How Skiing Can Survive Climate Change

From artificial clouds to autonomous snow-grooming vehicles, here are 12 ways for ski areas to weather warmer temperatures and less snow.

From artificial clouds to autonomous snow-grooming vehicles, here are 12 ways for ski areas to weather warmer temperatures and less snow.

Downhill skiing could become an increasingly exotic proposition in a warming world. By midcentury, the U.S. could see 90 fewer days below freezing each year, according to a 2016 study published in the Journal of Climate and based on data from the federally funded North American Regional Climate Change Assessment Program. Nearly all ski areas in the U.S. are projected to have at least a 50% shorter season by 2050, according to a 2017 study funded by the Environmental Protection Agency and published in the Global Environmental Change journal.

Higher temperatures make snow more elusive on the slopes, cutting into revenues for ski areas. Low snow years between 1999 and 2010 already cost ski areas an estimated $1 billion in revenue, according to a 2012 analysis commissioned by the nonprofits Protect Our Winters and the Natural Resources Defense Council.

Today, ski areas run snow guns 24/7 as soon as cold weather hits and send GPS-guided snowcat vehicles to the slopes to distribute snowpack. Snow-making technologies are making rapid advances and could alleviate some of the burden of weather volatility. Winter skiing could also be less of a focus as resorts become year-round destinations and offer more activities. Climate change presents ski areas with an opportunity to reduce their own carbon footprint by switching to cleaner energy sources.

From autonomous snowcats to solar-powered properties, take a look at what ski resorts might look like in the coming years.

Modifying clouds to boost mountain snowpack, or cloud seeding, has been done over Colorado’s ski areas for decades, but was scientifically proven effective only last year. It involves using generators to spray silver iodide into a frigid cloud to turn water droplets into snow, and it can increase snowfalls by up to 15%, says Neil Brackin, the CEO of Colorado-based Advanced Radar Co., a firm that sells weather radar systems. Tomorrow’s generators may be more accurate and deliver more advanced seeding materials into the sky, Mr Brackin says. Cloud-seeding programs could cost ski areas $100,000 to $1 million annually, he says.

Neuschnee GmbH, an Austrian startup, has invested more than $2.2 million to develop a balloon-shaped chamber that artificially recreates a snow-making cloud. Ice particles injected into a wooden-framed structure propped on steel rods and wrapped in nylon membranes bind to water droplets to make up to 1,000 cubic feet of snowflakes a day, enough to fill a midsize truck. Founder Michael Bacher says ski resorts could use the technology to give runs a natural feel and imagines a future where operators deploy fleets of autonomous artificial clouds. The company is looking for new partnerships to continue development.

Developing downhill mountain biking as a seasonal complement to winter sports could let the industry maximize the summer season and diversify revenue streams, says Rob McSkimming, a mountain resort development consultant at Select Contracts, a Canada-based tourism consulting firm. Ski areas could invest more in lift infrastructure like bike carriers and repurpose snow making systems into irrigation systems that water biking trails. “Good dirt is like good snow,” Mr McSkimming says.

Mr Snow, a German startup, sells a carpetlike faux ski hill that rolls out like a mat and has an arrangement of loops on the surface that reproduces gliding sensations, says Jens Reindl, one of the company’s founders. Mr Reindl says the product is beginner-friendly and could become popular in low-altitude ski resorts near urban centres. The mat, which is available for sale in the U.S., comes in modular 65-by-6.5-foot patches and costs $120 for every 10 square feet.

In the future, it may take skiers more twists and turns to reach the bottom of the slope as ski operators seek to have more people use the same patches of snow, says Joe Hession, the majority owner of Mountain Creek Resort in New Jersey. Moving snow blocks to create more jumps, rails, gradual hills and big turns could allow resorts to focus their snow-making capacity on selected segments and do more with less terrain, he says.

Today, snowcat operators drive vehicles equipped with sensors, GPS receivers and tablets to visualize snow depth and distribute fresh snowpack. Mr. Hession sees a day when driverless snowcats wirelessly feed terrain data to automated snow guns that pump out snow on shallow spots more accurately. The ski industry might need to hire more highly skilled and higher paid employees to manage these remote systems, he says.

Temperature increases mean ski resorts will have shrinking windows of cold weather to produce artificial snow, says Brian Fairbank, chairman of the Fairbank Group, which operates three ski resorts in the Northeastern U.S. More efficient, cheaper snow guns that pump out more snow could help make up for this change. One recent innovation is the “Sledgehammer,” a $3,150 snow gun developed by Fairbank that it says converts twice as much water into snow per hour as traditional machines and performs better at higher temperatures for about half the price.

Ski resorts could increasingly turn to green infrastructure like solar panels and wind turbines with the goal to operate 100% on renewable power and diminish their own carbon footprints. Wolf Creek Ski Area in Colorado purchases most of its electricity from green sources year-round, including a 25-acre off-site solar farm. Mountain Creek Resort relies on goats to mow the grass on the slopes in the summer rather than use fuel-intensive machinery. More operators are expected to adopt renewable energy in the future, says Adrienne Saia Isaac, the director of marketing and communications at the National Ski Areas Association, an industry group. “We as an industry can’t simply rely on pivoting to summer business as a climate change solution,” she says.

The Italian startup Nevexn has developed Snow4Ever Thermal, a container-size chiller that freezes water to make up to 1,700 cubic feet of snow a day, almost enough to cover a tennis court with a foot of snow, at above-freezing temperatures. The machine uses solar thermal energy and energy from burning biomass such as wood pellets. The company developed the system with a $2.1 million grant from the European Union and tested it in the Italian Dolomites last year, says Francesco Besana, a co-founder. It plans to commercialize it in the coming years.

Ziplines, climbing walls, water attractions and mountain roller coasters could be increasingly offered year-round as resorts endeavour to be less reliant on winter sports. This shift could come with a new focus on immersive educational experiences like night walks and light shows that introduce visitors to a mountain’s geological history, says Mr McSkimming of Select Contracts.

Indoor ski areas could make up for seasonal variations and provide access to new markets in urban areas, says Dr Natalie Ooi, the director of tourism enterprise programs at Colorado State University. Big Snow American Dream, the country’s first indoor ski area, opened in New Jersey in 2019 and could provide a blueprint for future investments. It boasts a 4-acre skiable area that operates at minus two degrees celsius and has a 48-metre vertical drop, four lifts and snow guns.

Customers could get much better deals by pre-buying season passes to access more resorts, including internationally, as the industry moves to insulate revenues from weather variations, says David Perry, an executive vice president at Alterra Mountain Co., the ski-resort giant. He anticipates passes will represent 60-70% of Alterra’s ticket sales in the coming years, up from 40-50% today. Resorts could also start selling megapasses valid both in summer and winter, says Auden Schendler, a senior vice president in charge of sustainability at Aspen Skiing Co.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

Report by the San Francisco Fed shows small increase in premiums for properties further away from the sites of recent fires

Wildfires in California have grown more frequent and more catastrophic in recent years, and that’s beginning to reflect in home values, according to a report by the San Francisco Fed released Monday.

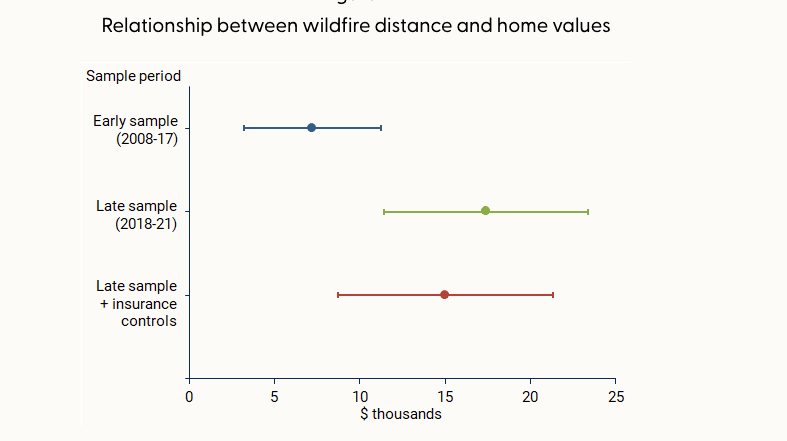

The effect on home values has grown over time, and does not appear to be offset by access to insurance. However, “being farther from past fires is associated with a boost in home value of about 2% for homes of average value,” the report said.

In the decade between 2010 and 2020, wildfires lashed 715,000 acres per year on average in California, 81% more than the 1990s. At the same time, the fires destroyed more than 10 times as many structures, with over 4,000 per year damaged by fire in the 2010s, compared with 355 in the 1990s, according to data from the United States Department of Agriculture cited by the report.

That was due in part to a number of particularly large and destructive fires in 2017 and 2018, such as the Camp and Tubbs fires, as well the number of homes built in areas vulnerable to wildfires, per the USDA account.

The Camp fire in 2018 was the most damaging in California by a wide margin, destroying over 18,000 structures, though it wasn’t even in the top 20 of the state’s largest fires by acreage. The Mendocino Complex fire earlier that same year was the largest ever at the time, in terms of area, but has since been eclipsed by even larger fires in 2020 and 2021.

As the threat of wildfires becomes more prevalent, the downward effect on home values has increased. The study compared how wildfires impacted home values before and after 2017, and found that in the latter period studied—from 2018 and 2021—homes farther from a recent wildfire earned a premium of roughly $15,000 to $20,000 over similar homes, about $10,000 more than prior to 2017.

The effect was especially pronounced in the mountainous areas around Los Angeles and the Sierra Nevada mountains, since they were closer to where wildfires burned, per the report.

The study also checked whether insurance was enough to offset the hit to values, but found its effect negligible. That was true for both public and private insurance options, even though private options provide broader coverage than the state’s FAIR Plan, which acts as an insurer of last resort and provides coverage for the structure only, not its contents or other types of damages covered by typical homeowners insurance.

“While having insurance can help mitigate some of the costs associated with fire episodes, our results suggest that insurance does little to improve the adverse effects on property values,” the report said.

While wildfires affect homes across the spectrum of values, many luxury homes in California tend to be located in areas particularly vulnerable to the threat of fire.

“From my experience, the high-end homes tend to be up in the hills,” said Ari Weintrub, a real estate agent with Sotheby’s in Los Angeles. “It’s up and removed from down below.”

That puts them in exposed, vegetated areas where brush or forest fires are a hazard, he said.

While the effect of wildfire risk on home values is minimal for now, it could grow over time, the report warns. “This pattern may become stronger in years to come if residential construction continues to expand into areas with higher fire risk and if trends in wildfire severity continue.”