China’s Ghost Cities Are a Problem for Europe’s Luxury Brands, Too

Chinese consumers watching the value of their homes fall are losing the confidence to spend on designer goods

Chinese consumers watching the value of their homes fall are losing the confidence to spend on designer goods

How closely is demand for $3,000 handbags tied to home prices in China? Quite closely, it turns out, which is unfortunate for luxury brands.

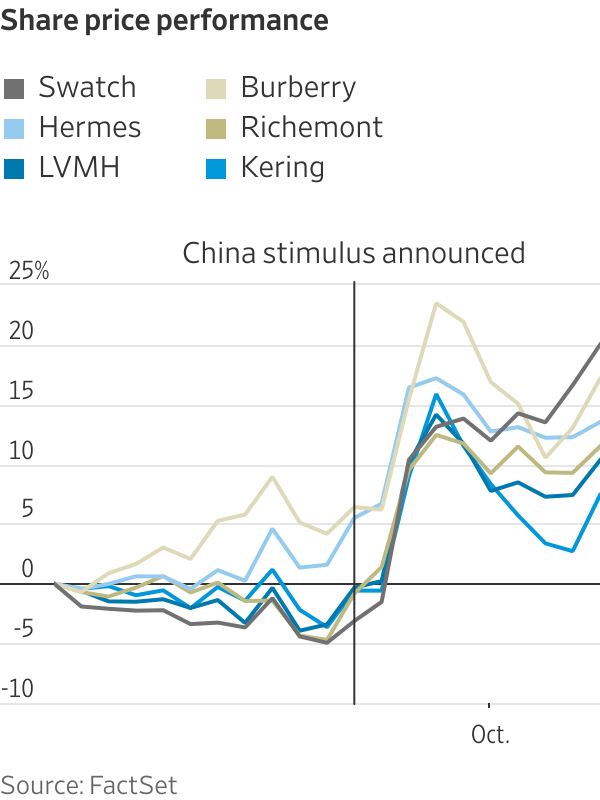

Europe’s luxury stocks fell in early trading Tuesday after China’s economic planning agency failed to announce additional measures to kickstart growth that some investors had hoped for. The sector is still up 10% on average since Beijing launched its initial stimulus plans late last month.

Beijing hopes a cut to mortgage rates, and lower down-payment requirements for buyers of second homes, will jump-start the country’s troubled housing market. A package of loans to brokers and insurers to buy Chinese shares has had initial success at lifting the stock market.

Luxury spending in China has traditionally been more correlated with its home prices than with the financial markets or overall economic growth. Around 60% of net household wealth was tied up in property before prices peaked in 2021. Barclays estimates that falling home prices have destroyed about $18 trillion in household wealth since then, which is equivalent to roughly $60,000 per family.

This, along with worries about the wider economy, is hurting consumer confidence. Retail sales rose just 2.1% in August compared with the same month last year, according to data from China’s National Bureau of Statistics. When global luxury brands start to report their third-quarter results next week, Chinese demand is expected to have slowed since they last updated investors.

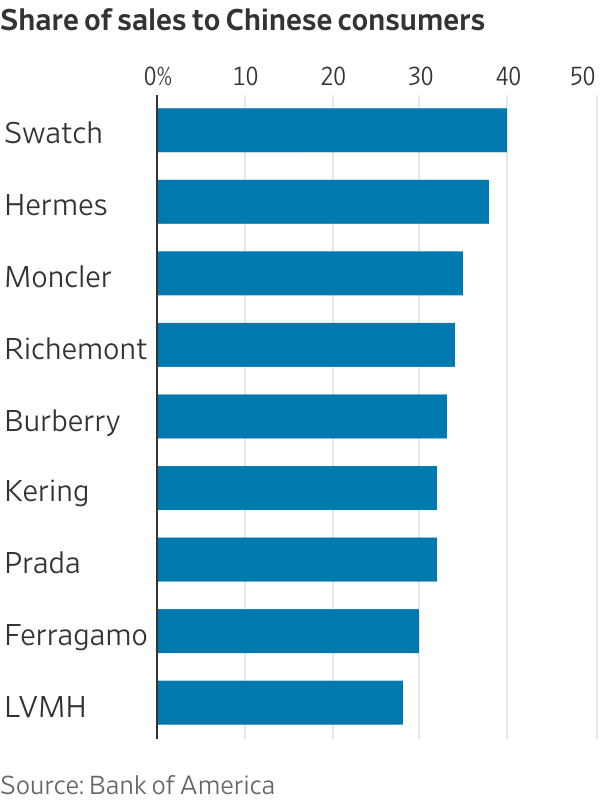

Flagging sales come at an unhelpful time for Europe’s luxury companies, which rely on Chinese consumers for a third of global luxury spending. After several bumpy years during the pandemic, luxury brands and their investors hoped that a comeback in Chinese spending would compensate for a slowdown among Europeans and Americans.

This looks increasingly unlikely. Luxury sales to Chinese shoppers are expected to shrink 7% in 2024 and by 3% next year, according to UBS estimates. As luxury brands have high fixed costs, including the most expensive retail rents in the world, a slowdown with such key customers could have an outsize impact on profit margins.

The last time the luxury industry went through such a rocky patch in China, barring the pandemic, was between 2014 and 2016 when Beijing was cracking down on corruption, including officials who were gifting Louis Vuitton handbags and Rolex watches in exchange for political favours. The global luxury industry barely grew for two years during China’s anticorruption drive, which also coincided with a property-market correction in the country. It didn’t help that shoppers in other markets were also tiring of logos back then.

Europe’s luxury stocks look expensive today compared with that time. As a multiple of expected earnings, listed brands’ shares now trade at a roughly 40% premium to their 2014 to 2016 average.

To justify the higher price tag, Beijing’s housing and wider economic stimulus would need to indirectly lift luxury demand. Measures rolled out so far may not be enough to slow the slide in home prices. China’s housing market is oversupplied by around 60 million units, according to Bloomberg Economics estimates.

New incentives to kick-start consumption are expected soon but will probably target mass-market products like white goods. China already rolled out trade-in subsidies for home appliances earlier this year and a range of consumption coupons.

None of this is very helpful for sellers of expensive luxury goods. For brands to see a recovery, Chinese consumers that spend anywhere from $7,000 to $43,000 a year on luxury products would need to feel much better about their finances than they currently do. Spending by this group has fallen 17% so far this year compared with the same period of 2023, according to a report by Boston Consulting Group.

Half-finished, abandoned housing estates are a big headache for China’s government, and are also on the mind of executives in Paris and Milan. Though the fortunes of luxury bosses likely isn’t high on Chinese officials’ priority list, their fates may be intertwined.

Pure Amazon has begun journeys deep into Peru’s Pacaya-Samiria National Reserve, combining contemporary design, Indigenous craftsmanship and intimate wildlife encounters in one of the richest ecosystems on Earth.

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

Designed by the late Kerry Hill and built by Hutchinson Builders, The Residence at Hayman Island blends tropical modernism with absolute waterfront luxury.

Is this Whitsunday’s best home?

Hayman Island may have been ravaged by Cyclone Debbie in 2017, which saw the island, one of the smallest of the major Whitsunday islands, all but shut down, but the 390-hectare paradise has made an extraordinary comeback.

The InterContinental brand took over the island’s only resort, which was completely devastated by the Category 4 cyclone. The same year the cyclone hit, The Residence at Hayman was built, one of just two private residences on the island.

Constructed by Hutchinson Builders, a Tier 1 builder better known for delivering some of South East Queensland’s finest multi-residential developments, the lavish home is made from reinforced concrete with a blend of glass and timber battening.

It was designed by the late, internationally renowned architect Kerry Hill, widely regarded as a key figure in refining tropical modernist architecture. Hill was an island specialist, having designed several major resorts in Bali.

The Residence at Hayman spans three levels and offers over 1,400 sqm of living space, including around 580 sqm of internal living areas. The remainder comprises breezeways, terraces, and balconies designed to embrace the island’s subtropical climate.

Entry to the home is via the upper level, as the property tiers down the site with direct access to the beach. The top and lower levels accommodate most of the home’s eight bedrooms, as well as a study and a double garage with buggy parking, the preferred mode of transport throughout the Whitsundays.

The middle level is home to the main kitchen, living, and dining areas, complete with a full butler’s pantry. It opens to a large, L-shaped terrace featuring an outdoor kitchen, alfresco dining and lounge zones, and a sundeck. The terrace flows to the basalt-clad infinity swimming pool, deck, and cabana with integrated seating, as well as a pool house.

Owners or guests of The Residence also have access to the InterContinental Hayman Island Resort facilities, including 24-hour room service, butler assistance, private chefs, and the resort’s wellness centre.

Whitefox agents Cheyne Fox and Nic Whitehead are marketing The Residence as “a rare and extraordinary find.”

“This is more than just a home, it’s an opportunity to own a piece of paradise, a legacy to share with family and friends for generations to come,” Fox said.

The only other private residence on Hayman Island, Hayman House, is also on the market. Commissioned by Terry Peabody, former billionaire and Transpacific Industries founder, Hayman House was first listed last year with hopes of $27 million, later reportedly reduced to $20 million in early 2025.

Designed by Kerry Hill and also built by Hutchies (in 2010), Hayman House shares a similar design ethos to The Residence, albeit on a smaller scale. Its 18-week construction endured three cyclones, with all site access via the beach, which had to be reinforced to prevent heavy vehicles from sinking into the sand.