MyTheresa Is E-Commerce for Luxury. The Stock Might Be the Cheapest Thing It Sells.

Mytheresa, based in Munich, went public in the U.S. in late January, raising about US$350 million for the company.

Mytheresa, based in Munich, went public in the U.S. in late January, raising about US$350 million for the company.

Bricks-and-mortar fashion boutiques have been in a tough spot during the pandemic. Small stores, after all, aren’t set up for social distance. Online retailer Mytheresa has been able to fill the void. The website caters to wealthy shoppers looking for help in finding their next designer handbag, pair of shoes, clothing item, or accessory.

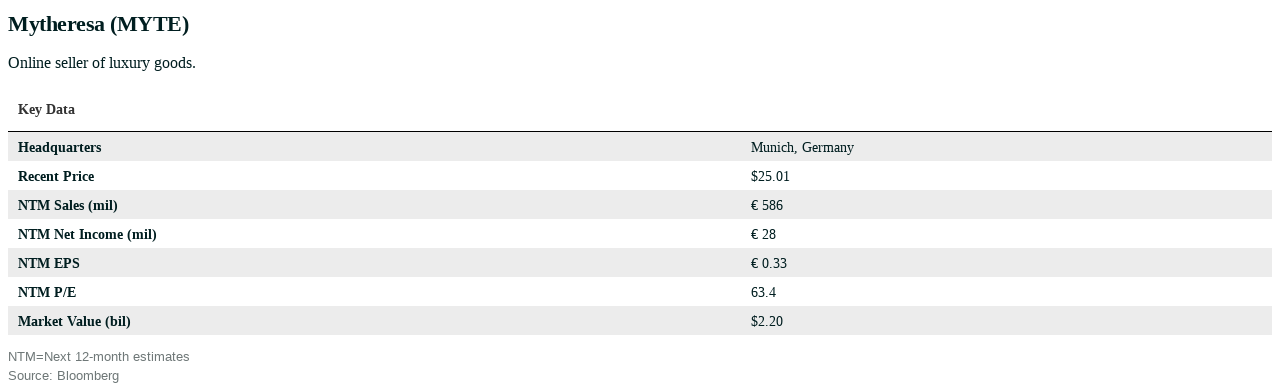

Mytheresa, based in Munich, went public in the U.S. in late January, raising about US$350 million for the company. The listing grew out of the bankruptcy of Neiman Marcus, which purchased Mytheresa in 2014. The small-cap has a market value of about $2.2 billion.

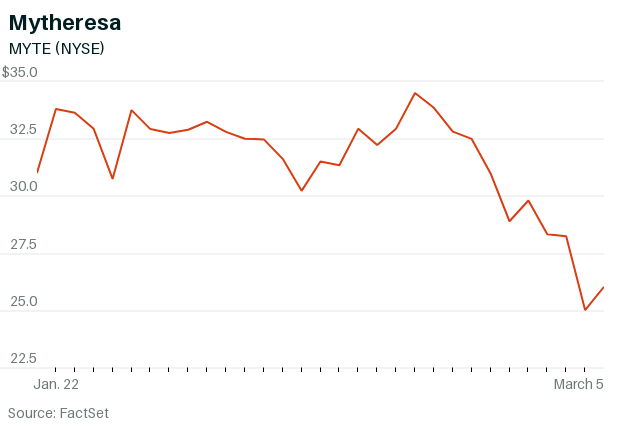

Mytheresa stock (ticker: MYTE)—technically an American depositary share of parent company MYT Netherlands Parent—was recently trading just below its $26 initial-public-offering price after having jumped to $36 shortly after the debut. The stock could recover those losses and more in the coming months.

“They are at the intersection of two higher-than-average growth trends in retail: luxury and e-commerce,” says J.P. Morgan analyst Matthew Boss.

Luxury buyers have been slower to adopt e-commerce. Before the Covid-19 pandemic, some 12% of global luxury sales happened online, compared with a 20% share of overall retail. The gap is closing. A recent study by consultancy Bain estimates that the share of luxury goods sold online could nearly triple to more than 30% by 2025.

Meanwhile, the overall luxury market is growing by about 7% annually.

The tailwinds put Mytheresa in an enviable position, and the company should get a further boost from its expansion in the U.S. and China, which are currently just 10% of sales each. (Europe was 60% in its latest fiscal year.) The company now has collections for men and kids, and it could expand into categories like jewellery and furniture in the future.

Mytheresa isn’t your typical money-losing tech start-up. The company, which reports in euros, earned €6.4 million ($9.9 million) in its latest fiscal year on €449 million in revenue.

Sales have grown an average of 22% over the past two fiscal years, while adjusted earnings before interest, taxes, depreciation, and amortization, or Ebitda, have grown at a 30% clip. For the fiscal year that ends in June, analysts are forecasting revenue growth of 25%, to €560 million. Analysts, who track adjusted earnings, expect the company to make €30.4 million this year, up about 60% from the adjusted figure last year.

“We are dealing with high-net-worth individuals who like to spend money—that’s a great customer base, and our core asset is this customer,” says Mytheresa CEO Michael Kliger.

The customer focus has helped the company earn a consistent profit, with a gross profit margin of about 45% and an adjusted Ebitda margin of about 8%. Other e-commerce players at Mytheresa’s early stage of growth have been years away from turning a profit.

If Amazon.com is the “Everything Store,” Mytheresa has taken the opposite approach. The site carries about 200 brands, fewer than luxury e-commerce rivals Farfetch (FTCH) or Richemont’s (CFRUY) Net-a-Porter. A recent search for “black dress” on Mytheresa’s U.S. site yielded just over 2,000 results, versus more than 7,000 at Farfetch.

Mytheresa’s most loyal shoppers get access to personal shoppers, styling and concierge services, and other perks like invitations to exclusive designer events and parties.

CEO Kliger says there’s a fine balance between presenting products in a way that’s helpful to shoppers and overwhelming them with an endless assortment. His company is focused on curation and more-abstract shopping desires, he tells Barron’s.

Customers looking for a specific Burberry coat, Chloé handbag, or pair of Gucci sneakers are better served buying directly from the designer.

Mytheresa’s website and app, now set up for spring and summer, are currently promoting multibrand compilations including “sandal season” and “talking-point pieces.”

The unique edit, to use the fashion-industry parlance, stands out to customers. Some 90% of Mytheresa customers surveyed by Cowen analyst Oliver Chen said they were likely to recommend the site to a friend, and 75% of them browse it weekly. Nearly 50% of Mytheresa’s customers spend at least $30,000 on luxury goods annually, the survey found.

Investors have been far more stingy when it comes to Mytheresa stock. The shares trade for 2.8 times this year’s estimated sales, versus 8.2 times for Farfetch and 4.5 times for The RealReal (REAL)—both of which are losing money.

Mytheresa could rally as investors reconsider that valuation gap. J.P. Morgan’s Boss has a price target of $38 on the stock, 50% above its recent close.

For now, Mytheresa stock is a luxury play at a bargain price. The sale is unlikely to last.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”