MyTheresa Is E-Commerce for Luxury. The Stock Might Be the Cheapest Thing It Sells.

Mytheresa, based in Munich, went public in the U.S. in late January, raising about US$350 million for the company.

Mytheresa, based in Munich, went public in the U.S. in late January, raising about US$350 million for the company.

Bricks-and-mortar fashion boutiques have been in a tough spot during the pandemic. Small stores, after all, aren’t set up for social distance. Online retailer Mytheresa has been able to fill the void. The website caters to wealthy shoppers looking for help in finding their next designer handbag, pair of shoes, clothing item, or accessory.

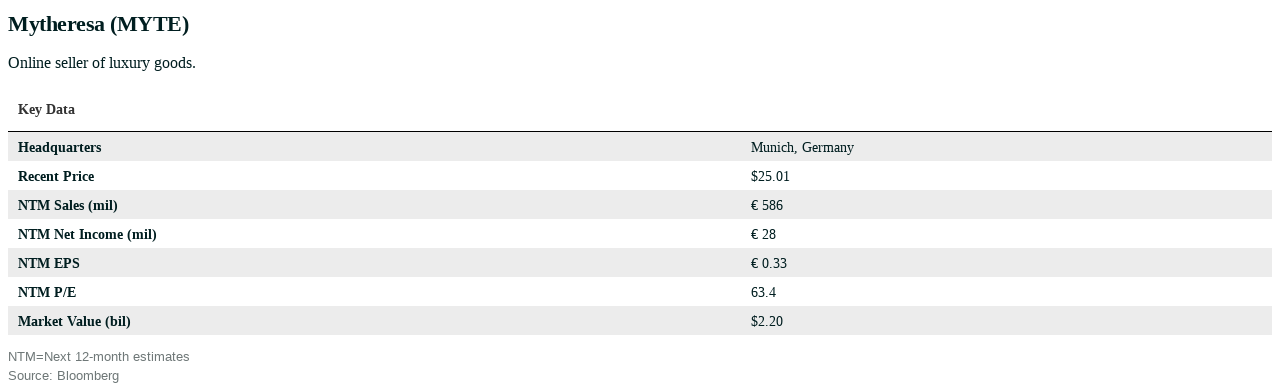

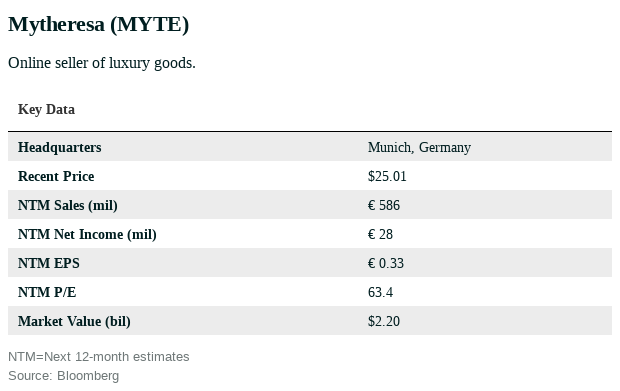

Mytheresa, based in Munich, went public in the U.S. in late January, raising about US$350 million for the company. The listing grew out of the bankruptcy of Neiman Marcus, which purchased Mytheresa in 2014. The small-cap has a market value of about $2.2 billion.

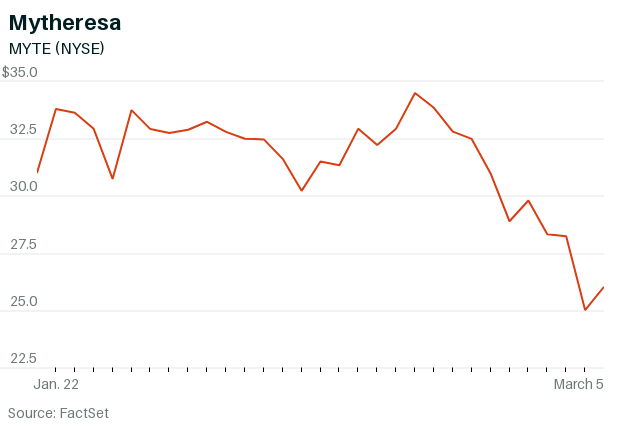

Mytheresa stock (ticker: MYTE)—technically an American depositary share of parent company MYT Netherlands Parent—was recently trading just below its $26 initial-public-offering price after having jumped to $36 shortly after the debut. The stock could recover those losses and more in the coming months.

“They are at the intersection of two higher-than-average growth trends in retail: luxury and e-commerce,” says J.P. Morgan analyst Matthew Boss.

Luxury buyers have been slower to adopt e-commerce. Before the Covid-19 pandemic, some 12% of global luxury sales happened online, compared with a 20% share of overall retail. The gap is closing. A recent study by consultancy Bain estimates that the share of luxury goods sold online could nearly triple to more than 30% by 2025.

Meanwhile, the overall luxury market is growing by about 7% annually.

The tailwinds put Mytheresa in an enviable position, and the company should get a further boost from its expansion in the U.S. and China, which are currently just 10% of sales each. (Europe was 60% in its latest fiscal year.) The company now has collections for men and kids, and it could expand into categories like jewellery and furniture in the future.

Mytheresa isn’t your typical money-losing tech start-up. The company, which reports in euros, earned €6.4 million ($9.9 million) in its latest fiscal year on €449 million in revenue.

Sales have grown an average of 22% over the past two fiscal years, while adjusted earnings before interest, taxes, depreciation, and amortization, or Ebitda, have grown at a 30% clip. For the fiscal year that ends in June, analysts are forecasting revenue growth of 25%, to €560 million. Analysts, who track adjusted earnings, expect the company to make €30.4 million this year, up about 60% from the adjusted figure last year.

“We are dealing with high-net-worth individuals who like to spend money—that’s a great customer base, and our core asset is this customer,” says Mytheresa CEO Michael Kliger.

The customer focus has helped the company earn a consistent profit, with a gross profit margin of about 45% and an adjusted Ebitda margin of about 8%. Other e-commerce players at Mytheresa’s early stage of growth have been years away from turning a profit.

If Amazon.com is the “Everything Store,” Mytheresa has taken the opposite approach. The site carries about 200 brands, fewer than luxury e-commerce rivals Farfetch (FTCH) or Richemont’s (CFRUY) Net-a-Porter. A recent search for “black dress” on Mytheresa’s U.S. site yielded just over 2,000 results, versus more than 7,000 at Farfetch.

Mytheresa’s most loyal shoppers get access to personal shoppers, styling and concierge services, and other perks like invitations to exclusive designer events and parties.

CEO Kliger says there’s a fine balance between presenting products in a way that’s helpful to shoppers and overwhelming them with an endless assortment. His company is focused on curation and more-abstract shopping desires, he tells Barron’s.

Customers looking for a specific Burberry coat, Chloé handbag, or pair of Gucci sneakers are better served buying directly from the designer.

Mytheresa’s website and app, now set up for spring and summer, are currently promoting multibrand compilations including “sandal season” and “talking-point pieces.”

The unique edit, to use the fashion-industry parlance, stands out to customers. Some 90% of Mytheresa customers surveyed by Cowen analyst Oliver Chen said they were likely to recommend the site to a friend, and 75% of them browse it weekly. Nearly 50% of Mytheresa’s customers spend at least $30,000 on luxury goods annually, the survey found.

Investors have been far more stingy when it comes to Mytheresa stock. The shares trade for 2.8 times this year’s estimated sales, versus 8.2 times for Farfetch and 4.5 times for The RealReal (REAL)—both of which are losing money.

Mytheresa could rally as investors reconsider that valuation gap. J.P. Morgan’s Boss has a price target of $38 on the stock, 50% above its recent close.

For now, Mytheresa stock is a luxury play at a bargain price. The sale is unlikely to last.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

Report by the San Francisco Fed shows small increase in premiums for properties further away from the sites of recent fires

Wildfires in California have grown more frequent and more catastrophic in recent years, and that’s beginning to reflect in home values, according to a report by the San Francisco Fed released Monday.

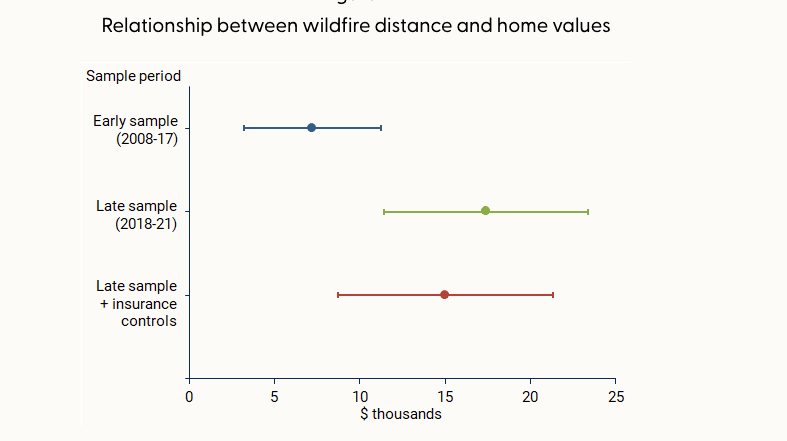

The effect on home values has grown over time, and does not appear to be offset by access to insurance. However, “being farther from past fires is associated with a boost in home value of about 2% for homes of average value,” the report said.

In the decade between 2010 and 2020, wildfires lashed 715,000 acres per year on average in California, 81% more than the 1990s. At the same time, the fires destroyed more than 10 times as many structures, with over 4,000 per year damaged by fire in the 2010s, compared with 355 in the 1990s, according to data from the United States Department of Agriculture cited by the report.

That was due in part to a number of particularly large and destructive fires in 2017 and 2018, such as the Camp and Tubbs fires, as well the number of homes built in areas vulnerable to wildfires, per the USDA account.

The Camp fire in 2018 was the most damaging in California by a wide margin, destroying over 18,000 structures, though it wasn’t even in the top 20 of the state’s largest fires by acreage. The Mendocino Complex fire earlier that same year was the largest ever at the time, in terms of area, but has since been eclipsed by even larger fires in 2020 and 2021.

As the threat of wildfires becomes more prevalent, the downward effect on home values has increased. The study compared how wildfires impacted home values before and after 2017, and found that in the latter period studied—from 2018 and 2021—homes farther from a recent wildfire earned a premium of roughly $15,000 to $20,000 over similar homes, about $10,000 more than prior to 2017.

The effect was especially pronounced in the mountainous areas around Los Angeles and the Sierra Nevada mountains, since they were closer to where wildfires burned, per the report.

The study also checked whether insurance was enough to offset the hit to values, but found its effect negligible. That was true for both public and private insurance options, even though private options provide broader coverage than the state’s FAIR Plan, which acts as an insurer of last resort and provides coverage for the structure only, not its contents or other types of damages covered by typical homeowners insurance.

“While having insurance can help mitigate some of the costs associated with fire episodes, our results suggest that insurance does little to improve the adverse effects on property values,” the report said.

While wildfires affect homes across the spectrum of values, many luxury homes in California tend to be located in areas particularly vulnerable to the threat of fire.

“From my experience, the high-end homes tend to be up in the hills,” said Ari Weintrub, a real estate agent with Sotheby’s in Los Angeles. “It’s up and removed from down below.”

That puts them in exposed, vegetated areas where brush or forest fires are a hazard, he said.

While the effect of wildfire risk on home values is minimal for now, it could grow over time, the report warns. “This pattern may become stronger in years to come if residential construction continues to expand into areas with higher fire risk and if trends in wildfire severity continue.”