and you’re very selfish if you have only had one…those are the things that took a toll on me.”

Her friend Ewa Sapieżyńska, a 44-year-old Polish-Norwegian writer and social scientist with one son, has helped her see the upside of the one-child lifestyle. “For me, the decision is not about money. It’s about my life,” she said.