Sydney Most Affordable East Coast City For Liveability … Apparently

While the median house price is high, there are other factors at play.

While the median house price is high, there are other factors at play.

Yes, you read that correctly. Sydney has been declared the east coast’s most affordable city for liveability by PRD Real Estate.

Ignoring the fact that the Harbour City has an entry-level price of $1.2 million for a house within 20km of the CBD, PRD’s research argues that Sydney is indeed “the most affordable city for liveability.”

The firm’s reasoning boils down to Sydney having the greatest cost differential between premium and affordable dwellings in the same metropolitan area.

Residents can purchase a house in a liveable suburb for 87% less than the premium needed to purchase in Sydney Metro, well above the other eastern capitals.

PRD’s considerations for affordable and liveable suburbs include property trends, investment potential, affordability, project development, and liveability factors such as low crime rates, availability of amenities within a 5km radius (i.e. school, green spaces, public transport) and a steady unemployment rate.

According to PRD, Peakhurst in Sydney’s south came out on top for houses.

The suburb’s median house price for the first quarter was $1.2 million while units were among the most affordable at $685,000.

Melbourne Metro is the runner up at 42% less, and Brisbane third at 16% less.

Melbourne’s most affordable and liveable houses are found in Greenvale ($728,000), Bellfield ($800,000) and Mulgrave ($850,000).

Elsewhere, Melbourne’s most affordable units were found in Northcote ($595,000), Lower Plenty and Pascoe Vale (both $630,000)

Brisbane’s best performing suburbs included Springwood $530,000, followed by Rochedale South ($545,000) and Ferny Grove ($653,000).

Warner had the lowest-priced units in the Queensland capital with a median of $290,000, followed by Taigum ($320,000) and Coorparoo ($422,000).

What a quarter-million dollars gets you in the western capital.

Alexandre de Betak and his wife are focusing on their most personal project yet.

New amenities, from a gym to a movie theatre, and a good commuter location filled this suburban office tower

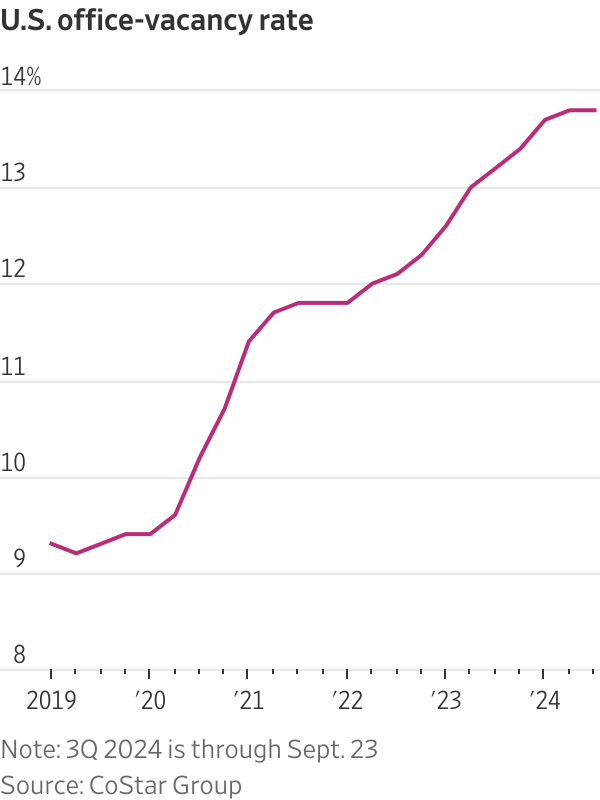

Manhattan’s office-vacancy rate climbed to more than 15% this year, a record high. About 80 miles away in Philadelphia, occupancy also is at historically low levels. But a 24-storey office tower located between the two cities has more than doubled its occupancy over the past five years.

Developer American Equity Partners bought the New Jersey office tower, known as 1 Tower Center, for $38 million in 2019. At the time, the 40-year-old building felt dated. It had no gym, tenant lounge or car-charging stations. The low price enabled the firm to spend more than $20 million overhauling and luring tenants to the 435,000-square-foot property.

Now, the suburban building is nearly fully leased at competitive rents, mopping up tenants from other buildings after the owner added a new lobby, movie theatre, golf simulator, fitness centre and a tenant lounge featuring arcade games and ping-pong tables.

“Our tenants told us what they needed in order to fill up their offices,” said David Elkouby , a co-founder of American Equity, which owns about 4 million square feet of New Jersey office space.

The new owner also liked the location at the 14-acre hotel and conference-centre complex, off the New Jersey Turnpike’s Exit 9 in East Brunswick. The site is a relatively short commute for millions of workers in central New Jersey and is passed by 160,000 vehicles daily.

The property’s turnaround shows how office buildings can thrive even during dismal times for most of the U.S. office market, where vacancies remain much higher than pre pandemic.

Success often requires an ideal location—one that shortens the commute time of employees used to working at home—and the sort of upgrades and amenities companies say are necessary to lure employees back to the workspace.

One Vanderbilt, a deluxe office tower with a Michelin-star chef’s restaurant and plenty of outdoor space in Midtown Manhattan, is fully leased while charging some of the highest rents in the country.

The 11-story Entrada office building, in Culver City, Calif., is making the same formula work on the other coast. It opened two years ago with a sky deck, concierge services and recessed balconies. A restaurant is in the works. The owner said this month that it has signed three of the largest leases in the Los Angeles area this year.

1 Tower Center shows how the strategy can be effective even in less glamorous suburban locations. The tower is prospering while neighbouring buildings that are harder to reach with outdated facilities and poor food options struggle to fill desks even at reduced rents.

The recent interest-rate cut and reports that some big companies such as Amazon .com are re-instituting a five-day office workweek have raised hopes that the office market might be getting closer to turning.

But with more than 900 million square feet of vacant space nationwide and remote work still weighing on office demand, more creditors are seizing properties that are in default on debt payments.

Rates are still much higher than they were when tens of billions of dollars of office loans were made, and much of that debt is now maturing. The recent interest-rate cut doesn’t mean “office-sector woes are now over,” said Ermengarde Jabir, director of economic research for Moody’s commercial real-estate division.

Lenders are dumping distressed properties at steep discounts to what the buildings were worth before the pandemic. Some buyers are trying to compete simply by cutting their rents.

“Most owners don’t have the wherewithal to do what is required,” said Jamie Drummond, the Newmark senior managing director who is 1 Tower Center’s leasing agent. “Owners positioned to highly amenitise their buildings are the ones who are successful.”

HCLTech, a global technology company, illustrates the appeal. It greatly expanded its presence in New Jersey by moving this year to a 40,000-square-foot space designed for its East Coast headquarters at 1 Tower Center.

The India-based company said it was drawn to the building’s amenities and design. That made possible a variety of workspaces for employees, from quiet nooks to an artificial-intelligence lab. “You can’t just open an office and expect [employees] to be there,” said Meenakshi Benjwal , HCLTech’s head of Americas marketing.

HCLTech also liked the location near the homes of its employees and clients in the pharmaceutical, financial-services and other businesses.

Finally, it didn’t hurt that the building is a short drive from nearby MetLife Stadium. The company has a 75-person suite on the 50 yard line where it entertains clients at concerts and National Football League games.

“All of our clients love to fly from distant locations to experience the suite and stadium,” Benjwal said.