The largest auction of Princess Diana’s belongings in 27 years, including clothes and accessories, will be held this summer in Los Angeles.

Julien’s Auctions will hold a sale of Princess Diana’s most important garments and accessories, both in Los Angeles and online, on June 27.

The collection, titled “Princess Diana’s Elegance & a Royal Collection,” will be the largest to go to auction since the Princess of Wales sold 79 of her dresses at Christie’s in 1997, just two months before her death, according to a news release from Julien’s Auctions, which is holding the sale on June 27. The previous sale brought in US$3.25 million for charity.

“Julien’s is honored to present this historic auction that will celebrate Princess Diana’s iconic fashion style and her reign as the People’s Princess,” said Martin Nolan, co-founder and executive director of Julien’s Auctions, in a news release.

The Julien’s auction will include some of the princess’s most famous cocktail and evening dresses, suits, shoes, hats, and accessories.

Hong Kong Red Cross

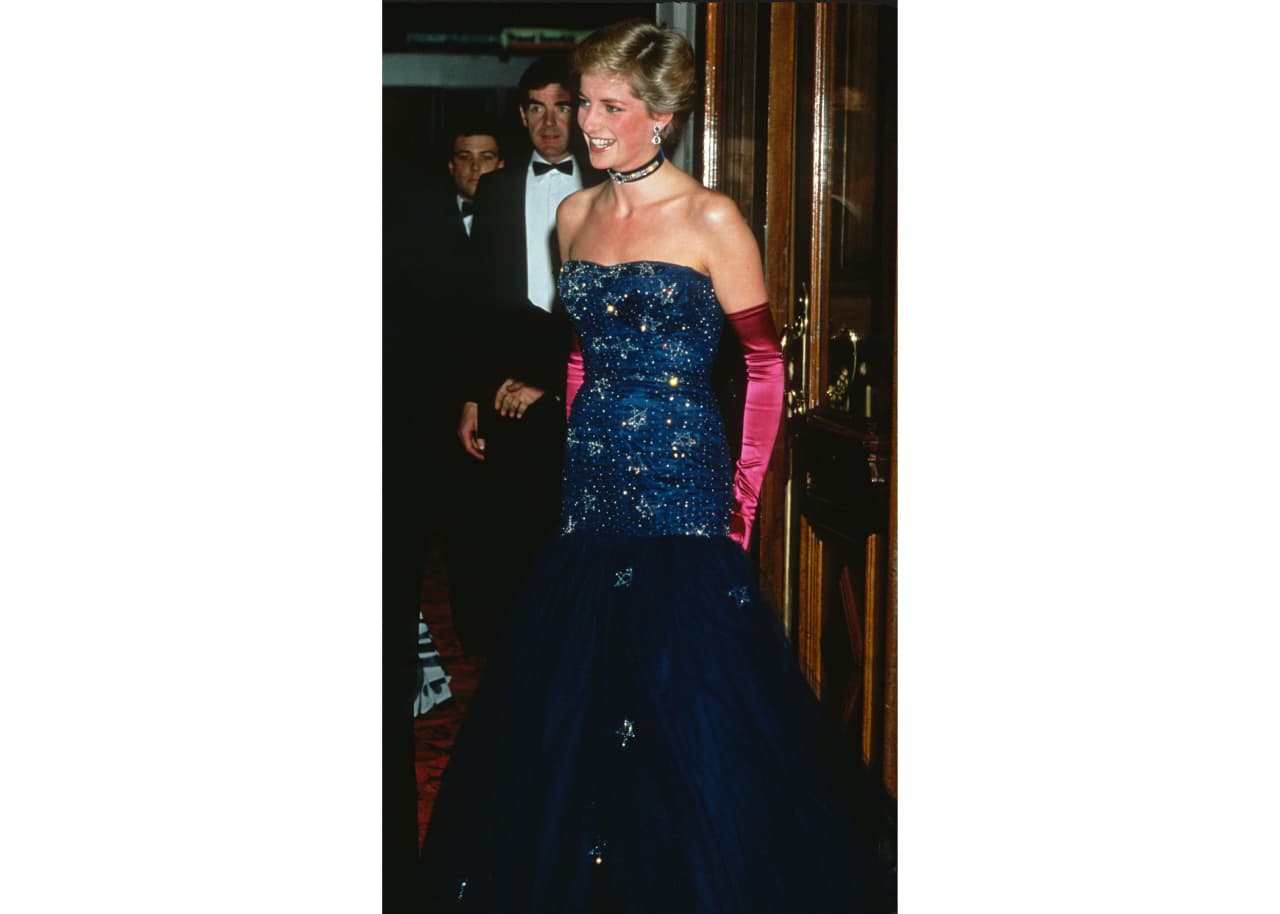

Among the highlights is a Murray Arbeid midnight blue strapless tulle diamante star gown that the princess wore twice in 1986, to the premiere of Phantom of the Opera and to a dinner at Claridge’s in London for King Constantine of Greece. The gown is estimated to sell for between US$200,000 and US$400,000.

Another highly anticipated piece is an off-the-shoulder magenta silk and lace evening dress, designed by Victor Edelstein, that’s also estimated between US$200,000 and US$400,000. Diana wore the dress in London and in Hamburg, Germany, in 1987. Edelstein also designed one of Diana’s most famous looks—the ink-blue velvet, mermaid-style gown she wore while dancing with John Travolta at the White House.

Other garments that will be offered in the auction include a pink floral shirtdress (estimate: US$100,000-US$200,000), a Victorian revival evening gown with a fitted bodice and a Basque waist (estimate: US$100,000-US$200,000) and a two-piece yellow and navy skirt suit (estimate: US$30,000-US$50,000), all designed by Catherine Walker, one of Princess Diana’s closest collaborators.

Julien’s Auctions

Many of Diana’s accessories, such as shoes, handbags, and hats, will also be sold. Some notable items include a pair of Kurt Geiger emerald green satin-jewelled vamp evening shoes (estimate: US$2,000-US$4,000) and a yellow and black felted wool turban-style hat, designed by Royal milliner Philip Somerville (estimate: US$10,000-US$20,000).

A portion of the auction proceeds will benefit Muscular Dystrophy U.K. Additionally, highlights of the collection will be on view at K11 MUSEA in Hong Kong from April 18-29 and at the Museum of Style Icons in Newbridge, Ireland, from June 11-27.

“We are also delighted to bring back many of Diana’s favourite fashion ensembles to Asia and Europe that she wore on some of her highly publicised international royal appearances and humanitarian efforts, such as her Catherine Walker suit from her 1989 visit to Hong Kong,” Nolan said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

CIOs can take steps now to reduce risks associated with today’s IT landscape

As tech leaders race to bring Windows systems back online after Friday’s software update by cybersecurity company CrowdStrike crashed around 8.5 million machines worldwide, experts share with CIO Journal their takeaways for preparing for the next major information technology outage.

Be familiar with how vendors develop, test and release their software

IT leaders should hold vendors deeply integrated within IT systems, such as CrowdStrike , to a “very high standard” of development, release quality and assurance, said Neil MacDonald , a Gartner vice president.

“Any security vendor has a responsibility to do extensive regression testing on all versions of Windows before an update is rolled out,” he said.

That involves asking existing vendors to explain how they write software, what testing they do and whether customers may choose how quickly to roll out an update.

“Incidents like this remind all of us in the CIO community of the importance of ensuring availability, reliability and security by prioritizing guardrails such as deployment and testing procedures and practices,” said Amy Farrow, chief information officer of IT automation and security company Infoblox.

Re-evaluate how your firm accepts software updates from ‘trusted’ vendors

While automatically accepting software updates has become the norm—and a recommended security practice—the CrowdStrike outage is a reminder to take a pause, some CIOs said.

“We still should be doing the full testing of packages and upgrades and new features,” said Paul Davis, a field chief information security officer at software development platform maker JFrog . undefined undefined Though it’s not feasible to test every update, especially for as many as hundreds of software vendors, Davis said he makes it a priority to test software patches according to their potential severity and size.

Automation, and maybe even artificial intelligence-based IT tools, can help.

“Humans are not very good at catching errors in thousands of lines of code,” said Jack Hidary, chief executive of AI and quantum company SandboxAQ. “We need AI trained to look for the interdependence of new software updates with the existing stack of software.”

Develop a disaster recovery plan

An incident rendering Windows computers unusable is similar to a natural disaster with systems knocked offline, said Gartner’s MacDonald. That’s why businesses should consider natural disaster recovery plans for maintaining the resiliency of their operations.

One way to do that is to set up a “clean room,” or an environment isolated from other systems, to use to bring critical systems back online, according to Chirag Mehta, a cybersecurity analyst at Constellation Research.

Businesses should also hold tabletop exercises to simulate risk scenarios, including IT outages and potential cyber threats, Mehta said.

Companies that back up data regularly were likely less impacted by the CrowdStrike outage, according to Victor Zyamzin, chief business officer of security company Qrator Labs. “Another suggestion for companies, and we’ve been saying that again and again for decades, is that you should have some backup procedure applied, running and regularly tested,” he said.

Review vendor and insurance contracts

For any vendor with a significant impact on company operations , MacDonald said companies can review their contracts and look for clauses indicating the vendors must provide reliable and stable software.

“That’s where you may have an advantage to say, if an update causes an outage, is there a clause in the contract that would cover that?” he said.

If it doesn’t, tech leaders can aim to negotiate a discount serving as a form of compensation at renewal time, MacDonald added.

The outage also highlights the importance of insurance in providing companies with bottom-line protection against cyber risks, said Peter Halprin, a partner with law firm Haynes Boone focused on cyber insurance.

This coverage can include protection against business income losses, such as those associated with an outage, whether caused by the insured company or a service provider, Halprin said.

Weigh the advantages and disadvantages of the various platforms

The CrowdStrike update affected only devices running Microsoft Windows-based systems , prompting fresh questions over whether enterprises should rely on Windows computers.

CrowdStrike runs on Windows devices through access to the kernel, the part of an operating system containing a computer’s core functions. That’s not the same for Apple ’s Mac operating system and Linux, which don’t allow the same level of access, said Mehta.

Some businesses have converted to Chromebooks , simple laptops developed by Alphabet -owned Google that run on the Chrome operating system . “Not all of them require deeper access to things,” Mehta said. “What are you doing on your laptop that actually requires Windows?”