Louis Vuitton, Dior Power LVMH’s Sales

Big fashion brands bolster results, while Champagne revenue falls amid pandemic.

Big fashion brands bolster results, while Champagne revenue falls amid pandemic.

PARIS—LVMH Moët Hennessy Louis Vuitton SE said surging revenue at its biggest fashion brands, Louis Vuitton and Dior, propped up the luxury-goods company’s results during the fourth quarter, offsetting other businesses such as Champagne that have fizzled during the pandemic.

The Paris-based conglomerate on Tuesday said revenue in the quarter fell 3% to €14.3 billion ($22.4 billion). Sales at its fashion and leather-goods division—where Louis Vuitton and Dior account for most of the revenue—rose 18%. Revenue for all of 2020 fell 17% to €44.7 billion. Net profit for the entire year was down 34% at €4.7 billion.

The results show how some of the marquee brands of luxury fashion have gained market share during the pandemic. Louis Vuitton, the world’s top-selling luxury brand, Dior and Hermès have posted strong sales growth since boutiques were allowed to reopen after lockdowns in March and April. Smaller brands—both inside and outside LVMH—have lagged behind.

Drawn by the performance of Dior and Louis Vuitton, investors have sent LVMH’s shares to near record highs, brushing aside concerns about the future of the luxury business during and after the pandemic. The company’s market capitalization is now €260 billion, solidifying the place of Bernard Arnault, LVMH’s chief executive and controlling shareholder, among the ranks of the world’s wealthiest people.

Jean Jacques Guiony, LVMH’s chief financial officer, said Louis Vuitton and Dior had a strong pipeline of new products that they continued to roll out despite the lockdowns. The brands also maintained fashion shows in reduced formats and continued digital-marketing efforts when others were forced to pull back drastically. Dior, for example, held a closed-door fashion show for its cruise collection in Lecce, Italy, in July, while rival brands pushed the unveiling of new collections until later in the year.

“We did it when nobody else was talking,” Mr Guiony said. “It was really Dior and Vuitton taking the bulk of the customers’ attention.”

Mr. Guiony said that Fendi and Celine—two of LVMH’s midsize fashion brands—also gathered momentum toward the end of the year. Marc Jacobs managed to turn a profit in 2020 for the first time in years, Mr Guiony said, though that came after a wave of layoffs at the American brand.

LVMH’s performance also benefited from strong consumption of Hennessy, the world’s top-selling cognac brand. Sales in the U.S. surged, LVMH said, bolstered by large government stimulus payments to consumers. Global cognac volumes were down only 4% for the year and rebounded in the second half, the company said.

That helped offset the poor performance of LVMH’s Champagne division, which includes brands such as Veuve Clicquot and Dom Pérignon. With weddings and birthday parties cancelled because of social-distancing rules, consumers had little reason to sip a glass of bubbly, pushing down Champagne sales by 19% for the year.

LVMH just completed its purchase of the American jeweller Tiffany & Co. at the start of this year, after the pandemic nearly cancelled the $15.8 billion deal. Mr Arnault pulled the plug on the merger in September before deciding to see it through after Tiffany agreed to a small discount.

The acquisition could be riding a tailwind: Jewellery sales in the final months of last year were one of the bright spots in the global luxury business, Mr Guiony said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

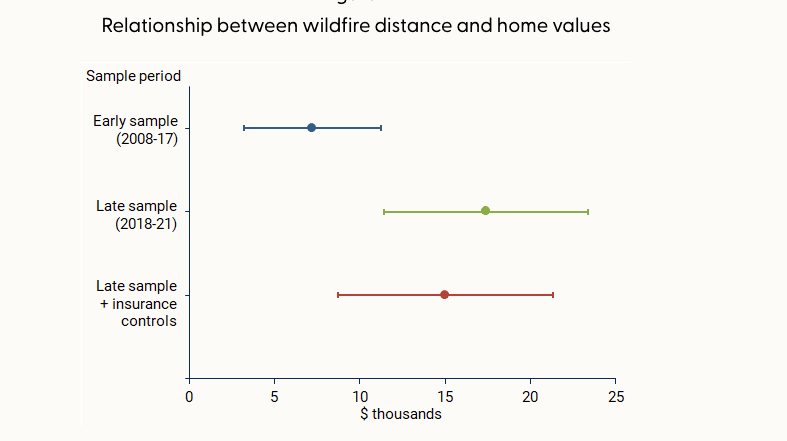

Report by the San Francisco Fed shows small increase in premiums for properties further away from the sites of recent fires

Wildfires in California have grown more frequent and more catastrophic in recent years, and that’s beginning to reflect in home values, according to a report by the San Francisco Fed released Monday.

The effect on home values has grown over time, and does not appear to be offset by access to insurance. However, “being farther from past fires is associated with a boost in home value of about 2% for homes of average value,” the report said.

In the decade between 2010 and 2020, wildfires lashed 715,000 acres per year on average in California, 81% more than the 1990s. At the same time, the fires destroyed more than 10 times as many structures, with over 4,000 per year damaged by fire in the 2010s, compared with 355 in the 1990s, according to data from the United States Department of Agriculture cited by the report.

That was due in part to a number of particularly large and destructive fires in 2017 and 2018, such as the Camp and Tubbs fires, as well the number of homes built in areas vulnerable to wildfires, per the USDA account.

The Camp fire in 2018 was the most damaging in California by a wide margin, destroying over 18,000 structures, though it wasn’t even in the top 20 of the state’s largest fires by acreage. The Mendocino Complex fire earlier that same year was the largest ever at the time, in terms of area, but has since been eclipsed by even larger fires in 2020 and 2021.

As the threat of wildfires becomes more prevalent, the downward effect on home values has increased. The study compared how wildfires impacted home values before and after 2017, and found that in the latter period studied—from 2018 and 2021—homes farther from a recent wildfire earned a premium of roughly $15,000 to $20,000 over similar homes, about $10,000 more than prior to 2017.

The effect was especially pronounced in the mountainous areas around Los Angeles and the Sierra Nevada mountains, since they were closer to where wildfires burned, per the report.

The study also checked whether insurance was enough to offset the hit to values, but found its effect negligible. That was true for both public and private insurance options, even though private options provide broader coverage than the state’s FAIR Plan, which acts as an insurer of last resort and provides coverage for the structure only, not its contents or other types of damages covered by typical homeowners insurance.

“While having insurance can help mitigate some of the costs associated with fire episodes, our results suggest that insurance does little to improve the adverse effects on property values,” the report said.

While wildfires affect homes across the spectrum of values, many luxury homes in California tend to be located in areas particularly vulnerable to the threat of fire.

“From my experience, the high-end homes tend to be up in the hills,” said Ari Weintrub, a real estate agent with Sotheby’s in Los Angeles. “It’s up and removed from down below.”

That puts them in exposed, vegetated areas where brush or forest fires are a hazard, he said.

While the effect of wildfire risk on home values is minimal for now, it could grow over time, the report warns. “This pattern may become stronger in years to come if residential construction continues to expand into areas with higher fire risk and if trends in wildfire severity continue.”