A range of rare historical artefacts, including astronaut-signed spacecraft hardware from NASA’s Apollo and Space Shuttle programs, will go under the hammer next month in Los Angeles.

Consisting of more than 250 objects, the one-day sale on Feb. 1 at Julien’s Auctions spans a dizzying range of categories, from collectibles signed by the world’s most famous politicians, writers, aviators, and scientists, to war regalia and other military accessories.

From the actual parts of the NASA Space Shuttle program that were flown in space to uniforms and accessories used in combat in the Great War as well as a collection of letters from the brilliant minds of our times, this is one of Julien’s most exceptional history auctions to date,” Martin Nolan, executive director and co-founder of Julien’s Auctions, tells Penta.

Julien’s Auctions

The items span more than 300 years and include artefacts from the first mission to the moon.

“Many of these important museum-worthy objects represent the powerful achievements of the great innovators and trailblazers whose impact helped create the modern age,” Nolan said in a news release.

Lots from some of history’s most iconic space journeys include an original, space-flown rocket booster lid and orbiter wing insulator panels. Also up for grabs is a selection of photographs signed by Apollo 11 crew members Neil Armstrong, Buzz Aldrin, and Michael Collins.

Hobbyists with a focus on military history and conflict can choose from uniforms, accessories, newspapers, and everyday objects from bygone eras. Original World War I items such as a British Army steel combat helmet, a U.S. Marine Corps wool uniform, and a spiked German Pickelhaube helmet all carry presale estimates between US$300 and US$500.

Julien’s Auctions

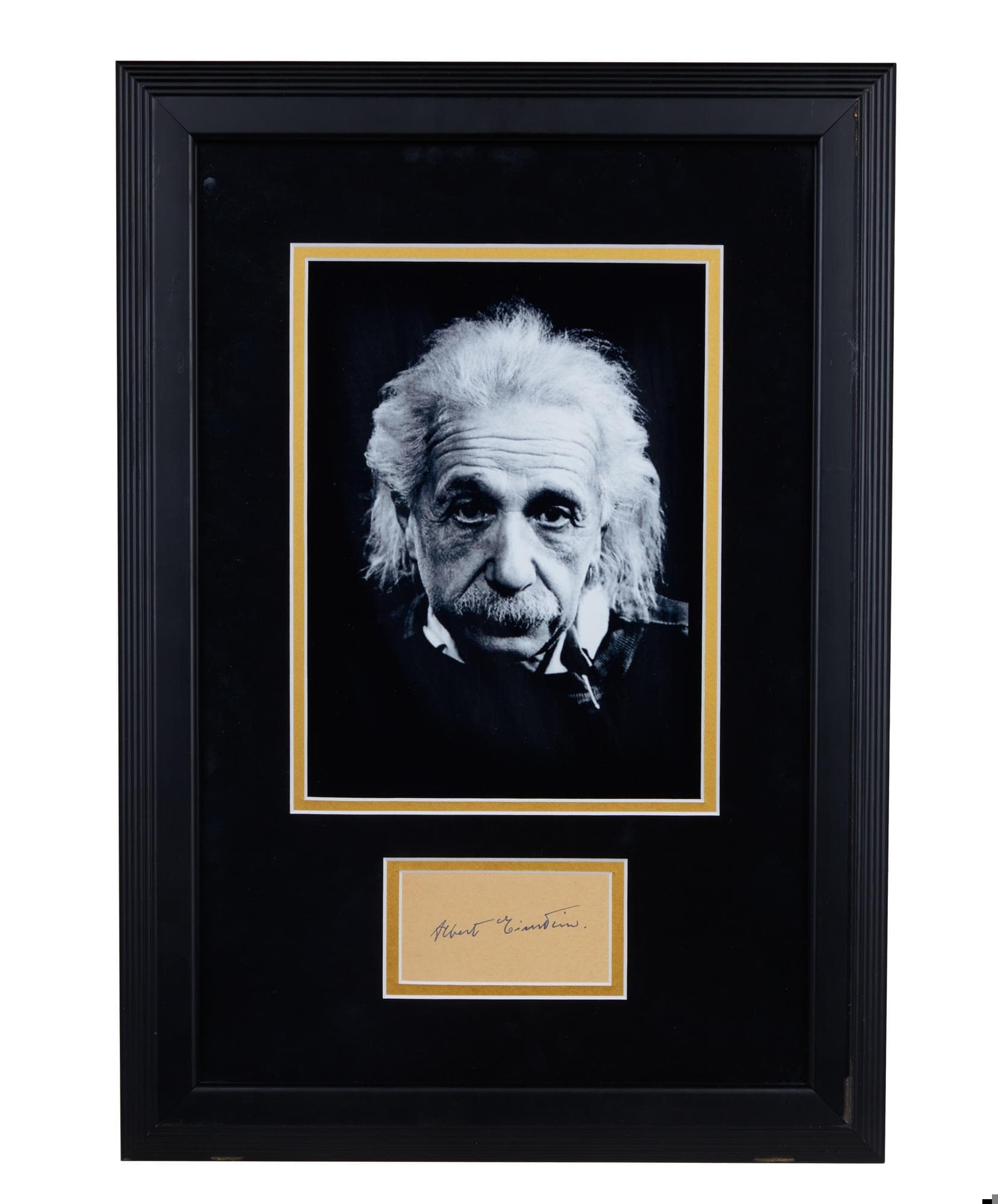

An assortment of literary greats, scientific pioneers, and influential politicians will be represented with signed notes and ephemera. Boldface names include Eleanor Roosevelt, the Dalai Lama, Carl Jung, Albert Einstein, and Dorothy Parker.

Among the more notable examples is a typed and signed Hunter S. Thompson letter dating from 1959, in which the notable author describes his short-lived attempt to earn money by driving a taxi cab and how his mother keeps asking him when he’s going to finish his book. Also available is a collection of eulogies and correspondence relating to the death of John F. Kennedy, featuring statements and appreciation cards from Richard Nixon, Nelson Rockefeller, and various members of the Kennedy family.

Other highlights include a Bell X-1 model rocket research plane signed by Chuck Yeager (presale estimate: US$600 to US$800), and a cloche hat from Amelia Earhart Fashions, the 1933 fashion line designed by the aviator to help fund her circumnavigation of the globe (estimate: US$2,000 to US$3,000).

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

Be familiar with how vendors develop, test and release their software

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

Re-evaluate how your firm accepts software updates from ‘trusted’ vendors

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

Develop a disaster recovery plan

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

Review vendor and insurance contracts

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

Weigh the advantages and disadvantages of the various platforms

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”