The 24-year-old actor James Dean died in a car accident, colliding with a college student at a California intersection on the evening of Sept. 30, 1955. The car he was driving was a Porsche, but not an ordinary 356. It was a very streamlined 550 Spyder, nicknamed “Little Bastard” by the race-crazy Dean.

The 550 Spyder was an out-and-out racer, but the kind that owners could register and drive to and from the track in those days. The open-topped Porsche was made for only three years, from 1953 to 1956, and although they were very successful in competition, only 90 were produced. The mid-mounted “Carrera” engine in the 550 had four overhead camshafts and dual ignition. With twin Solex carburetors, it produced 110 horsepower. That wasn’t a lot, but the 550 Spyder was a very light car, just 590 kilograms (1,300 pounds).

An example of the 550 Spyder, from 1955 with colourful racing history, is one of the cars that will be sold by RM Sotheby’s in an auction by Lake Tegernsee, about 40 minutes south of Munich, on July 27. Also on the block is a pair of modern Bugattis, a rare Mercedes-Benz SLR McLaren Stirling Moss, and a 2006 Porsche Carrera GT. The auction is taking place in partnership with the new Concours of Elegance Germany in Bavaria, held July 22-27.

RM Sotheby’s

This Porsche 550 Spyder, with coachwork by Wendler (which also had its hand in the 718 sport racing cars), was delivered to Portugal and competed in European racing circuits. Originally white with burgundy accents, the car was first owned by Fernando Mascarenhas, who achieved class podium positions in races at Barajas and Monsanto in 1955. The 550 then went to Germany that summer for the Nürburgring 500 Kilometers, but the race was cut short because of an accident.

The second owner was Cypriano Flores in 1958. Flores’ son eventually returned the car to Porsche, which did the mechanical work while Wendler restored the body.

Despite the racing, which often results in swapped engines and other components, the 550 still boasts its original chassis, four-cam Carrera motor, and gearbox. The car was restored by Porsche and its original coachbuilder, Wendler, in the early 1990s—and not driven since then. During the restoration, the car’s colour was changed to silver, and the interior from beige vinyl to black leather. The pre-auction estimate is €3.5 million to €4.2 million (US$3.78 million to US$4.54 million).

Also to be auctioned at Tegernsee is the aforementioned 2010 Mercedes SLR McLaren Stirling Moss, a virtually unused example with just 45 kilometres on the odometer. First shown in 2009, it was a tribute to the late racing driver’s win in a 300 SLR Mercedes at the 1955 Mille Miglia.

The auction SLR features a lightweight carbon-fibre structure and a supercharged, 5.4-litre V8 with 641 horsepower. A mere 75 Stirling Moss cars were built, and only offered to customers who already owned an SLR McLaren. Without a roof or windshield, the Moss edition was 200 kilograms lighter than the standard car. It could reach 62 miles per hour in 3.5 seconds. The pre-sale estimate is €3.2 million to €3.8 million.

The modern Bugattis include a 2019 Chiron Sport “110 Ans Bugatti” edition, one of 20. The odometer reads only 1,461 kilometres. It’s estimated at €3.3 million to €3.8 million. The other one is the 2010 Veyron 16.4 Grand Sport “Soleil de Nuit,” a one-off Veyron in two-tone black/blue metallic sold new to the royal family of Kuwait. The estimate is €1.5 million to €2 million.

The 2006 Porsche Carrera GT, one of just 1,270 of these race-derived high-performance cars, is also a low-mileage example in silver metallic with 35,698 kilometres showing. It’s powered by a 5.7-litre V10 engine and could reach 62 miles per hour in 3.57 seconds and had a top speed of 205 mph. This one was supplied to Porsche in Leipzig, and a succession of owners barely used it. In 2001, the Porsche benefitted from a major €27,000 service that included a clutch replacement. It’s estimated at €975,000 to €1.275 million.

Porsche collectors might also want to visit the Bonhams|Cars Quail auction during Monterey Car Week starting Aug. 16. The lots include a one-of-62 1971 Porsche 911 S/T (estimated between US$900,000 and US$1.2 million); and a 1993 959 “Komfort” model, one of six, estimated at US$1.5 million to US$2 million.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

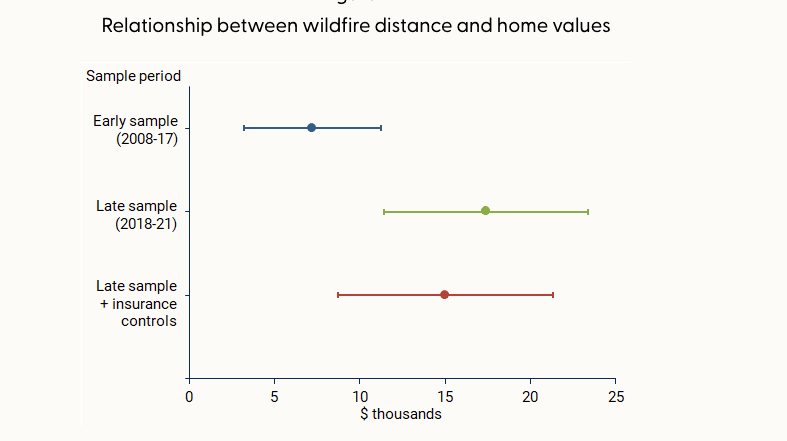

Report by the San Francisco Fed shows small increase in premiums for properties further away from the sites of recent fires

Wildfires in California have grown more frequent and more catastrophic in recent years, and that’s beginning to reflect in home values, according to a report by the San Francisco Fed released Monday.

The effect on home values has grown over time, and does not appear to be offset by access to insurance. However, “being farther from past fires is associated with a boost in home value of about 2% for homes of average value,” the report said.

In the decade between 2010 and 2020, wildfires lashed 715,000 acres per year on average in California, 81% more than the 1990s. At the same time, the fires destroyed more than 10 times as many structures, with over 4,000 per year damaged by fire in the 2010s, compared with 355 in the 1990s, according to data from the United States Department of Agriculture cited by the report.

That was due in part to a number of particularly large and destructive fires in 2017 and 2018, such as the Camp and Tubbs fires, as well the number of homes built in areas vulnerable to wildfires, per the USDA account.

The Camp fire in 2018 was the most damaging in California by a wide margin, destroying over 18,000 structures, though it wasn’t even in the top 20 of the state’s largest fires by acreage. The Mendocino Complex fire earlier that same year was the largest ever at the time, in terms of area, but has since been eclipsed by even larger fires in 2020 and 2021.

As the threat of wildfires becomes more prevalent, the downward effect on home values has increased. The study compared how wildfires impacted home values before and after 2017, and found that in the latter period studied—from 2018 and 2021—homes farther from a recent wildfire earned a premium of roughly $15,000 to $20,000 over similar homes, about $10,000 more than prior to 2017.

The effect was especially pronounced in the mountainous areas around Los Angeles and the Sierra Nevada mountains, since they were closer to where wildfires burned, per the report.

The study also checked whether insurance was enough to offset the hit to values, but found its effect negligible. That was true for both public and private insurance options, even though private options provide broader coverage than the state’s FAIR Plan, which acts as an insurer of last resort and provides coverage for the structure only, not its contents or other types of damages covered by typical homeowners insurance.

“While having insurance can help mitigate some of the costs associated with fire episodes, our results suggest that insurance does little to improve the adverse effects on property values,” the report said.

While wildfires affect homes across the spectrum of values, many luxury homes in California tend to be located in areas particularly vulnerable to the threat of fire.

“From my experience, the high-end homes tend to be up in the hills,” said Ari Weintrub, a real estate agent with Sotheby’s in Los Angeles. “It’s up and removed from down below.”

That puts them in exposed, vegetated areas where brush or forest fires are a hazard, he said.

While the effect of wildfire risk on home values is minimal for now, it could grow over time, the report warns. “This pattern may become stronger in years to come if residential construction continues to expand into areas with higher fire risk and if trends in wildfire severity continue.”