EV Home Charging: I Did the Math—and Saved Hundreds of Dollars

High-voltage outlets, smart chargers, money-saving utility programs: what to know about charging EVs at home

High-voltage outlets, smart chargers, money-saving utility programs: what to know about charging EVs at home

Things I miss about my local gas station:

…

That’s it. That’s the list. OK, fine, I did enjoy the communal squeegees.

This week marks six months since the grand opening of my home electric-vehicle charging station. Congrats to the whole team! (Me and my electrician.) Located between my garage door and recycling bin, it’s hard to beat for the convenience. And also the price.

If you’ve followed my ad-EV-ntures, you’re aware of my feelings about the hell that is public EV charging , at least before Tesla started sharing its Superchargers with its rivals. Truth is, I rarely go to those public spots. The vast majority of EV owners—83%—regularly charge at home, according to data-analytics company J.D. Power.

I already discovered many EV virtues , but I didn’t quite grasp the cost savings until I tallied up half a year of home-charging data. In that time, I spent roughly $125 on electricity to drive just under 2,500 miles. In my old car, that would have cost me more than twice as much—assuming gas held steady at around $3.25 a gallon . And I was charging through the winter, when electricity doesn’t stretch as far in an EV.

Rebates and programs from my state and utility company sweeten the deal. So I will be able to take advantage of discounted electricity, and offset the cost of my charger. The same may be available to you.

But first, there are technical things to figure out. A 240-volt plug? Kilowatt-hours? Peak and off-peak charging? While other people are in their garages founding world-altering tech companies or hit rock bands, I’m in there finding answers to your home-charging questions.

Sure, you can plug your car into a regular 120-volt wall outlet. (Some cars come with a cable.) And sure, you can also simultaneously watch all of Netflix while it charges. It would take more than two days to fill my Ford Mustang Mach-E’s 290-mile battery via standard plug, known as Level 1 charging.

That’s why you want Level 2, which can charge you up overnight. It requires two components:

• A 240-volt electric outlet. Good news: You might already have one of these higher-powered outlets in your house. Some laundry dryers and other appliances require them. Bad news: It might not be in your garage—assuming you even have a garage. I realise not everybody does.

Since my suburban New Jersey home has an attached garage, the install process wasn’t horrible—or at least that’s what my electrician said. He ran a wire from the breaker panel in the basement to the garage and installed a new box with a NEMA 14-50 outlet. People with older homes or detached garages might face trickier wiring issues—more of a “Finding NEMA” adventure. (I apologise to everyone for that joke.)

My installation cost about $1,000 but the pricing can vary widely.

• A smart charger. Choosing a wall charger for your car is not like choosing one for your phone. These mini computers help you control when to start and stop charging, calculate pricing and more.

“This is not something where you just go to Amazon and sort for lowest to highest price,” said Tom Moloughney, the biggest EV-charging nerd I know. On his website and “State of Charge” YouTube channel , Moloughney has reviewed over 100 home chargers. In addition to technical measurements, he does things like freezing the cords, to see if they can withstand wintry conditions.

“Imagine you are fighting with this frozen garden hose every time you want to charge,” he said.

One of his top picks, the ChargePoint Home Flex , was the same one my dad had bought. So I shelled out about $550 for it.

Just remember, if you want to make use of a charger’s advanced features—remote controls, charging updates, etc.—you’ll also need strong Wi-Fi in your garage.

I hear all you money-minded WSJ readers: That’s at least $1,600 after getting the car. How the heck is this saving money? I assumed I’d recoup the charging-equipment investment over time, but then I found ways to get cash back even sooner.

My utility provider, PSE&G, says it will cover up to $1,500 on eligible home-charger installation costs . I just need to submit some paperwork for the rebate. In addition, New Jersey offers a $250 rebate on eligible charger purchases. (Phew! My ChargePoint is on the list.) If all is approved, I’d get back around $1,250. Fingers crossed!

I didn’t know about these programs until I started reporting on this. Nearly half of home-charging EV owners say they, too, are unaware of the programs offered by their electric utility, according to a 2024 study released by J.D. Power . So yes, it’s good to check with your provider. Kelley Blue Book also offers a handy state-by-state breakdown.

Now I just plug in, right? Kinda. Even if you have a Level 2 charger, factors affect how many hours a fill-up will take, from the amperage in the wall to the current charge of your battery. Take Lionel Richie’s advice and plan on charging all night long .

It can also save you money to charge during off-peak hours.

Electricity costs are measured in kilowatt-hours. On my basic residential plan, PSE&G charges 18 cents per kWh—just 2 cents above the 2023 national average . My Mustang Mach-E’s 290-mile extended-range battery holds 91 kilowatt-hours.

Translation: A “full tank” costs $16. For most gas-powered cars, that wouldn’t cover half a tank.

And If I’m approved for PSE&G’s residential smart-charging plan, my off-peak charging (10 p.m. to 6 a.m. and weekends) will be discounted by up to 10.5 cents/kWh that I’ll get as a credit the following month. I can set specific charging times in the ChargePoint app.

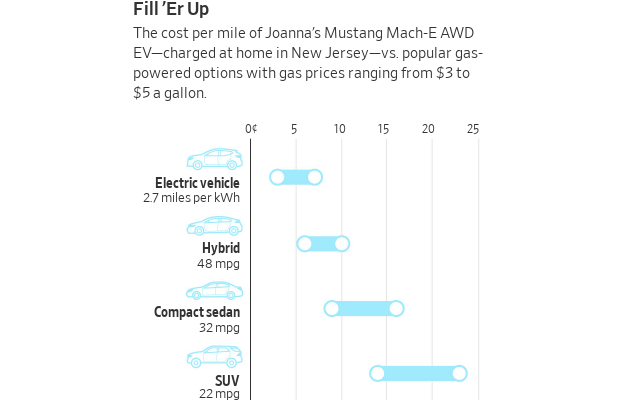

Electricity prices fluctuate state to state but every expert I spoke to said no matter where in the country you live, home charging should cost less than half what gas would for the same mileage. (See chart above for a cost comparison of electric versus gas.) And as I’ve previously explained , fast charging at public stations will cost much more.

One big question: Am I actually doing anything for the environment if I’m just taxing the grid? Eventually, I’d like to offset the grid dependence—and cost—by powering my fancy little station with solar panels. Then, I’ll just be missing the squeegee.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”