HONG KONG’S PROPERTY MARKET IS A MESS—AND THE FED IS PARTLY TO BLAME

U.S. rate increases have tamed inflation at home but caused pain elsewhere

U.S. rate increases have tamed inflation at home but caused pain elsewhere

Hong Kong’s notoriously expensive property market is often seen as a barometer of the city’s economy. It isn’t looking good.

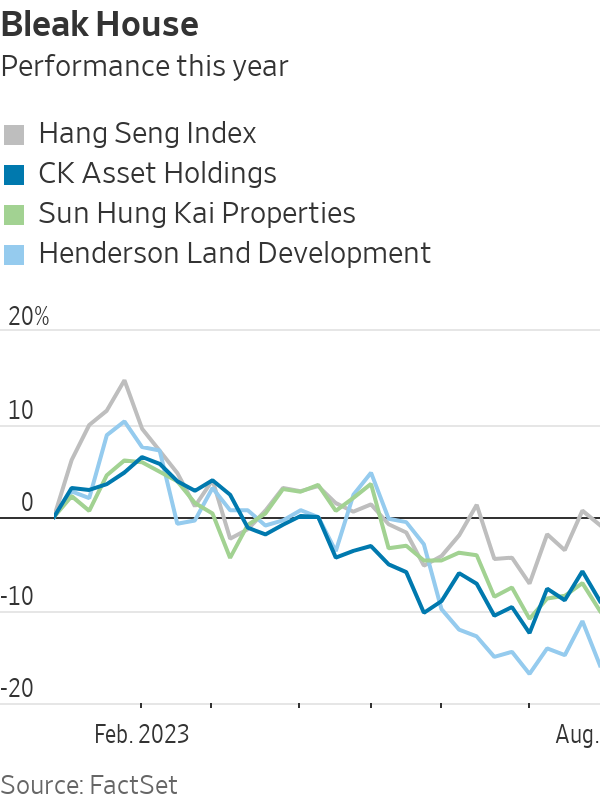

Home prices are down. Office vacancy rates have hit a record high. Commercial real-estate investment has plummeted. The shares of some big developers in the city are trading at a 30-year low to their net asset value, a measure of financial health, according to research by analysts at JPMorgan.

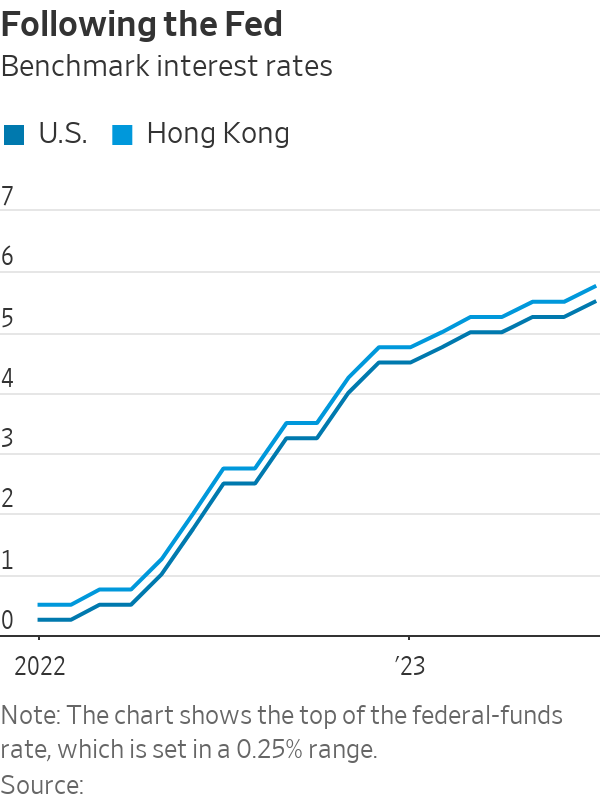

A key reason is high interest rates, which have increased the burden on mortgage-paying home buyers, said Cathie Chung, senior director of research at Jones Lang LaSalle, a real-estate services company. The Hong Kong dollar’s peg to the U.S. dollar forces monetary authorities in the city to track U.S. interest-rate decisions, limiting their ability to stimulate the property sector and the wider economy.

The Federal Reserve has embarked on a historic cycle of interest-rate rises since last March, raising the benchmark federal-funds rate from around zero to 5.25% to 5.50%. The Hong Kong Monetary Authority, the city’s de facto central bank, has followed these hikes, increasing its base rate to 5.75% from 0.75% over the same period.

The full impact of higher interest rates in the city still hasn’t been felt, said Asif Ghafoor, chief executive of online real-estate marketplace Spacious. Asking prices of residential properties listed on the platform have fallen 5% since the start of the year. Sales prices tend to follow suit, and are likely to fall 5% to 10% in the next six months, he said.

To prop up the market, the HKMA relaxed mortgage rules in early July for the first time since 2009, allowing home buyers to pay less upfront and borrow more for some properties if they plan to live in them. But those working in the sector think the pain is far from over.

“We expect that the recovery will be slow and long,” said Chung at Jones Lang LaSalle.

The slump in the property market has hurt the share prices of developers, a major source of wealth for some of the city’s richest families. CK Asset Holdings, Henderson Land Development, Sun Hung Kai Properties and New World Development—all still partly owned by the families of the founders—are performing much worse than the wider stock market this year. New World and Henderson Land have lost more than 15% this year, according to FactSet data.

Hong Kong is one of the world’s leading financial centres and is seen by many foreign businesses as a gateway to mainland China. It is now being hit by a slowdown in investment-banking activity—with several large banks cutting staff this year—and the shaky recovery of China’s economy, which has undermined confidence among businesses and potential home buyers in Hong Kong.

The overall vacancy rate for offices reached a record high of 15.7% in the first half of this year, compared with an average of under 5% in 2018, according to figures by CBRE. In the central business district, there was almost eight times as much empty office space as in 2018, when the area had a vacancy rate of just 1.3%.

The equivalent of $603 million was invested in commercial real estate between April and June, according to CBRE data, just a third of the first-quarter tally and the lowest quarterly figure since the end of 2008, when the global financial crisis caused a huge drop in confidence.

Hong Kong’s border with mainland China was reopened earlier this year, but companies from the mainland haven’t grabbed office space in the numbers many had hoped, said Ada Fung, head of office services at CBRE Hong Kong. Flexible working arrangements and geopolitical tensions that have made many companies pause expansion plans are also crimping demand, she said.

The drop in demand is being exacerbated by a supply glut. Developers bought land and started constructing a number of new buildings before 2019, when widespread protests rocked the city and only ended with the passing of a strict national-security law. Demand for commercial property after that was soon undermined by the spread of Covid-19.

This shift in supply and demand is finally giving potential renters the upper hand, said Fung. “It could be a healthy reset,” she said.

There are some reasons for optimism. Retail businesses have increased their demand for commercial property after the reopening of the border with China, which has brought in tourists looking to spend on luxury goods. There is also hope that a recent rise in residential rents could help home prices.

After an exodus of professionals and other residents in recent years, people have started to move to the city, including foreign students and those coming to Hong Kong through government talent schemes designed to reverse a brain drain. That is helping rents pick up after hitting a bottom in the first quarter, and could lead to more demand for properties as investments, said Cusson Leung, head of property research in Hong Kong at JPMorgan.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

New amenities, from a gym to a movie theatre, and a good commuter location filled this suburban office tower

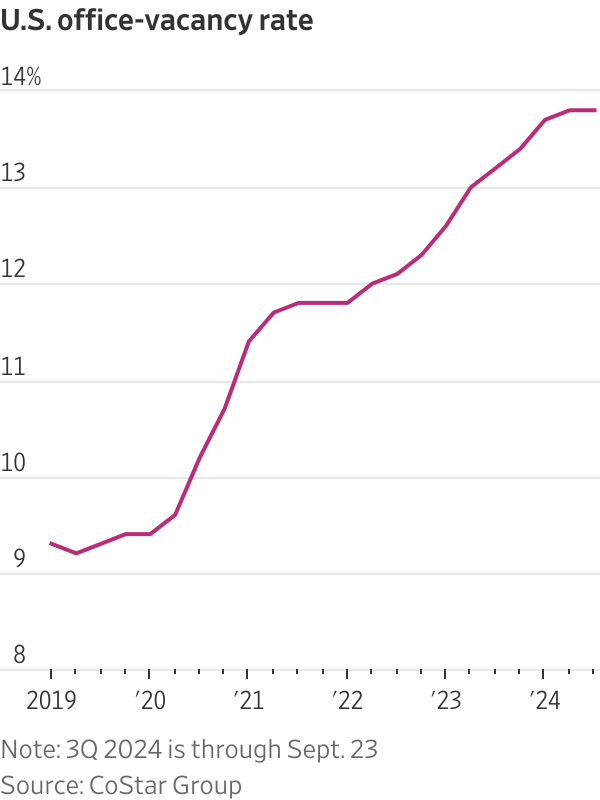

Manhattan’s office-vacancy rate climbed to more than 15% this year, a record high. About 80 miles away in Philadelphia, occupancy also is at historically low levels. But a 24-storey office tower located between the two cities has more than doubled its occupancy over the past five years.

Developer American Equity Partners bought the New Jersey office tower, known as 1 Tower Center, for $38 million in 2019. At the time, the 40-year-old building felt dated. It had no gym, tenant lounge or car-charging stations. The low price enabled the firm to spend more than $20 million overhauling and luring tenants to the 435,000-square-foot property.

Now, the suburban building is nearly fully leased at competitive rents, mopping up tenants from other buildings after the owner added a new lobby, movie theatre, golf simulator, fitness centre and a tenant lounge featuring arcade games and ping-pong tables.

“Our tenants told us what they needed in order to fill up their offices,” said David Elkouby , a co-founder of American Equity, which owns about 4 million square feet of New Jersey office space.

The new owner also liked the location at the 14-acre hotel and conference-centre complex, off the New Jersey Turnpike’s Exit 9 in East Brunswick. The site is a relatively short commute for millions of workers in central New Jersey and is passed by 160,000 vehicles daily.

The property’s turnaround shows how office buildings can thrive even during dismal times for most of the U.S. office market, where vacancies remain much higher than pre pandemic.

Success often requires an ideal location—one that shortens the commute time of employees used to working at home—and the sort of upgrades and amenities companies say are necessary to lure employees back to the workspace.

One Vanderbilt, a deluxe office tower with a Michelin-star chef’s restaurant and plenty of outdoor space in Midtown Manhattan, is fully leased while charging some of the highest rents in the country.

The 11-story Entrada office building, in Culver City, Calif., is making the same formula work on the other coast. It opened two years ago with a sky deck, concierge services and recessed balconies. A restaurant is in the works. The owner said this month that it has signed three of the largest leases in the Los Angeles area this year.

1 Tower Center shows how the strategy can be effective even in less glamorous suburban locations. The tower is prospering while neighbouring buildings that are harder to reach with outdated facilities and poor food options struggle to fill desks even at reduced rents.

The recent interest-rate cut and reports that some big companies such as Amazon .com are re-instituting a five-day office workweek have raised hopes that the office market might be getting closer to turning.

But with more than 900 million square feet of vacant space nationwide and remote work still weighing on office demand, more creditors are seizing properties that are in default on debt payments.

Rates are still much higher than they were when tens of billions of dollars of office loans were made, and much of that debt is now maturing. The recent interest-rate cut doesn’t mean “office-sector woes are now over,” said Ermengarde Jabir, director of economic research for Moody’s commercial real-estate division.

Lenders are dumping distressed properties at steep discounts to what the buildings were worth before the pandemic. Some buyers are trying to compete simply by cutting their rents.

“Most owners don’t have the wherewithal to do what is required,” said Jamie Drummond, the Newmark senior managing director who is 1 Tower Center’s leasing agent. “Owners positioned to highly amenitise their buildings are the ones who are successful.”

HCLTech, a global technology company, illustrates the appeal. It greatly expanded its presence in New Jersey by moving this year to a 40,000-square-foot space designed for its East Coast headquarters at 1 Tower Center.

The India-based company said it was drawn to the building’s amenities and design. That made possible a variety of workspaces for employees, from quiet nooks to an artificial-intelligence lab. “You can’t just open an office and expect [employees] to be there,” said Meenakshi Benjwal , HCLTech’s head of Americas marketing.

HCLTech also liked the location near the homes of its employees and clients in the pharmaceutical, financial-services and other businesses.

Finally, it didn’t hurt that the building is a short drive from nearby MetLife Stadium. The company has a 75-person suite on the 50 yard line where it entertains clients at concerts and National Football League games.

“All of our clients love to fly from distant locations to experience the suite and stadium,” Benjwal said.