With its 1997 launch as a name-your-own-price site, Priceline helped usher in the era of online travel booking―and the growth of a trillion-dollar category. Priceline itself has mushroomed into a global business with 1,500 full-time employees; along with global airline bookings, the site claims to offer 1.2 million accommodations in 116 countries.

Now, the Connecticut-based company is focusing on generative AI, and CEO Brett Keller is behind the leap. It’s just the latest technology push from Keller, a 25-year veteran of the company who has also served as CMO and COO. Under Keller, Priceline launched the travel industry’s first full-service mobile app in 2009; he also helped conceive the hugely popular William Shatner-fronted “Negotiator” ad campaign.

Keller, 56, talked to Penta about how AI is changing travel planning, what luxury travellers do to save money, and why Japan blows his mind.

Penta: Much of Priceline’s marketing is about value. Do you see luxury travellers in your customer mix along with budget-conscious travellers?

Brett Keller: High-net-worth consumers take a significantly higher number of trips than the average leisure traveller. For a high-end vacation like a safari in Tanzania, they’ll work with experts. But for the other 30 trips they book that year, either for themselves or family members, they don’t always reach for the stars. They want to manage money effectively. And as they’re moving around the country and the world, they need a fast, easy way to book travel that accommodates their needs. Priceline is a great platform for that kind of trip. And if you’re taking a quick weekend trip to Miami, and want to stay in the Four Seasons, we’ve negotiated with them. Even high-net-worth individuals seek value.

Priceline made headlines last year for partnering with both Google and OpenAI on Penny, your AI assistant. How has Penny evolved?

She’s gone from, “I can answer questions about the hotel you’re looking at” to actually servicing the customer through more complicated scenarios. If you need to cancel a hotel that’s fully refundable, you can do it with one click. But if there are issues, like a reservation that’s not fully cancelable, Penny can walk through those steps for you.

Penny’s also helping people find, search, and book properties. For example, if the customer tells her, “I’m looking for a great resort with these features, anywhere warm”—she’ll present recommended properties that meet those requirements. You can continue with Penny on the site, or go with the traditional experience.

Has there been any pushback from consumers about Penny and generative AI?

There has been none. Customers still have access to phone agents. Anyway, the younger generation doesn’t want to talk to anyone. And with traditional chat agents, live agents, or even messaging apps, there’s typically a delay. Penny answers immediately and in real time.

What’s the future of generative AI and online travel booking?

The future is a highly personalised shopping experience. It’s hard to achieve, because we don’t know about the consumer when they come in. But generative AI lets us dramatically improve personalisation. As you work with Penny, and tell us your preferences, the way you interact lets us find and book the best products and services every time you return. The ability to customise and personalise increases exponentially.

Is the travel experience even more bifurcated between elite, ultra-high-net-worth travellers and everyone else?

Consumers seem to be a little less sensitive in some areas. On planes, first-class and comfort-plus seats are the first to go, most of the time, and people are burning through points to sit in the front because they’re tired of not having legroom. But seats are packed in economy, too, so people are flying.

Hotel bookings are more economically driven in the U.S. Higher-income people are not as affected by interest rates or the cost of living, so they spend more freely than economy-minded consumers. There is a bit of bifurcation there. The low end is not filling, but the high end is.

It’s been reported Europe’s going to get even more crowded this summer. Does Priceline ever suggest alternatives to over-touristed or overpriced destinations?

We’re not in the business of telling you where you shouldn’t travel. We market popular destinations because that’s where people want to go. As much as we could tell people, “Las Vegas is overcrowded, don’t go,” people will want to go.

Social media is highlighting some overpopulated destinations and suggesting alternatives, so that comes back to us. But price is the No. 1 motivator. Vegas is a great value. There are so many hotel rooms available that you can go in a non-peak period and get a room in a four-star hotel for US$120. Try doing that in New York City.

What destinations are going to pop over the next year or two?

Asia will continue to be exciting and interesting to people. Bangkok is a great place to move in, then travel throughout Southeast Asia. As the region gets more popular, people will keep trying to find more remote and more unique destinations. People love Europe, but it was the hot spot in 2022 and ’23. Some travellers are saying, “I’ve had enough, and I’m moving on.” Japan is also amazing, for so many reasons. It’s easy to navigate. English is not a challenge. It’s safe. It feels like a different world, but completely first-world. The strength of the dollar is also driving some of that―again, price plays a role.

Beyond that, Mexico and the Caribbean took a real hit in 2022 and ’23 after a boom in 2021. They’re coming back now. A lot of people don’t want to travel far—“I just want to go to a beach and not think of anything.” And because not everyone wants to travel overseas, unique and relaxing cities like Nashville, Tennessee; Houston; and Austin, Texas, will be popular, especially into the fall.

Every day brings more headlines about airline woes. Who gets blamed if a Priceline customer has a bad flying experience, you or the airline?

When you have a bad experience traveling, you want to blame everybody. No matter what happened, the online travel agency takes blame and the airline takes the blame. It could be your seat, the person sitting next to you, whatever. We get the complaint, and we take on that responsibility and that role. We have leverage because of the amount of business we drive to partners. They want to work with us to make sure the customer has the best experience. Something goes wrong almost every time you take a trip. That’s just the reality.

What are your favourite places to travel?

My favourite destination, and a place where I spend a lot of time every summer, is [resort town] McCall, Idaho, one of the most beautiful towns in the West, with hiking, trails, and mountain biking. Outside of the country, it’s Japan, absolutely. Tokyo is the most exciting city in the world. It’s mind-blowing.

This interview has been edited for length and clarity.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

Report by the San Francisco Fed shows small increase in premiums for properties further away from the sites of recent fires

Wildfires in California have grown more frequent and more catastrophic in recent years, and that’s beginning to reflect in home values, according to a report by the San Francisco Fed released Monday.

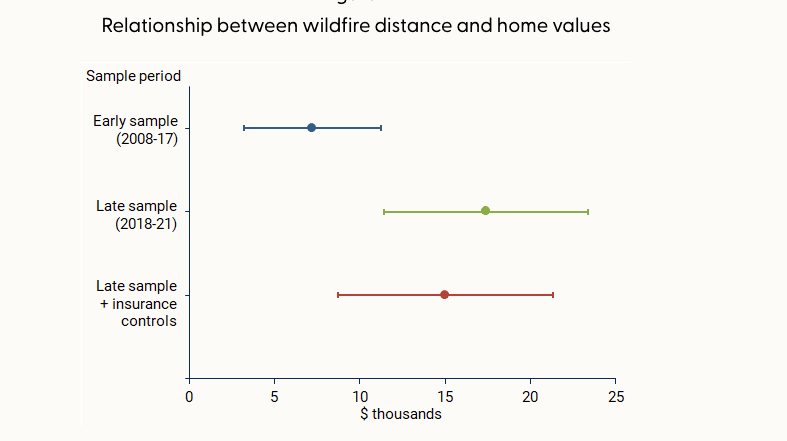

The effect on home values has grown over time, and does not appear to be offset by access to insurance. However, “being farther from past fires is associated with a boost in home value of about 2% for homes of average value,” the report said.

In the decade between 2010 and 2020, wildfires lashed 715,000 acres per year on average in California, 81% more than the 1990s. At the same time, the fires destroyed more than 10 times as many structures, with over 4,000 per year damaged by fire in the 2010s, compared with 355 in the 1990s, according to data from the United States Department of Agriculture cited by the report.

That was due in part to a number of particularly large and destructive fires in 2017 and 2018, such as the Camp and Tubbs fires, as well the number of homes built in areas vulnerable to wildfires, per the USDA account.

The Camp fire in 2018 was the most damaging in California by a wide margin, destroying over 18,000 structures, though it wasn’t even in the top 20 of the state’s largest fires by acreage. The Mendocino Complex fire earlier that same year was the largest ever at the time, in terms of area, but has since been eclipsed by even larger fires in 2020 and 2021.

As the threat of wildfires becomes more prevalent, the downward effect on home values has increased. The study compared how wildfires impacted home values before and after 2017, and found that in the latter period studied—from 2018 and 2021—homes farther from a recent wildfire earned a premium of roughly $15,000 to $20,000 over similar homes, about $10,000 more than prior to 2017.

The effect was especially pronounced in the mountainous areas around Los Angeles and the Sierra Nevada mountains, since they were closer to where wildfires burned, per the report.

The study also checked whether insurance was enough to offset the hit to values, but found its effect negligible. That was true for both public and private insurance options, even though private options provide broader coverage than the state’s FAIR Plan, which acts as an insurer of last resort and provides coverage for the structure only, not its contents or other types of damages covered by typical homeowners insurance.

“While having insurance can help mitigate some of the costs associated with fire episodes, our results suggest that insurance does little to improve the adverse effects on property values,” the report said.

While wildfires affect homes across the spectrum of values, many luxury homes in California tend to be located in areas particularly vulnerable to the threat of fire.

“From my experience, the high-end homes tend to be up in the hills,” said Ari Weintrub, a real estate agent with Sotheby’s in Los Angeles. “It’s up and removed from down below.”

That puts them in exposed, vegetated areas where brush or forest fires are a hazard, he said.

While the effect of wildfire risk on home values is minimal for now, it could grow over time, the report warns. “This pattern may become stronger in years to come if residential construction continues to expand into areas with higher fire risk and if trends in wildfire severity continue.”