One of America’s Biggest Homes Hits the Market for $195 Million

The roughly 50,000-square-foot mansion in Los Angeles comes up for sale following the divorce of billionaire Tony Pritzker and philanthropist Jeanne Pritzker

The roughly 50,000-square-foot mansion in Los Angeles comes up for sale following the divorce of billionaire Tony Pritzker and philanthropist Jeanne Pritzker

The Pritzker estate in Los Angeles, one of the largest homes in the country, is hitting the market for $195 million. If it sells for that price, it would set a record for the city, where the priciest home sale on record was Jeff Bezos’ $165 million purchase of the Warner Estate in 2020.

The Pritzker listing comes in the wake of a bitter divorce battle between billionaire Tony Pritzker and philanthropist Jeanne Pritzker. The former couple built the house, completing it in 2011.

The roughly 6-acre parcel is in the Beverly Hills Post Office area, just over a mile from Bezos’ home. Situated on a promontory overlooking the city, the home has 180-degree views of downtown L.A. and the ocean, according to Stephen Shapiro of Westside Estate Agency, who has the listing with colleague Kurt Rappaport .

Clad in imported white Italian limestone, the gated estate is about 50,000 square feet with 16 bedrooms, 27 bathrooms and 18 fireplaces. The primary suite has his and hers bathrooms and closets, as well as an indoor and outdoor fireplaces, a hairdressing area, a custom pop-up TV and a balcony.

The lower level of the house has a flower-prep room and a soundproofed bowling alley with custom cabinetry for the bowling balls and shoes. A large theatre has velvet curtains, stage lighting, stadium seating and a projector room. The kitchen has three Gaggenau ovens, two stainless-steel sinks and a dumbwaiter.

On the grounds, a detached two-bedroom guesthouse has a balcony, elevator and its own patio. The estate also has a lighted tennis court with a viewing pavilion. The 75-foot green marble infinity pool overlooks the city, and there is a nearby outdoor kitchen with two barbecues, a large pizza oven, and a custom swimsuit spinner.

In Los Angeles, these types of features are unusual for properties in the hills, Rappaport said. “It’s very rare to have this type of acreage with a view,” he said.

The property also has a detached two-bedroom staff apartment, multiple staff lounges and a staff kitchen.

The Pritzkers are major philanthropists and the home was designed to host large fundraisers, with a large walk-in refrigerator and an extensive underground parking structure.

Because of new restrictions on building, the estate couldn’t be recreated, Shapiro said. “You couldn’t build it today,” he said, adding: “This is the finest house I’ve ever seen.”

Tony and Jeanne Pritzker, who were married for more than 30 years and have six children, declined to comment. The son of Hyatt hotel chain co-founder Donald Pritzker, Tony is a member of one of the country’s wealthiest and more powerful families. He and his brother, J.B. Pritzker , co-founded the investment firm the Pritzker Group, with J.B. ceasing his involvement around the time he became governor of Illinois in 2019.

In 2001, Tony and Jeanne paid $9.5 million for a circa-1938 house in the Beverly Hills Post Office area, according to property records. Then, through LLCs, they purchased several parcels on a ridge adjacent to their previous home. It is unclear how much they paid for the land, but one batch of parcels was purchased in 2005 for $14.7 million, records show.

Once the land was assembled, the Pritzkers started building a new home designed by the late Ed Tuttle of Paris-based architecture firm Designrealization. The Pritzkers moved into the estate in 2011, selling their previous home to celebrity chef Wolfgang Puck for $14 million, property records show.

Jeanne and Tony separated in 2022. The Pritzkers reached a preliminary settlement in April 2024, and Jeanne moved out of the estate that month. The divorce was finalised in May 2024, according to court records. Tony has since paid $19.5 million for a penthouse at Westwood’s Beverly West condominium.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

New amenities, from a gym to a movie theatre, and a good commuter location filled this suburban office tower

Manhattan’s office-vacancy rate climbed to more than 15% this year, a record high. About 80 miles away in Philadelphia, occupancy also is at historically low levels. But a 24-storey office tower located between the two cities has more than doubled its occupancy over the past five years.

Developer American Equity Partners bought the New Jersey office tower, known as 1 Tower Center, for $38 million in 2019. At the time, the 40-year-old building felt dated. It had no gym, tenant lounge or car-charging stations. The low price enabled the firm to spend more than $20 million overhauling and luring tenants to the 435,000-square-foot property.

Now, the suburban building is nearly fully leased at competitive rents, mopping up tenants from other buildings after the owner added a new lobby, movie theatre, golf simulator, fitness centre and a tenant lounge featuring arcade games and ping-pong tables.

“Our tenants told us what they needed in order to fill up their offices,” said David Elkouby , a co-founder of American Equity, which owns about 4 million square feet of New Jersey office space.

The new owner also liked the location at the 14-acre hotel and conference-centre complex, off the New Jersey Turnpike’s Exit 9 in East Brunswick. The site is a relatively short commute for millions of workers in central New Jersey and is passed by 160,000 vehicles daily.

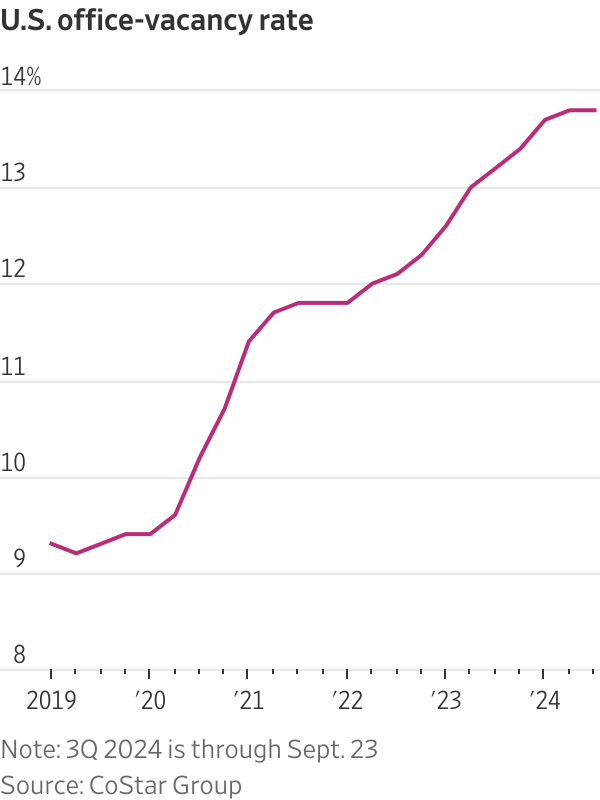

The property’s turnaround shows how office buildings can thrive even during dismal times for most of the U.S. office market, where vacancies remain much higher than pre pandemic.

Success often requires an ideal location—one that shortens the commute time of employees used to working at home—and the sort of upgrades and amenities companies say are necessary to lure employees back to the workspace.

One Vanderbilt, a deluxe office tower with a Michelin-star chef’s restaurant and plenty of outdoor space in Midtown Manhattan, is fully leased while charging some of the highest rents in the country.

The 11-story Entrada office building, in Culver City, Calif., is making the same formula work on the other coast. It opened two years ago with a sky deck, concierge services and recessed balconies. A restaurant is in the works. The owner said this month that it has signed three of the largest leases in the Los Angeles area this year.

1 Tower Center shows how the strategy can be effective even in less glamorous suburban locations. The tower is prospering while neighbouring buildings that are harder to reach with outdated facilities and poor food options struggle to fill desks even at reduced rents.

The recent interest-rate cut and reports that some big companies such as Amazon .com are re-instituting a five-day office workweek have raised hopes that the office market might be getting closer to turning.

But with more than 900 million square feet of vacant space nationwide and remote work still weighing on office demand, more creditors are seizing properties that are in default on debt payments.

Rates are still much higher than they were when tens of billions of dollars of office loans were made, and much of that debt is now maturing. The recent interest-rate cut doesn’t mean “office-sector woes are now over,” said Ermengarde Jabir, director of economic research for Moody’s commercial real-estate division.

Lenders are dumping distressed properties at steep discounts to what the buildings were worth before the pandemic. Some buyers are trying to compete simply by cutting their rents.

“Most owners don’t have the wherewithal to do what is required,” said Jamie Drummond, the Newmark senior managing director who is 1 Tower Center’s leasing agent. “Owners positioned to highly amenitise their buildings are the ones who are successful.”

HCLTech, a global technology company, illustrates the appeal. It greatly expanded its presence in New Jersey by moving this year to a 40,000-square-foot space designed for its East Coast headquarters at 1 Tower Center.

The India-based company said it was drawn to the building’s amenities and design. That made possible a variety of workspaces for employees, from quiet nooks to an artificial-intelligence lab. “You can’t just open an office and expect [employees] to be there,” said Meenakshi Benjwal , HCLTech’s head of Americas marketing.

HCLTech also liked the location near the homes of its employees and clients in the pharmaceutical, financial-services and other businesses.

Finally, it didn’t hurt that the building is a short drive from nearby MetLife Stadium. The company has a 75-person suite on the 50 yard line where it entertains clients at concerts and National Football League games.

“All of our clients love to fly from distant locations to experience the suite and stadium,” Benjwal said.