The World’s Biggest Crypto Firm Is Melting Down

‘Every battle is a do-or-die situation,’ Binance co-founder Yi He writes

‘Every battle is a do-or-die situation,’ Binance co-founder Yi He writes

After FTX crashed, the world of crypto seemed to belong to the largest exchange, Binance. Less than a year later, Binance is the one in distress.

Under threat of enforcement actions by U.S. agencies, Binance’s empire is quaking. Over the past three months, more than a dozen senior executives have left, and the exchange has laid off at least 1,500 employees this year to cut costs and prepare for a decline in business. And while Binance still looms large in crypto, its dominance is dwindling.

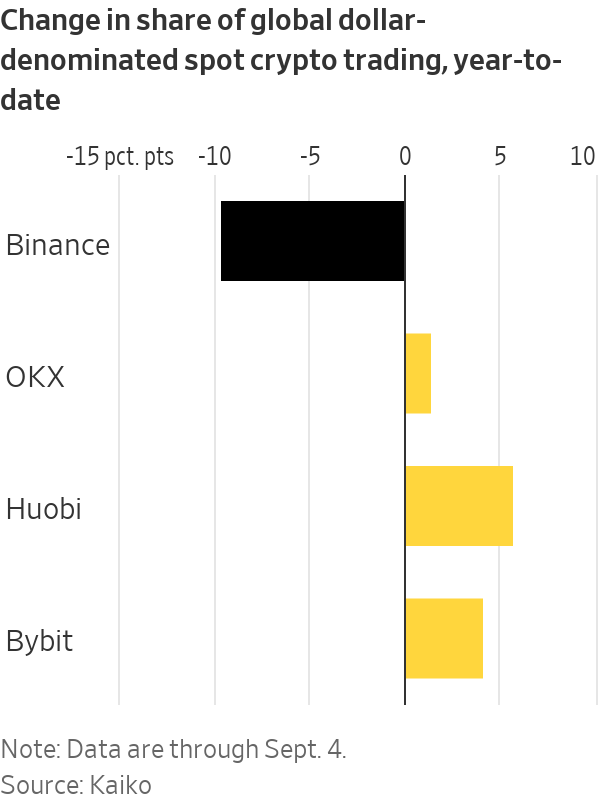

Binance now handles about half of all trades where cryptocurrencies are directly bought and sold, down from about 70% at the start of the year, according to data provider Kaiko.

What happens to Binance will have immense implications for the crypto industry because the exchange is so big. Industry players and watchers say other exchanges would fill the void if Binance were to collapse. But in the short term, liquidity in the market could evaporate, driving the price of tokens sharply down.

One institutional trader told The Wall Street Journal that his company has conducted fire drills to withdraw its assets from Binance quickly in the event of a meltdown.

Yi He, Binance’s co-founder and chief marketing officer, vowed to overcome the troubles in a message to Binance staff last month.

“Every battle is a do-or-die situation, and the only thing that can defeat us is ourselves,” she wrote in the message viewed by the Journal. “We have won countless times, and we need to win this time as well.”

Binance is a frequent investor in third-party crypto projects and beyond. Binance has invested in X, formerly known as Twitter. Binance co-founder Changpeng Zhao—or CZ as his 8.6 million X followers know him—is the biggest face of crypto.

“You just can’t quantify what would happen to the industry if Binance disappeared, given it has been responsible for fostering a huge amount of innovation and growth,” said Anthony Georgiades, a general partner at Innovating Capital, a fund that invests in early-growth companies.

The U.S. Justice Department has undergone a years long investigation that could result in criminal charges for Binance and Zhao as well as billions of dollars of fines, according to people familiar with the probe.

Binance also faces a Securities and Exchange Commission lawsuit that alleges it and Zhao operated illegally in the U.S. and misused customers’ funds. The firm has acknowledged past mistakes but says customer money is safe and it is committed to compliance.

“We have worked tirelessly not just to learn the lessons of the past, but also to continue to invest in the teams and systems that ensure user protection,” a spokesman said.

Binance launched in China in 2017, though it claims to be based nowhere, with staff scattered around the world. Its global website is accessible by traders almost everywhere, but that number is falling as its presence has been forbidden in many countries. In Europe, more countries are shutting their doors to the exchange.

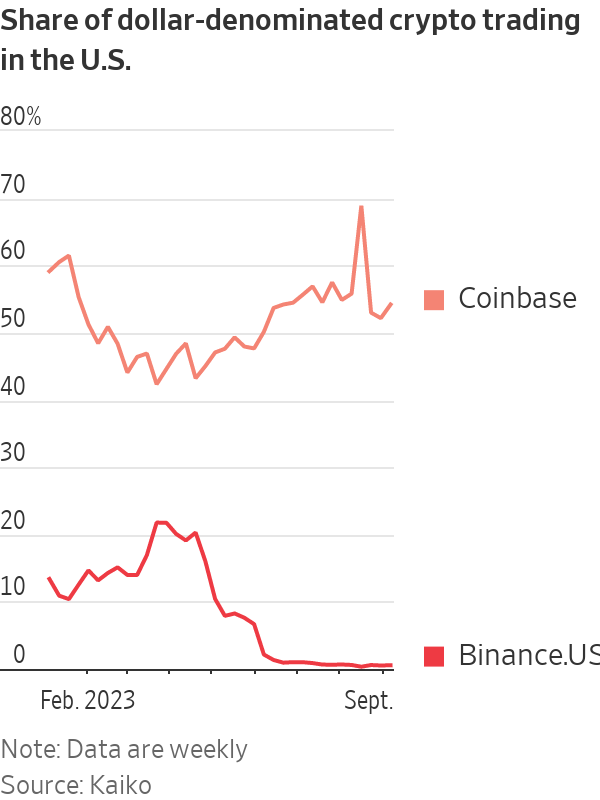

In the U.S., activity at its local exchange, Binance.US, has basically dissipated. Its chief executive officer, legal chief and risk head all left recently.

In a virtual Binance.US meeting days before his departure earlier this month, Binance.US CEO Brian Shroder said revenue at the exchange had fallen 70% year to date, according to a presentation viewed by the Journal. Executives looked on with dismay.

Shroder told employees Zhao would need to resolve “his regulatory matters, put his .US holdings in a blind trust, or sell his shares” in order for the U.S. platform to maintain its growth initiative. Those steps would allow the company to unblock banking relationships and get licenses, he said. Zhao is the majority owner of Binance.US and the global exchange.

A spokeswoman for Binance.US declined to comment.

Binance and the DOJ have been talking for months, according to people familiar with the discussions, and inside Binance, there have been discussions on whether Zhao should step down.

Zhao’s insistence in remaining at the helm of the company has frustrated some executives who believed him leaving would improve the chances of the company surviving, the Journal previously reported.

The company upheaval has also hurt employee morale.

Employees confronted Zhao in a summer meeting following layoffs, according to messages viewed by the Journal, in a rare showing of criticism.

“Some ppl laid off were given 0 days notice and/or found out they got laid off because they couldn’t login to the system anymore. How is that treating them respectfully? Is 2 weeks severance respectful?” one anonymous employee asked Zhao in the all-hands meeting chat. Nine others upvoted that. The question went unanswered.

A further stumbling block for Binance came in late August, when the Journal published an article on Binance customers’ use of sanctioned Russian banks. The DOJ has also been investigating Binance in connection with possible violations of U.S. sanctions on Russia, the Journal has reported.

Following the Journal story, the Justice Department questioned Binance about the banks’ usage, and Binance’s chief compliance officer, Noah Perlman, met with department officials to discuss their concerns, a person with direct knowledge of the matter said.

Pressure from the DOJ was partly responsible for Zhao’s decision to begin winding down Binance’s business in Russia, once one of its most important markets, the person said. Over the following two weeks, Binance barred customers from using the sanctioned banks and forced out the executives managing its Russia business. It said it was considering a full withdrawal from Russia.

Zhao publicly remained defiant. “We are one community,” he wrote on X on the day the Russia executives left. “Keep building!”

But behind closed doors, Zhao has been bringing new lawyers to handle the DOJ case, according to people familiar with the move. And Zhao has been staying put in his home in the United Arab Emirates, which doesn’t have a mutual extradition treaty with the U.S.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

As Paris makes its final preparations for the Olympic games, its residents are busy with their own—packing their suitcases, confirming their reservations, and getting out of town.

Worried about the hordes of crowds and overall chaos the Olympics could bring, Parisians are fleeing the city in droves and inundating resort cities around the country. Hotels and holiday rentals in some of France’s most popular vacation destinations—from the French Riviera in the south to the beaches of Normandy in the north—say they are expecting massive crowds this year in advance of the Olympics. The games will run from July 26-Aug. 1.

“It’s already a major holiday season for us, and beyond that, we have the Olympics,” says Stéphane Personeni, general manager of the Lily of the Valley hotel in Saint Tropez. “People began booking early this year.”

Personeni’s hotel typically has no issues filling its rooms each summer—by May of each year, the luxury hotel typically finds itself completely booked out for the months of July and August. But this year, the 53-room hotel began filling up for summer reservations in February.

“We told our regular guests that everything—hotels, apartments, villas—are going to be hard to find this summer,” Personeni says. His neighbours around Saint Tropez say they’re similarly booked up.

As of March, the online marketplace Gens de Confiance (“Trusted People”), saw a 50% increase in reservations from Parisians seeking vacation rentals outside the capital during the Olympics.

Already, August is a popular vacation time for the French. With a minimum of five weeks of vacation mandated by law, many decide to take the entire month off, renting out villas in beachside destinations for longer periods.

But beyond the typical August travel, the Olympics are having a real impact, says Bertille Marchal, a spokesperson for Gens de Confiance.

“We’ve seen nearly three times more reservations for the dates of the Olympics than the following two weeks,” Marchal says. “The increase is definitely linked to the Olympic Games.”

According to the site, the most sought-out vacation destinations are Morbihan and Loire-Atlantique, a seaside region in the northwest; le Var, a coastal area within the southeast of France along the Côte d’Azur; and the island of Corsica in the Mediterranean.

Meanwhile, the Olympics haven’t necessarily been a boon to foreign tourism in the country. Many tourists who might have otherwise come to France are avoiding it this year in favour of other European capitals. In Paris, demand for stays at high-end hotels has collapsed, with bookings down 50% in July compared to last year, according to UMIH Prestige, which represents hotels charging at least €800 ($865) a night for rooms.

Earlier this year, high-end restaurants and concierges said the Olympics might even be an opportunity to score a hard-get-seat at the city’s fine dining.

In the Occitanie region in southwest France, the overall number of reservations this summer hasn’t changed much from last year, says Vincent Gare, president of the regional tourism committee there.

“But looking further at the numbers, we do see an increase in the clientele coming from the Paris region,” Gare told Le Figaro, noting that the increase in reservations has fallen directly on the dates of the Olympic games.

Michel Barré, a retiree living in Paris’s Le Marais neighbourhood, is one of those opting for the beach rather than the opening ceremony. In January, he booked a stay in Normandy for two weeks.

“Even though it’s a major European capital, Paris is still a small city—it’s a massive effort to host all of these events,” Barré says. “The Olympics are going to be a mess.”

More than anything, he just wants some calm after an event-filled summer in Paris, which just before the Olympics experienced the drama of a snap election called by Macron.

“It’s been a hectic summer here,” he says.

Parisians—Barré included—feel that the city, by over-catering to its tourists, is driving out many residents.

Parts of the Seine—usually one of the most popular summertime hangout spots —have been closed off for weeks as the city installs bleachers and Olympics signage. In certain neighbourhoods, residents will need to scan a QR code with police to access their own apartments. And from the Olympics to Sept. 8, Paris is nearly doubling the price of transit tickets from €2.15 to €4 per ride.

The city’s clear willingness to capitalise on its tourists has motivated some residents to do the same. In March, the number of active Airbnb listings in Paris reached an all-time high as hosts rushed to list their apartments. Listings grew 40% from the same time last year, according to the company.

With their regular clients taking off, Parisian restaurants and merchants are complaining that business is down.

“Are there any Parisians left in Paris?” Alaine Fontaine, president of the restaurant industry association, told the radio station Franceinfo on Sunday. “For the last three weeks, there haven’t been any here.”

Still, for all the talk of those leaving, there are plenty who have decided to stick around.

Jay Swanson, an American expat and YouTuber, can’t imagine leaving during the Olympics—he secured his tickets to see ping pong and volleyball last year. He’s also less concerned about the crowds and road closures than others, having just put together a series of videos explaining how to navigate Paris during the games.

“It’s been 100 years since the Games came to Paris; when else will we get a chance to host the world like this?” Swanson says. “So many Parisians are leaving and tourism is down, so not only will it be quiet but the only people left will be here for a party.”