Big Tech Is Downsizing Workspace in Another Blow to Office Real Estate

Pullback marks a sharp reversal after years when companies had been bolstering their office footprints

Pullback marks a sharp reversal after years when companies had been bolstering their office footprints

Big technology companies are cutting back on office space across major coastal cities, leaving some exposed landlords with empty buildings and steep losses.

The pullback marks a sharp reversal after years when companies such as Amazon.com , Meta Platforms ’ Facebook and Google parent Alphabet had been bolstering their office footprints by adding millions of square feet of space.

Their expansion continued even after the pandemic erupted and many employees started working remotely. Tech companies have been the dominant tenant in West Coast cities like Seattle and San Francisco, and by 2021 these companies came to rival those in the finance industry as Manhattan’s biggest user of office space .

Now, big tech companies are letting leases expire or looking to unload some offices. Amazon is ditching or not renewing some office leases and last year paused construction on its second headquarters in northern Virginia. Google has listed office space in Silicon Valley for sublease, according to data company CoStar . Meta has also dumped some office space and is leasing less than it did early on in the pandemic.

Salesforce , the cloud-based software company, said in a recent securities filing that it leased or owned about 900,000 square feet of San Francisco office space as of January. That is barely half the 1.6 million of office space it reported having in that city a year earlier.

Tech giants looking to unload part of their workplace face a lot of competition. Office space listed for sublease in 30 cities with a lot of technology tenants has risen to the highest levels in at least a decade, according to brokerage CBRE . The 168.4 million square feet of office space for sublease in the first quarter was down slightly from the fourth-quarter 2023 peak but up almost threefold from early 2019.

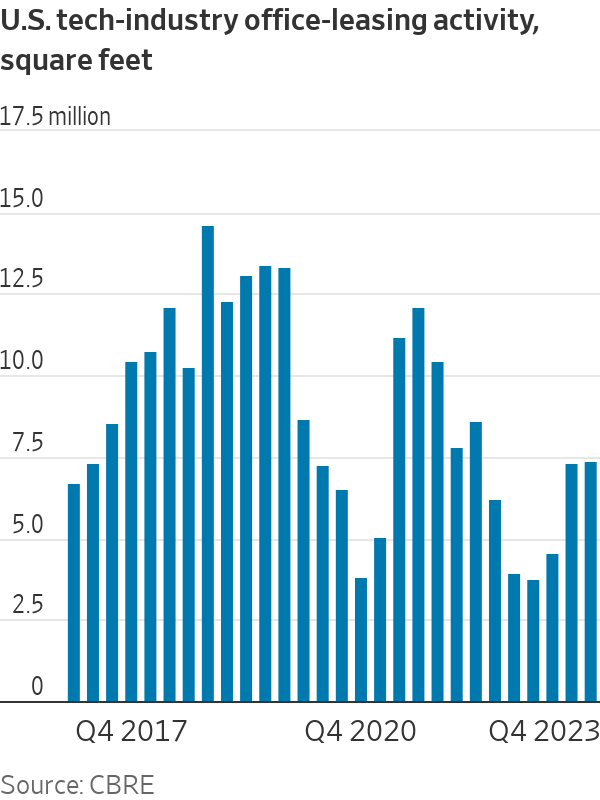

Even tech companies that are renewing or adding space want less than they did before. The amount of new office space tech companies leased fell by almost half in the fourth quarter of last year compared with 2019, CBRE said.

Tech’s voracious appetite for office and other commercial real estate had been an economic boon for cities. The new workspace usually brought an influx of well-paid employees, boosted cities’ property-tax revenue and translated into more business for local retailers and shop owners.

Now, the waning appetite is a blow to cities at a time when it is difficult to find other big tenants. For landlords already grappling with higher interest rates and a drop in demand from financial companies, law firms and other tenants, tech’s reversal is especially painful.

In some cases, tech’s softening demand can lead to plunging real-estate values. Take 1800 Ninth Avenue, a 15-story office building in Seattle. Amazon’s rent payments helped almost triple the building’s value in the decade after the 2008-09 financial crisis.

In 2013, Amazon moved into about two-thirds of the building. At the end of that year, the building sold for $150 million—almost double the $77 million it had sold for just two years earlier.

Its price kept climbing as strong demand from tech companies and low interest rates drew big investment firms into the Seattle commercial-real-estate market. In 2019, J.P. Morgan Asset Management bought the building for $206 million.

Amazon’s lease expires this year, and the company is moving out. The building is listed for sale. It is expected to sell for about a quarter of its 2019 price, according to estimates by real-estate people familiar with the property.

“We’re constantly evaluating our real-estate portfolio based on the dynamic and diverse needs of Amazon’s businesses by looking at trends in how employees are using our offices,” an Amazon spokeswoman said in a statement.

When the pandemic upended the U.S. office market, large tech companies were initially a bright spot. They continued adding space, betting they would eventually need it as they hired more people and as employees gradually returned to the office.

“Big tech was pretty resilient,” said Brooks Hauf , a senior director at brokerage Avison Young.

That changed in 2022. Remote work continued to be popular, and some big tech companies laid off workers , meaning they needed less space than they had thought, said Colin Yasukochi , an executive director at CBRE’s Tech Insights Center.

Leasing by tech companies fell by about half between the third quarter of 2021 and the third quarter of 2022, according to CBRE.

Since then, companies tied to the booming artificial-intelligence business have leased more space in San Francisco and other cities. But that hasn’t been enough to meaningfully boost the office market. San Francisco’s office-vacancy rate hit a record 36.7% in the first quarter, according to CBRE, up from just 3.6% in early 2019.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

Owned by Richard Outten, who’s penned screenplays for films including “Pet Sematary Two” and “Lionheart,” this is only the third time the home has been on the market

A Mid-Century Modern home in Carmel, California, hit the market on Friday for just the third time in 70 years with a listing price of $4.25 million.

Located in the community of Carmel Highlands, the house is just steps from the coastline and comes with private beach access, according to the listing with Tim Allen of Coldwell Banker Realty in Northern California. Allen was not immediately available for comment.

The property last changed hands in 2010 when Hollywood screenwriter Richard Outten bought it for $990,000, public records show. Outten penned the screenplays for the 1992 movie “Pet Sematary Two” and the 1987 film “Lionheart,” and created the story for the 2012 “Journey to the Center of the Earth” sequel, “Journey 2: The Mysterious Island.” He was not immediately available for comment.

Built in 1953, the home’s mid-century charm has been preserved over the years while still being updated for modern living. Interior details include wood paneling, exposed-brick walls and beamed ceilings.

The single-level house has 1,785 square feet, which includes three bedrooms and two full bathrooms. Though not directly on the water, large windows flanking the adobe-brick, wood-burning fireplace look out at the ocean.

Sliding glass doors create a seamless flow between indoor and outdoor living. Outside, there’s a large patio surrounded by lush landscaping, and there are also meandering paths through sustainable succulent gardens, according to the listing.

In addition to its close proximity to the beach, the home is a 10-minute walk from downtown Carmel-by-the-Sea.

As of July, the median list price in Carmel is $3.1 million, up 8% from last year, even as active listings have increased 50% year over year, according to data from Realtor.com.