In a transaction that further cements NBA Hall of Famer Michael Jordan’s standing atop the world of sports memorabilia, Sotheby’s New York sold six Air Jordan sneakers earlier Friday for the whopping total of US$8 million.

Dubbed the Dynasty Collection, the set of six shoes were sold to an anonymous buyer who was in the room during the bidding, according to the auction house. Sotheby’s had publicised the sale with a far-reaching tour, displaying the sneakers around the world while estimating that the set would sell for between US$7 million and US$10 million.

“To have something from one of Jordan’s championship clinching games is a goal for every collector of sports artifacts. To have something from all six is unheard of,” says Brahm Wachter, Sotheby’s head of modern collectables. “We are thrilled with the result which is a testament to the greatest to ever play the game.”

The Dynasty Collection earned headlining status for the second edition of Sotheby’s “The One,” a cross-category sale that features an eclectic range of notable objects representing human achievement and excellence.

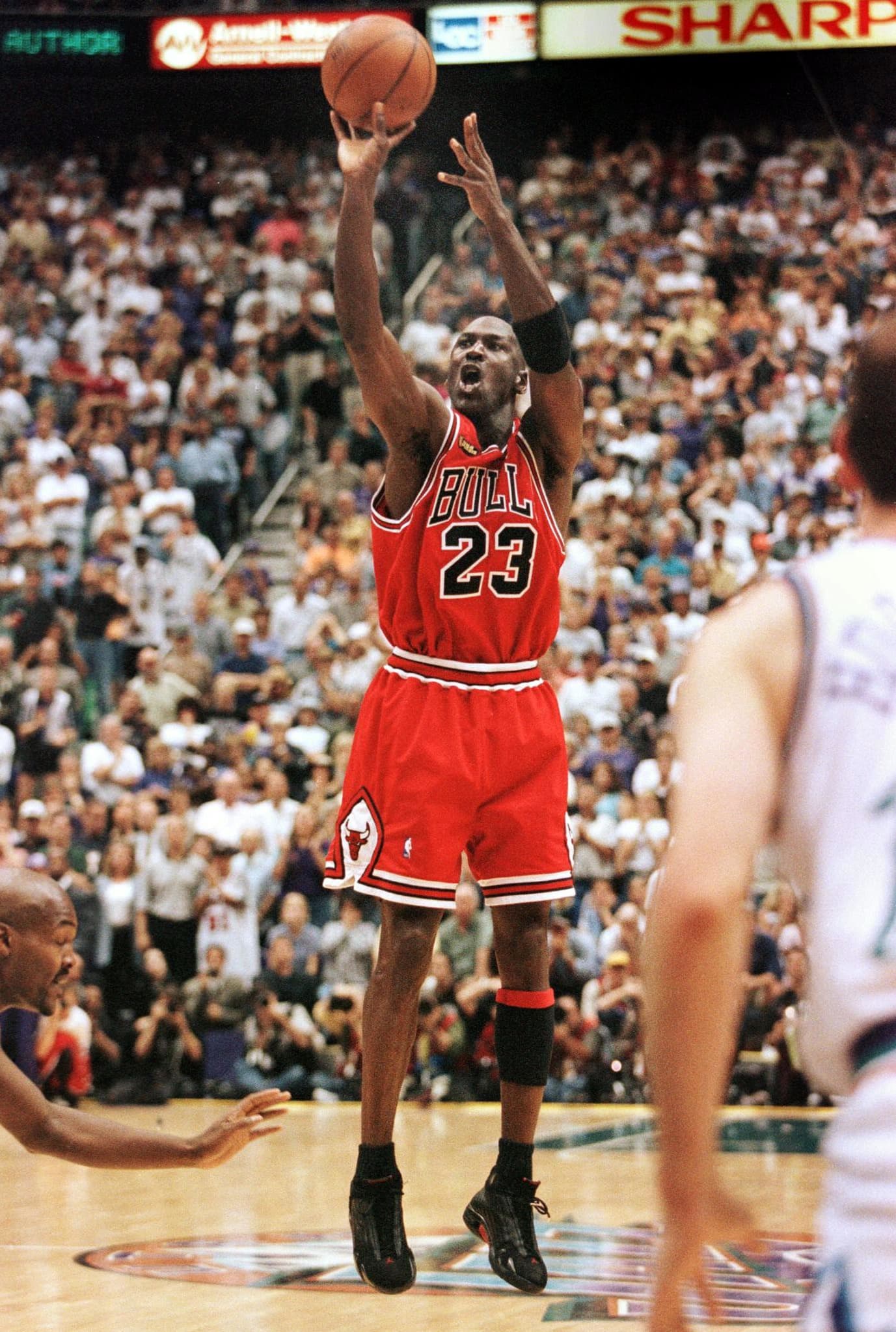

AFP via Getty Images

As the hammer fell, the final price tag set a new global benchmark for game-worn sneakers while becoming the second-highest price achieved for any Jordan memorabilia, just behind Jordan’s 1998 NBA Finals Game 1 jersey from the famed “Last Dance” season, which achieved US$10.1 million at Sotheby’s in September 2022 and still holds the world record for any game-worn sports memorabilia.

The auctioneer also holds the record for any pair of sneakers, with Jordan’s 1998 NBA Finals Game 2 Air Jordan 13s having earned $2.2 million in April 2023.

Jordan, who turns 61 on Feb. 17, famously handed off one of his size-13 and 13.5 shoes—an Air Jordan VI (1991), Air Jordan VII (1992), Air Jordan VIII (1993), Air Jordan XI (1996), Air Jordan XII (1997), and Air Jordan XIV (1998)—after each championship-deciding victory to Bulls PR exec Tim Hallam.

The sneakers were later obtained from Hallam by a private American collector, who ultimately enlisted Sotheby’s for the sale. Initially announced nearly a year ago, the collection has captured the attention of sports fans and hobbyists alike.

“Today’s record-breaking price is a testament to the GOAT. The Dynasty Collection undeniably ranks among the most significant compilations of sports memorabilia in history,” Wachter said in a statement announcing the result.

“Serving as both a reminder of Michael Jordan’s lasting impact on the world and a tangible expression of his recognised legendary status, its significance is further validated by this monumental result.

One other piece of Jordan memorabilia was included in the auction: the signed official scorekeeper’s sheet from the highest-scoring game of his career—a 69-point effort against the Cleveland Cavaliers on March 28, 1990. It sold for US$50,800.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

Be familiar with how vendors develop, test and release their software

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

Re-evaluate how your firm accepts software updates from ‘trusted’ vendors

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

Develop a disaster recovery plan

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

Review vendor and insurance contracts

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

Weigh the advantages and disadvantages of the various platforms

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”