With tech earnings season about to start, investors should be aware that a flurry of the industry’s less-followed players have been warning about emerging weakness across the enterprise and telecommunications-networking landscape.

Evercore ISI hardware analyst Amit Daryanani, speaking Tuesday on Barron’s Live, noted that heading into earnings he has concerns about weakness in IT enterprise spending, continued soft demand from communications carriers, and continued caution by consumers. The primary bright spot he sees heading into earnings: spending on cloud and AI infrastructure.

The list of companies providing cautious commentary on the outlook is growing by the day.

NetScout Systems stock (ticker: NTCT) is down 17% on Tuesday after the cybersecurity software company slashed its revenue forecast for its March 2024 fiscal year to a range of $840 million to $860 million, down from a previous forecast of $915 million to $945 million. NetScout also trimmed its adjusted profit per share forecast for the year to $2 to $2.20, down from $2.20 to $2.32. The company said it is seeing “slower order conversion,” due to “industry and economic headwinds facing our customers” that began in September.

Ericsson American depositary receipts (ERIC) are 3.3% lower after the networking infrastructure company on Tuesday provided disappointing financial guidance. “We expect the underlying uncertainty impacting our Mobile Networks business to persist into 2024,” the company said.

Adtran (ADTN), which provides networking hardware, on Monday warned that it now sees third-quarter revenue of $272.3 million, below its previous guidance range of $275 million to $305 million. Adtran said that its “customers remain focused on reducing inventory levels and managing capital expenses.”

Late last week, Belden (BDC), another network infrastructure provider, said it now sees third-quarter revenue of $625 million, down from a previous forecast of $675 million to $690 million. “Demand began to weaken in the third quarter, adding to ongoing pressure from channel destocking,” Belden said in its announcement. “We believe softer demand will continue as we move into the fourth quarter, impacting both revenue and profitability.”

A10 Networks (ATEN), which also provides networking infrastructure, likewise provided September quarter preliminary results that failed to match previous estimates. “In our third quarter we experienced delays related to North American service provider customers pushing out capital expenditures,” the company said earlier this month. “Deals we expected to close at the end of the quarter were delayed into future periods.”

Cambium Networks (CMBM), which provides wireless-network infrastructure, said earlier this month that it now sees third quarter revenue of $40 million to $45 million, below previous guidance of $62 million to $70 million. The company cited a number of reasons for the big miss, including a delay in government orders due to U.S. government budgetary timing issues, and a decrease in orders from distributors in the company’s enterprise business, among other things.

Tech earnings season kicks off Wednesday with results from Netflix (NFLX), to be followed by a deluge of financial reports next week from Alphabet (GOOGL), Microsoft (MSFT), International Business Machines (IBM), Meta Platforms (META), ServiceNow (NOW), Amazon.com (AMZN), Intel (INTC), and Juniper Networks (JNPR), among others.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

Report by the San Francisco Fed shows small increase in premiums for properties further away from the sites of recent fires

Wildfires in California have grown more frequent and more catastrophic in recent years, and that’s beginning to reflect in home values, according to a report by the San Francisco Fed released Monday.

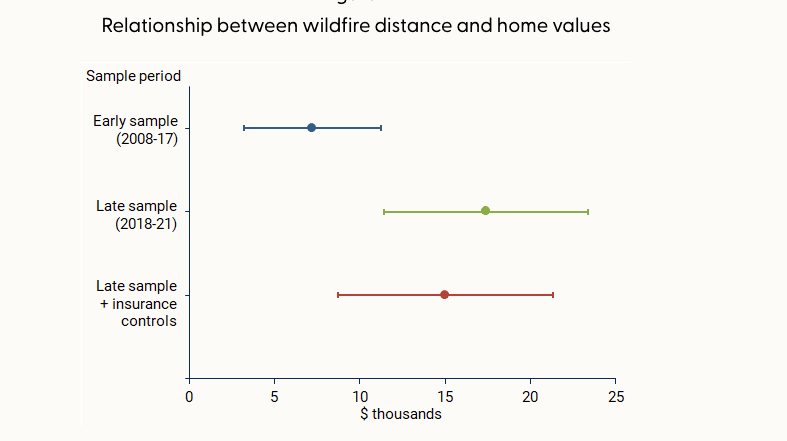

The effect on home values has grown over time, and does not appear to be offset by access to insurance. However, “being farther from past fires is associated with a boost in home value of about 2% for homes of average value,” the report said.

In the decade between 2010 and 2020, wildfires lashed 715,000 acres per year on average in California, 81% more than the 1990s. At the same time, the fires destroyed more than 10 times as many structures, with over 4,000 per year damaged by fire in the 2010s, compared with 355 in the 1990s, according to data from the United States Department of Agriculture cited by the report.

That was due in part to a number of particularly large and destructive fires in 2017 and 2018, such as the Camp and Tubbs fires, as well the number of homes built in areas vulnerable to wildfires, per the USDA account.

The Camp fire in 2018 was the most damaging in California by a wide margin, destroying over 18,000 structures, though it wasn’t even in the top 20 of the state’s largest fires by acreage. The Mendocino Complex fire earlier that same year was the largest ever at the time, in terms of area, but has since been eclipsed by even larger fires in 2020 and 2021.

As the threat of wildfires becomes more prevalent, the downward effect on home values has increased. The study compared how wildfires impacted home values before and after 2017, and found that in the latter period studied—from 2018 and 2021—homes farther from a recent wildfire earned a premium of roughly $15,000 to $20,000 over similar homes, about $10,000 more than prior to 2017.

The effect was especially pronounced in the mountainous areas around Los Angeles and the Sierra Nevada mountains, since they were closer to where wildfires burned, per the report.

The study also checked whether insurance was enough to offset the hit to values, but found its effect negligible. That was true for both public and private insurance options, even though private options provide broader coverage than the state’s FAIR Plan, which acts as an insurer of last resort and provides coverage for the structure only, not its contents or other types of damages covered by typical homeowners insurance.

“While having insurance can help mitigate some of the costs associated with fire episodes, our results suggest that insurance does little to improve the adverse effects on property values,” the report said.

While wildfires affect homes across the spectrum of values, many luxury homes in California tend to be located in areas particularly vulnerable to the threat of fire.

“From my experience, the high-end homes tend to be up in the hills,” said Ari Weintrub, a real estate agent with Sotheby’s in Los Angeles. “It’s up and removed from down below.”

That puts them in exposed, vegetated areas where brush or forest fires are a hazard, he said.

While the effect of wildfire risk on home values is minimal for now, it could grow over time, the report warns. “This pattern may become stronger in years to come if residential construction continues to expand into areas with higher fire risk and if trends in wildfire severity continue.”