One Husband Is Enough: Women in Their 60s See No Need to Remarry

Many don’t want the hassle or financial complications. ‘What would be the point?’

Many don’t want the hassle or financial complications. ‘What would be the point?’

In many ways, Alexandra Cruse is living the American retirement dream.

Cruse moved to Palm Beach Gardens, Fla., a year and a half ago to escape the cold winters in Massachusetts. She describes her financial situation as “perfectly comfortable” after a career in banking. She keeps active with yoga, volunteering at a local hospice, piano lessons, art classes and a bicycling group.

One thing she’s not interested in: saying “I do.” Cruse lost her husband of nearly four decades, Stephen, in 2015. And while she’s open to meeting a new partner, she has no desire to remarry.

“What would be the point?” said Cruse, 68. “Just the commingling funds is just too complicated.” Besides, “over 65, you’re not going to have any children.”

Plenty of American women are finding that they don’t need a husband to enjoy their golden years. Both men and women in their mid-60s or older are more likely to be divorced or never married than at any time in the past three decades. But the women are much less likely than their male counterparts to get remarried.

Part of the reason is that women have a smaller pool to choose from. They on average live about five years longer than men, according to the federal Centers for Disease Control and Prevention.

About 53% of U.S. women 65 and older are divorced, widowed or never married, compared with 30% of men, according to an analysis of Census Bureau data by Bowling Green State University’s National Center for Family & Marriage Research.

But there are other considerations, too. Women are more likely to maintain stronger social ties with family and friends, which means they have more support after a divorce or the death of a spouse. And for both men and women, American society has become more accepting of couples living together outside of marriage.

Susan Brown, a sociology professor at Bowling Green and one of the authors of the Census analysis, said that many older women “don’t want to be a ‘nurse or a purse.’ ” That means, Brown said, that they “don’t want to provide care and they don’t want to jeopardise their own financial stability.”

That’s the case for Christy Sahler, who has been divorced for almost three decades. She has no plans to remarry, as she wants to ensure her assets pass only to her daughter.

“It’s a bit lonely having dinner on my own,” said Sahler, who is 61 and lives in Tucson, Ariz. “But I recognise that if I had a partner I’d be going home to make dinner for that person.” Being single also frees her up to do other things in the evenings, like yoga and pottery.

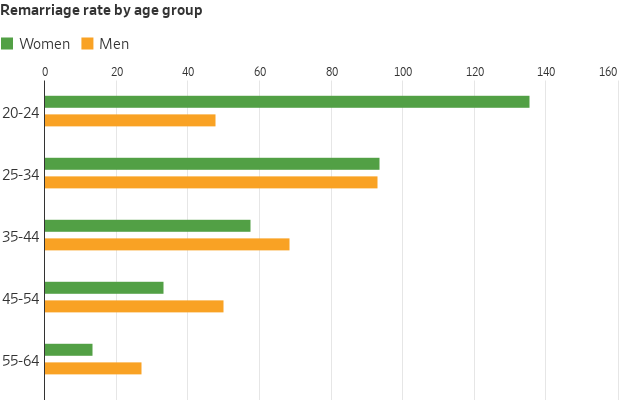

After a divorce or bereavement, younger women are more likely than men to find a new partner. That trend shifts after age 35. By age 55 to 64, men are twice as likely to remarry, and more than three times as likely when they are age 65 and older.

The last time Pew Research Center polled divorced or widowed Americans about their intentions to remarry , in 2014, 54% of women said they didn’t want to get married again. Only 30% of men gave the same answer.

Research shows that marriage tends to be good for a person’s finances. Married people have a higher median net worth and are more likely to be homeowners than their unmarried peers, thanks in part to their ability to split costs, pool assets and get certain tax breaks.

Divorce is financially detrimental at any age, but particularly punishing later in life when people have less time to catch up financially. Women who divorce at age 50 or older experience a 45% decline in their standard of living, while men see their standard of living drop by just 21%, according to a 2021 study in the Journals of Gerontology. That can make women especially hesitant about entering another marriage: They worry about having to go through the same thing again.

Remarriage can also create thorny disputes around issues like inheritance and power of attorney, especially when both partners bring children into the relationship. Widows and divorcées who remarry may lose eligibility to their former spouse’s Social Security benefits.

Norma Israel’s first marriage ended in divorce when she was in her 30s, and she lost her second husband to cancer in her 50s.

She wasn’t looking for another relationship when, a year later, a co-worker invited her to a concert. She and Larry Chase have now been together for a decade and live together in North Beach, Md. They share a love for music and travel, but they don’t share bank accounts. And Israel has no plans to put a ring on it.

“It’s hard for me to have three strikes,” said Israel, 63.

Chase said he would get remarried if it were important to Israel, but he’s equally happy not to.

“Society seems pretty OK with it nowadays,” said Chase, 78, who was previously married and has a son.

“We’re in love,” he added. “It’s a pretty nice life.”

Na’ama Shenhav, who teaches public policy at the University of California, Berkeley, found that when women’s wages increase relative to men’s, so does the share of women who choose not to marry. The share of divorced women also rises when women’s wages increase.

Rosemary Hopcroft, a sociology professor emerita at the University of North Carolina at Charlotte, found that higher-income men are more likely to get married and remarried than men who make less money. For women, the effect is the opposite, at least for remarriage: Higher-income women are less likely to get remarried than other women.

“As women get older, the group of men they find attractive gets smaller and smaller; whereas for men, as they get older and more financially stable, the group of women they find attractive gets larger and larger,” said Hopcroft.

What’s more, longer lifespans mean people are looking at their golden years with a different time horizon. By the end of this year, the youngest of the baby boomer generation—around 70 million strong, or one in five Americans— will all turn 60 . According to the Social Security Administration, a 60-year-old man today can expect to live for nearly 24 more years, while a 60-year-old woman can expect to live for nearly 27 more years.

“For a lot of people that means thinking, ‘Am I going to stay in a potentially unsatisfying relationship for the rest of my life if the rest of my life is decades instead of years?’ ” said Jeffrey Stokes, associate professor at the Gerontology Institute at the University of Massachusetts Boston.

Today, overall divorce rates are falling. But the share of adults ages 65 and up who were divorced in 2022 was nearly triple the 1990 level, according to the Bowling Green analysis .

Lyn Silarski divorced in her early 50s after 16 years of marriage. A period of financial hardship followed, as she had to restart her career and deal with legal costs. She had to dip into her retirement savings and sell her house during a three-year spell of unemployment.

Today, Silarski is working as a graphic designer and living in a rented house in Manchester, N.H., enjoying the fact that she’s no longer responsible for the upkeep of the outdoors of the property. In her free time, she works out and goes hiking.

“I often say I wish I had a man to run around with, somebody who was a friend who wanted to do things, because I do have the girlfriends but they’re married and they’re busy,” said Silarski, 69.

Silarski, who has two sons and one grandchild, tried online dating, but found men her own age wanted to date younger women. Older men interested in a relationship with her were looking for someone to take care of them, she said.

“Perhaps someone might come along who would be an incredible fit,” Silarski said, “but I see that as kind of in the realm of miracles, really.”

Corrections & Amplifications undefined Research by Rosemary Hopcroft, a sociology professor emerita at the University of North Carolina at Charlotte, found that higher-income women are less likely to get remarried than other women. An earlier version of this article incorrectly implied the research also found they are less likely to get married. (Corrected on Aug. 24)

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A resurgence in high-end travel to Egypt is being driven by museum openings, private river journeys and renewed long-term investment along the Nile.

In the lead-up to the country’s biggest dog show, a third-generation handler prepares a gaggle of premier canines vying for the top prize.

Parts for iPhones to cost more owing to surging demand from AI companies.

Apple has dominated the electronics supply chain for years. No more.

Artificial-intelligence companies are writing huge checks for chips, memory, specialised glass fibre and more, and they have begun to out-duel Apple in the race to secure components.

Suppliers accustomed to catering to Apple’s every whim are gaining the leverage to demand that the iPhone maker pay more.

Apple’s normally generous profit margins will face pressure this year, analysts say, and consumers could eventually feel the hit.

Chief Executive Tim Cook mentioned the problem in a Thursday earnings call, saying Apple was seeing constraints in its chip supplies and that memory prices were increasing significantly.

Those comments appeared to weigh on Apple shares, which traded flat despite blowout iPhone sales and record company profit.

“Apple is getting squeezed for sure,” said Sravan Kundojjala, who analyses the industry for research firm SemiAnalysis.

AI chip leader Nvidia recently became the largest customer of Taiwan Semiconductor Manufacturing , or TSMC, Nvidia Chief Executive Jensen Huang said on a podcast.

Apple had been TSMC’s biggest customer by a wide margin for years. TSMC is the world’s leading manufacturer of advanced chips for AI servers, smartphones and other computing devices.

Spokesmen for Apple and TSMC declined to comment.

The big computers that handle AI tasks don’t look like the smartphones consumers own, but many companies supply components for both. In particular, memory chips are in short supply as companies such as OpenAI, Alphabet’s Google, Meta , Microsoft and others collectively spend hundreds of billions of dollars to build AI computing capacity.

“The rate of increase in the price of memory is unprecedented,” said Mike Howard , an analyst for research firm TechInsights.

That applies both to the flash memory chips that store photos and videos, called NAND, as well as the memory used to run apps quickly, called DRAM.

By the end of this year, the price of DRAM will quadruple from 2023 levels, and NAND will more than triple, estimates TechInsights.

Howard estimates that Apple could pay $57 more for the two types of memory that go into the base-model iPhone 18 due this fall compared with the base model iPhone 17 currently on sale. For a device that retails for $799, that would be a big hit to profit margins.

Apple’s purchasing power and expertise in designing advanced electronics long made it an unrivaled Goliath among the Asian companies that make most of the iPhone’s parts and assemble the device.

Apple spends billions of dollars a year on NAND, for instance, according to people familiar with the figures, likely making it the single biggest buyer globally. Suppliers flocked to win Apple’s business, hoping to leverage its know-how and prestige to attract other customers.

These days, however, “the companies now pushing the boundaries of human‑scale engineering are the ones like Nvidia,” said Ming-chi Kuo, an analyst with TF International Securities.

Demand for AI hardware is poised to keep growing rapidly. Apple’s spending growth is modest in comparison with what is being spent to fill up AI data centers, even though it is breaking records with huge sales of the iPhone 17.

Samsung Electronics and SK Hynix are raising the price of a type of DRAM chip for Apple, according to people familiar with Apple’s supply chain.

Big AI companies pay generously and are willing to lock in supply and make upfront payments, giving the South Korean chip makers leverage against the iPhone maker.

Apple signs long-term contracts for memory, but it has used its heft to squeeze suppliers.

Its contracts have empowered it to negotiate prices as often as weekly, and to even refuse to buy any memory from a supplier if Apple didn’t view the price as favorable, according to people familiar with its memory purchases.

To boost leverage with suppliers, Apple even began stocking more inventory of memory. That was atypical for Cook, who normally cuts inventory to the bone to maximize Apple’s cash flow.

Apple is fighting not only for current deliveries but also for the attention of engineers at suppliers.

Glass scientists who worked on developing the smoothest and lightest smartphone displays are now also spending time on specialised glass for packaging advanced AI processing chips, according to industry executives.

Makers of sensors and other gizmos inside the iPhone are winning new business from AI companies such as OpenAI that are developing their own hardware.

Still, suppliers said they were far from giving up on business with Apple. Working with Apple is a form of education, they said, because it remains one of the most demanding and disciplined customers in the industry.

TSMC, the Taiwanese chip manufacturer, has built successive generations of its most advanced chips with Apple as its lead customer, relying on the big predictable demand for iPhones.

Now that TSMC is doing more business with Nvidia and other AI companies, people with knowledge of the chip supply chain said Apple was exploring whether some lower-end processors could be made by someone other than TSMC.

One of Apple’s biggest profit-spinners is selling extra memory for far more than the memory chips cost the company.

Last fall Apple discontinued the iPhone Pro model with 128 gigabytes of storage.

Customers who want that model must now start at 256 gigabytes and pay $100 more—the type of move that could be repeated this year to help Apple offset higher costs, wrote Craig Moffett, an analyst at Moffett Nathanson, in an investor note.

However, Apple isn’t expected to raise the price of its next iPhone models over similarly equipped iPhone 17s, said Kuo, the analyst.

News Corp, owner of The Wall Street Journal, has a commercial agreement to supply news through Apple services.