Over the last decade, investment in London property had one of the best returns, only beat by Bitcoin and gold, according to a report from Foxtons on Tuesday.

The average price of a London home in December 2013 was £352,028 (US$444,777)—today, the average home is worth £508,037, according to the Land Registry’s December 2023 price data. That’s a 44.3% increase over the last 10 years.

“The London market is undoubtedly the pinnacle when it comes to U.K. property investment and while the last year may have been a challenging one, the value of a London home has still climbed considerably over the last decade,” Foxtons CEO Guy Gittins said in the report.

Gittins added that the capital city’s real estate market has seemingly “turned a corner,” with home sales beginning the year on a promising note.

Foxtons analysed nine other kinds of investments, including wheat, crude oil, natural gas and the FTSE 100 Index, and only two had higher returns than London property over the last decade. No other real estate markets were included in this analysis.

Bitcoin’s value increased the most, up a whopping 4,963% from 2013, according to the report. Gold was the second-best investment of the last decade, with a 66.8% increase in value.

Following London property, the value of silver increased 22.9%, the FTSE 100 Index saw a return of 15.7% and corn’s value increased by 7.9%, according to the report.

The rest of the investment options Foxtons analysed saw a decline in value: wheat fell by 2.5%, WTI Crude Oil by 26.3%, Brent Crude Oil by 30.2% and natural gas by 41.5%.

“The investment landscape is constantly changing, and while some traditional vehicles have seen a sharp decline in value over the last decade, such as natural gas, other emerging markets such as cryptocurrency have experienced a boom period, albeit with a heightened degree of volatility,” Gittins said. “However, it’s fair to say that bricks and mortar has remained one of the most consistent investments one can make down the years and the long-term returns speak for themselves.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

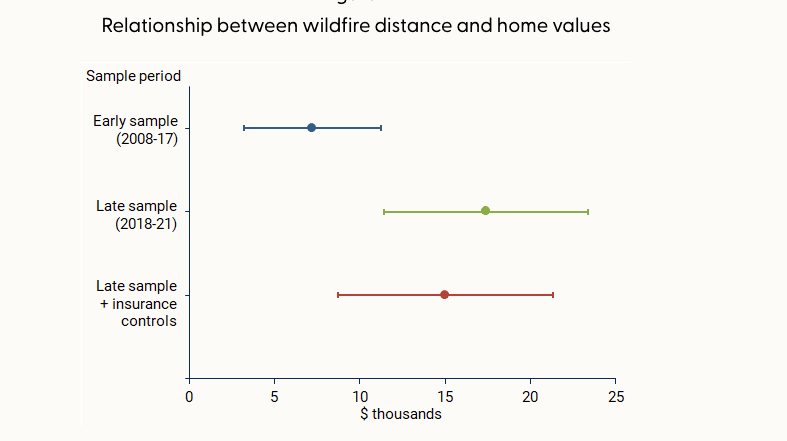

Report by the San Francisco Fed shows small increase in premiums for properties further away from the sites of recent fires

Wildfires in California have grown more frequent and more catastrophic in recent years, and that’s beginning to reflect in home values, according to a report by the San Francisco Fed released Monday.

The effect on home values has grown over time, and does not appear to be offset by access to insurance. However, “being farther from past fires is associated with a boost in home value of about 2% for homes of average value,” the report said.

In the decade between 2010 and 2020, wildfires lashed 715,000 acres per year on average in California, 81% more than the 1990s. At the same time, the fires destroyed more than 10 times as many structures, with over 4,000 per year damaged by fire in the 2010s, compared with 355 in the 1990s, according to data from the United States Department of Agriculture cited by the report.

That was due in part to a number of particularly large and destructive fires in 2017 and 2018, such as the Camp and Tubbs fires, as well the number of homes built in areas vulnerable to wildfires, per the USDA account.

The Camp fire in 2018 was the most damaging in California by a wide margin, destroying over 18,000 structures, though it wasn’t even in the top 20 of the state’s largest fires by acreage. The Mendocino Complex fire earlier that same year was the largest ever at the time, in terms of area, but has since been eclipsed by even larger fires in 2020 and 2021.

As the threat of wildfires becomes more prevalent, the downward effect on home values has increased. The study compared how wildfires impacted home values before and after 2017, and found that in the latter period studied—from 2018 and 2021—homes farther from a recent wildfire earned a premium of roughly $15,000 to $20,000 over similar homes, about $10,000 more than prior to 2017.

The effect was especially pronounced in the mountainous areas around Los Angeles and the Sierra Nevada mountains, since they were closer to where wildfires burned, per the report.

The study also checked whether insurance was enough to offset the hit to values, but found its effect negligible. That was true for both public and private insurance options, even though private options provide broader coverage than the state’s FAIR Plan, which acts as an insurer of last resort and provides coverage for the structure only, not its contents or other types of damages covered by typical homeowners insurance.

“While having insurance can help mitigate some of the costs associated with fire episodes, our results suggest that insurance does little to improve the adverse effects on property values,” the report said.

While wildfires affect homes across the spectrum of values, many luxury homes in California tend to be located in areas particularly vulnerable to the threat of fire.

“From my experience, the high-end homes tend to be up in the hills,” said Ari Weintrub, a real estate agent with Sotheby’s in Los Angeles. “It’s up and removed from down below.”

That puts them in exposed, vegetated areas where brush or forest fires are a hazard, he said.

While the effect of wildfire risk on home values is minimal for now, it could grow over time, the report warns. “This pattern may become stronger in years to come if residential construction continues to expand into areas with higher fire risk and if trends in wildfire severity continue.”